Insight

April 17, 2017

Tax Day Facts: IRS Paperwork Generates 8.1 Billion Hours of Paperwork, 1,000 Forms

In the coming weeks, Congress and the White House will begin to cement plans for fundamental tax reform, for individuals and corporations. The economic benefits of a leaner and more efficient tax code are obvious, but there are tremendous regulatory savings available as well.

Based on American Action Forum (AAF) research, the IRS currently imposes 8.1 billion hours of paperwork and generates more than 1,000 tax forms. To put these incredible burdens into perspective, that is 25 hours per person in the U.S. or 54 hours per taxpayer. In other words, the average working American spends more than a week sifting through paperwork and preparing to file. What is the cost of all of this? According to the IRS, it’s $86 billion annually, but the agency only monetized a small fraction of its more-than-seven-hundred distinct paperwork collections. When assuming every hour of paperwork imposes some cost, the actual burden jumps to around $170 billion annually, which exceeds the gross domestic product of Kenya. Given this evidence, there are plenty of reasons to support fundamental tax reform.

Methodology

For this research, AAF examined every IRS “OMB Control Number” (collections of information or recordkeeping requirements) on reginfo.gov, the government website that houses all federal paperwork information. This returned more than 700 distinct paperwork collections. AAF then retrieved the number of forms, responses, hours, and listed cost of each requirement. From this data, AAF also calculated the number of hours per response, a measure of how much of a burden a requirement imposes. In addition, for collections that did not monetize the cost of paperwork hours, AAF assumed the average wage rate for a “compliance officer” ($33.77). There is little doubt some corporations spend far more per hour on tax compliance and the average individual filer likely spends less. AAF has used this metric in the past as a central figure for hourly regulatory compliance.

Results

Thanks in large part to the individual and business income tax return, IRS imposes more than 8.1 billion hours of paperwork and generates at least $86 billion in costs. Below are some quick facts on IRS paperwork:

- Hours: 8.1 billion

- Average Hours Per Paperwork Submission: 11.4

- Total Projected Cost: $170 billion

- Forms: 1,054

The total projected cost of $170 billion differs from the listed cost, because for so many regulations, IRS does not list a cost. The agency only lists monetary figures for its two most burdensome requirements: the individual income tax ($33.6 billion) and the business income tax ($52.5 billion). Even those costs are scant, just $17 per hour for business taxes and only $12 per hour for individual returns. Regulators typically mention costs to the federal government, but that is not the purpose of the Paperwork Reduction Act (PRA). The law is designed to estimate and relieve burdens on individuals, states, and businesses, not government.

For all other unmonetized hours, AAF applied the average wage rate for a compliance officer. This increased projected compliance costs from $86 billion to $170 billion. It’s difficult to understand how more than 2.5 billion hours is costless, as IRS represents publicly.

In terms of the largest collections, as mentioned, the business (2.9 billion hours) and individual (2.6 billion hours) tax returns take the top two spots. Here are the five next most burdensome IRS paperwork requirements.

- Depreciation and Amortization: 448 million hours

- Employer’s Quarterly Tax Return: 388 million hours

- Return for Estates and Trusts: 307 million hours

- Employer’s Federal Unemployment Tax Return: 105 million hours

- Sales of Business Property: 100 million hours

Those represent the largest cumulative totals, but they don’t reveal the collections that impose the highest number of hours per response. For example, the individual income tax generates 2.6 billion hours of paperwork from roughly 150 million tax filers. This equates to 17 hours per response, or roughly two work-days dedicated to tax returns. The average across all IRS collections is 11.4 hours per submission, but there are some dramatic differences across the sample. See below:

- Pre-filing Agreements Program: 729 hours per response

- Alien Withholding Program: 700 hours per response

- Benefits under Multiemployer Pension Reform Act: 500 hours per response

- U.S. Business Income Tax: 275 hours per response

- Return of Private Foundations: 200 hours per response

Here again, the business income tax makes an appearance. At 275 hours per response, the average small business must spend the equivalent of 6.8 work-weeks of time preparing and filing taxes (assuming one full-time equivalent dedicated to filing). Regardless of the macro burden, the burden per response offers perhaps a more compelling case for fundamental tax reform, both at the individual and corporate level. Small businesses are particularly affected by regulatory and compliance costs and there are few burdens as large as 275 hours dedicated to tax compliance.

Forms

For many Americans, there most direct exposure to the regulatory state is through forms. There are more than 20,000 federal forms, and whether it’s sitting in a doctor’s office or preparing for tax season, forms are ubiquitous. For IRS, there are 1,054, four more than there were last year.

