Research

April 13, 2016

The Impact of Falling Oil Prices on Russian Financing

Summary

- Russia’s economy has contracted in the face of low oil prices, but large foreign currency reserves and a weakening ruble are helping to keep Russia’s budget financed.

- Examination of Russian financing should consider the exchange rate from ruble to dollar which has gone from 30:1 to 70:1, causing oil revenues in ruble values to become inflated.

- Since Russia sets its budget in rubles, not dollars, financing sources from foreign currencies are exceptionally strong relative to rubles.

Introduction

Oil prices have plunged, and this raises a serious question as to the impact this has had on Russia’s budgetary outlook. Clearly the collapse of oil prices has brought tremendous economic pain to oil reliant countries, particularly Russia, which saw its economy contract by 3.7 percent during 2015. However, Russia has proven to have an exceptionally resilient budget, only recently announcing moderate cuts despite low oil prices that have been depressed for over a year and are projected to remain low. Russia is an example of both the significance and insignificance of energy prices on oil dependent regimes. As America considers its foreign policy with Russia moving forward, it should bear in mind that there are limits to the pressure oil prices can have, and a weak energy market is not the sole solution to resurged Russian aggression.

Local Currency vs. U.S. Dollars

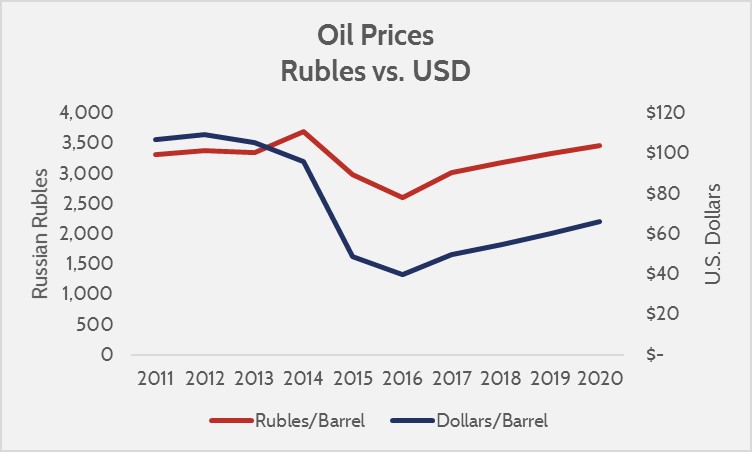

Governments set their budgets in local currency, but oil is traded in U.S. dollar (USD) values. For budgeting, this favors the oil exporter, because a drop in oil revenues weakens the exporter’s economy—and consequently their currency. Between 2013 and 2016, oil prices fell from over $100/barrel to under $30/barrel. In the same time period, the ruble to USD value changed from 30:1 to over 70:1. Even though oil prices fell by over 70 percent, the ruble price only fell by 20 to 30 percent.

Projections based on EIA data and AAF estimates. 2016-2020 are projected years.

Projections based on EIA data and AAF estimates. 2016-2020 are projected years.

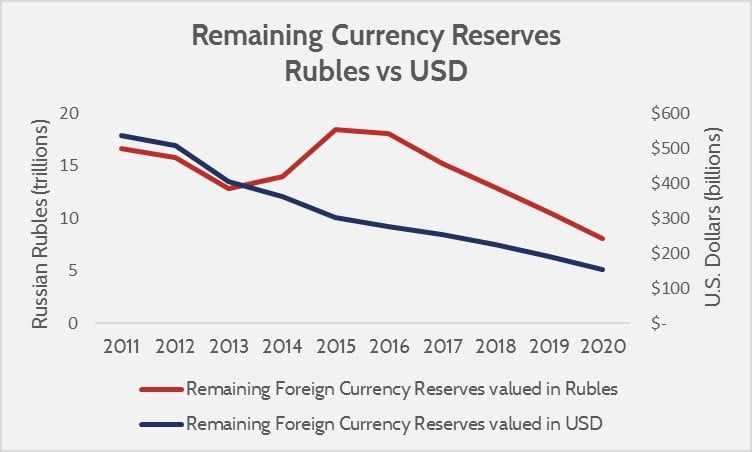

The exchange rate has also improved the financing power of Russia’s foreign currency reserves. Russia’s $302 billion in convertible foreign currency are now worth more rubles than before the oil slump. From 2014 to 2015, Russia’s currency reserves went from $362 billion to $302 billion in USD value, but went from 14 trillion to 18.5 trillion when valued in rubles thanks to the exploding exchange rate.

Projections based on IMF data and AAF assumptions of partial deficit financing from reserves. 2016-2020 are projected years.

Projections based on IMF data and AAF assumptions of partial deficit financing from reserves. 2016-2020 are projected years.

Sources of income that are determined in USD value, such as currency reserves or exported oil, have greater power to finance the budget as the exchange rate weakens. The key takeaway is that predictions regarding Russia’s future income and financing should be done in local currency, not in USD, as that would give a flawed picture that exaggerates budget shortfalls.

Russia’s Fiscal Outlook

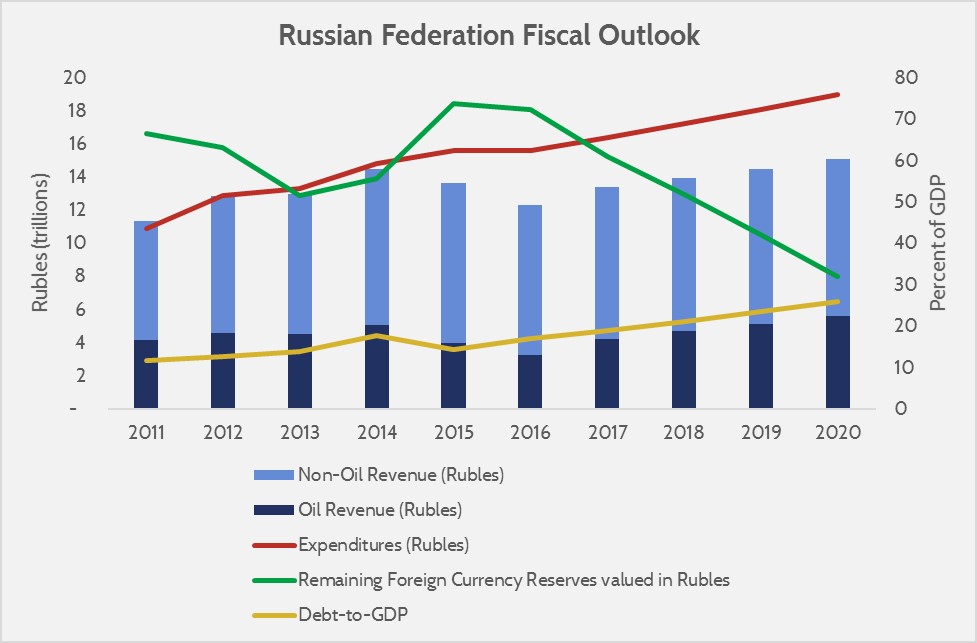

The common method of analyzing an oil exporter’s budgetary health is to observe breakeven prices. A breakeven price is the oil price needed for an oil exporter’s budget to be balanced, and in 2015 Russia’s breakeven price was around $105/barrel. Breakeven analysis can offer an idea of expected deficits for an oil producer, but does not offer insight as to when it would be unable to finance its budget. When faced with a budgetary shortfall, oil reliant regimes have three options: incur debt, cut expenditures, or draw from reserves.

Russia announced a 10 percent budget cut (700 billion rubles) in January, and has also incurred debt and drawn from reserves. Russia will utilize all three of these levers to strike a balance that keeps debt down, stretches currency reserves, and maintains funding for key programs. In AAF’s estimates, it is assumed that Russia’s expenditures will grow at its historical rate, that non-oil revenues will be consistent as a percent-of-GDP, and that Russia will opt to finance half its deficit from reserves and half from debt.

Figures based on IMF data, Russian Treasury Data, EIA oil price projections, and AAF projections. 2016-2020 are projected years.

Figures based on IMF data, Russian Treasury Data, EIA oil price projections, and AAF projections. 2016-2020 are projected years.

The greatest risk to Russia’s budget is the projected deficit of around 4 to 6 percent of GDP, which will require either further budget cuts or bolstered revenue to close. Under AAF’s scenario, Russia’s debt level would reach 26 percent debt-to-GDP in 2020, which is still well within the IMF’s “safe” level of 60 percent.

Russia’s weakening economy as well as lagging revenue have increased the relative costs of its policies, but low debt levels and strong reserves means that it will still manage to finance essential programs. Russia will eventually have to balance its budget to adjust for reduced oil revenue, but it has some freedom to determine when and how to make adjustments without sacrificing near term interests.

Conclusion

Low oil prices are harming the economies of oil exporters, and America must take this into account when engaging these states. However, states with budgets backed by large foreign currency reserves and low debt levels are well situated to weather the oil slump. With Russia in particular, which has had significant schisms with NATO members since its unlawful annexation of Crimea, policymakers need to be aware that energy prices alone may not force an agenda shift.