Not surprisingly, the business and individual income tax generate the most forms at IRS. Combined, they produce 442 forms (242 for individuals and 200 for businesses). Aside from those leaders, here are the other collections generating a dozen or more forms:

- Organizations Exempt from Income Taxes: 27 forms

- Estate Taxes: 23 forms

- Employer’s Quarterly Return: 14 forms

- Employee Compliance Resolution System: 12 forms

- Employee Benefit Plan: 12 forms

Treasury’s Growing Burden

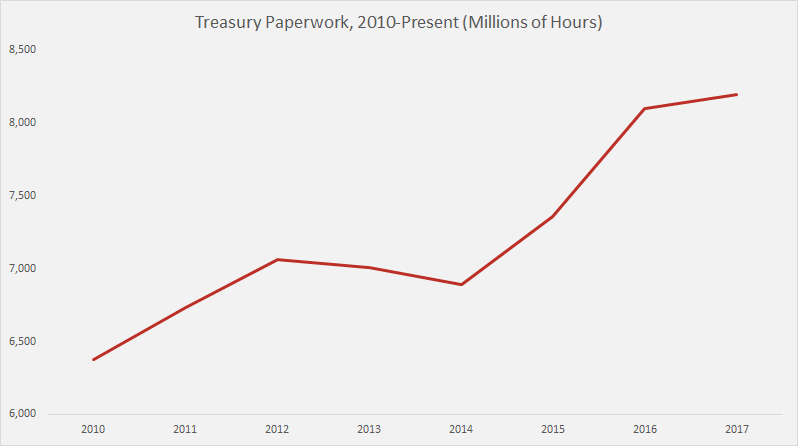

As Congress has continued to add various deductions, exemptions, and tax credits to the code, the amount of paperwork imposed on taxpayers continues to increase. For instance, in 1995, the Department of Treasury imposed 5.3 billion hours of paperwork or 83 percent of the cabinet-agency total. By 2000, Treasury’s burden grew to 6.1 billion hours, 87 percent of the cabinet total. Today, Treasury imposes 8.1 billion hours, or 75 percent of the cabinet-agency total. This reflects increasing tax filing compliance and how, despite Treasury’s growth, other agencies have accelerated the pace of their paperwork impositions. The graph below displays the paperwork increases from Treasury.

The growth here is due largely to a recalculation of the aforementioned business income tax, which grew from 362 million hours to nearly three billion hours today. The other driving factor is the Affordable Care Act (ACA). The ACA has imposed more than 153 million hours of paperwork since 2010, but IRS is responsible for 71 million hours of ACA compliance, stemming mainly from the individual mandate.

Alternative Measures of Tax Compliance Costs

As noted by the Taxpayer Advocate Service (TAS), many entities have attempted to estimate the total cost of tax compliance and experts have embraced a range of methodologies. The TAS, for example, estimated the cost of income tax compliance in 2015 at $195 billion.[1] Inclusion of additional cost considerations and alternative approaches to monetizing hours spent in compliance alter these estimates considerably. Fichtner and Feldman completed a thorough assessment of the costs that the U.S. tax code extracts from the economy through complexity and inefficiency, beyond TAS’s estimate. According to the authors, in addition to time and money expended in compliance, foregone economic growth, and lobbying expenditures amount to hidden costs estimated to range from $215 billion to $987 billion. [2]

Other measurements beyond mere time and pecuniary estimates reflect an increasingly burdensome tax code. The TAS has reported that tax compliance is so onerous for individual taxpayers, 94 percent used a preparer or tax software to submit their returns.[3] The tax code has become so onerous that the IRS struggles to administer it. According to the TAS, the IRS’s ability to answer taxpayer telephone calls and the IRS’s ability to respond to taxpayer correspondence offer key metrics for taxpayer service. The TAS reports the IRS received 104 million calls in fiscal year 2016. In 2016, the IRS was only able to answer 53 percent of calls received, compared to 87 percent in 2004. The amount of time that callers waited on hold has also increased over this period from 2.5 minutes to about 18 minutes. The IRS failed to respond in a timely manner to about 37 percent of taxpayer letters received in 2016, compared to 12 percent in 2004. This worsening response rate comes despite the use of preparers and software by more than 90 percent of individual taxpayers.

A Reform Hypothetical

During the tax debate in Congress, if reform is “fundamental,” even reducing the regulatory burden of compliance by 10 to 20 percent could produce massive regulatory benefits and savings for the average American. Consider, a ten percent cut in IRS paperwork would save 814 million hours, the equivalent of 407,414 workers (at 2,000 hours annually) no longer dedicated to tax compliance. It would also save $17 billion each year, the equivalent of a $170 billion tax cut during a ten-year budget horizon. A 20 percent reduction would double these figures: 1.6 billion hours of savings, 814,829 worker-equivalent, and produce $34 billion in annual savings ($340 billion over ten years).

Conclusion

The benefits of fundamental tax reform are not just fiscal or direct economic rewards. There are substantial tertiary regulatory benefits possible if tax compliance costs were reduced. With 8.1 billion hours of paperwork and at least $170 billion in direct costs, there is plenty of low-hanging fruit available. By this time next year, Americans could be paying less taxes and spending less time negotiating the more than 1,000 federal tax forms.

[1]National Taxpayer Advocate. “Annual Report to Congress.” Taxpayeradvocate.irs.gov. Internal Revenue Service Web. https://taxpayeradvocate.irs.gov/Media/Default/Documents/2016-ARC/ARC16_Volume1.pdf

[2] Fichtner, Jason J. and Jacob M. Feldman, “The Hidden Costs Of Tax Compliance.” Mercatus Center 2015 Web. http://mercatus.org/sites/default/files/Fichtner-Hidden-Cost-ch1-web.pdf

[3] “National Taxpayer Advocate, op. cit.