Research

January 9, 2015

The ACA’s Risk Spreading Mechanisms: A Primer on Reinsurance, Risk Corridors and Risk Adjustment

Background

The 2010 Affordable Care Act (ACA) health reform law established state-based health insurance exchanges to provide an individual market for qualified health insurance plans. The state exchanges sell insurance plans to any citizen, regardless of health status. Enrollees who purchase plans through an exchange can receive federal premium subsidies if their household income falls between 100 and 400 percent of the federal poverty level. This primer provides an overview of the ACA’s risk mitigation provisions that apply to individual and/or small group market plans: reinsurance, risk corridors, and risk adjustment.

While the exchanges are implemented and administered by either the state or the federal government, the qualified health plans offered are sold by private insurance companies and designed to be in compliance with the ACA regulations. For insurers, offering a plan on the exchange is very different than offering a plan on the pre-ACA individual market or to a group purchaser such as a large company. For one, the issuer offering their first exchange plan in 2014 had no way of knowing the health status or previous claims history of the applicants; some exchange enrollees may have been uninsured for many years and have a long list of unmet medical needs. Secondly, the applicant must be charged the same premium as everyone else in their age band, and the oldest applicants cannot be charged more than three times the rate of the youngest. And finally, insurance companies are selling a new insurance product, with newly mandated benefits, and limits on cost-sharing, but they have no control over how many, or how few, individuals enroll.

Issuers priced their products according to their best projections. However, for the reasons listed above, uncertainty about risk pools is larger than for a mature market. In order to improve the incentives for insurers to participate, the ACA includes three risk spreading mechanisms: temporary reinsurance, temporary risk corridors, and permanent risk adjustment, all of which address potential risk pool issues by limiting the amount an insurance company can lose by participating in the marketplace. Risk adjustment is designed to spread risk among plans to prevent adverse selection, reinsurance helps plans with individuals who have unexpectedly high medical costs, and risk corridors protect both health plans and the federal government against uncertainty in pricing during the initial years of the ACA’s market reforms. These mechanisms allow insurance companies to price their products more competitively, as any significant losses will be partially offset.

Reinsurance

Reinsurance provides a safeguard against individuals with high medical costs – known as “high risk” – during the first three years of the ACA’s insurance market reforms (2014-2016). All ACA-compliant, non-grandfathered plans on the individual market, both inside and outside the exchanges are eligible for reinsurance payments.[1] The legislative language left the determination of a high risk individual vague, noting that it could be based on diagnoses or another method. Through regulation, the Department of Health and Human Services (HHS) has determined that a high risk determination will be based on the cost of actual medical claims. For 2014, a health plan becomes eligible for reinsurance payments when an enrollee reaches medical costs of $45,000 (the so-called “attachment point”) which was adjusted downward from the previous proposed regulation of $60,000.[2] The reinsurance attachment point for 2015 is $70,000.[3] Reinsurance payments stop when an individual’s medical claims reach a cap, which is $250,000 in 2014 and 2015. The federal government will reimburse the plan for at least 80 percent of the claims cost between the attachment point and the cap in 2014, and 50 percent for claims in 2015.[4] For example, if an enrollee incurred $300,000 in medical claims during the 2014, the health plan would be responsible for the first $45,000, the reinsurance program would reimburse the plan at least $164,000 (80 percent of the amount between the attachment point and the cap), and the health plan would be pay the $50,000 above the cap.

Reinsurance programs can be implemented by each state, using a non-profit entity to collect and distribute reinsurance funds. Or, states can defer implementation to the federal government. In 2014, only Maryland and Connecticut elected to operate their own reinsurance programs.[5]

The reinsurance program is funded through fees levied on all health insurance plans, including self-insured plans that use a third-party administrator for core health care services. A rule finalized in early 2014 exempted self-insured, self-administered plans from paying the fee in 2015 and 2016.[6] The reinsurance fee is statutorily required to equal a specific amount for reinsurance payments, a specific amount paid to the U.S. Treasury, and a variable amount for administrative expenses. Each insurer’s portion is calculated based on their enrollment. The funds available for reinsurance payments will total $10 billion in 2014, $6 billion in 2015 and $4 billion in 2016; additional payments to the U.S. Treasury will be $2 billion in 2014 and 2015 and drop to $1 billion in 2016. This translates to $63 per person for the 2014 benefit year,[7] $44 per person for 2015, and $27 per person in 2016. The Center for Medicare and Medicaid Services (CMS) estimates[8] that these contribution amounts will be sufficient to collect the statutorily-required amounts for 2014 and 2015.

A CMS regulatory impact analysis estimated that the reinsurance protection allowed insurers to price their premiums 10-15 percent lower in 2014 than what prices would have been otherwise.[9]

Table 1: Reinsurance Program Funds Collected 2014-2016

| Year | Reinsurance Payments | Payments to the US Treasury | Administrative Expenses | Per-Enrollee Cost Levied on Each Insurer* |

| 2014 | $10 Billion | $2 Billion | Variable | $63/ per person (HHS Estimate) |

| 2015 | $6 Billion | $2 Billion | Variable | $44/ per person (HHS Estimate) |

| 2016 | $4 Billion | $1 Billion | Variable | $27 2016 Notice of Proposed Payment Parameters[10] |

*Note: All self-insured plans would contribute in 2014; the latest proposed rule exempts self-insured, self-administered plans from the reinsurance fee in 2015 and 2016.

Risk Corridors

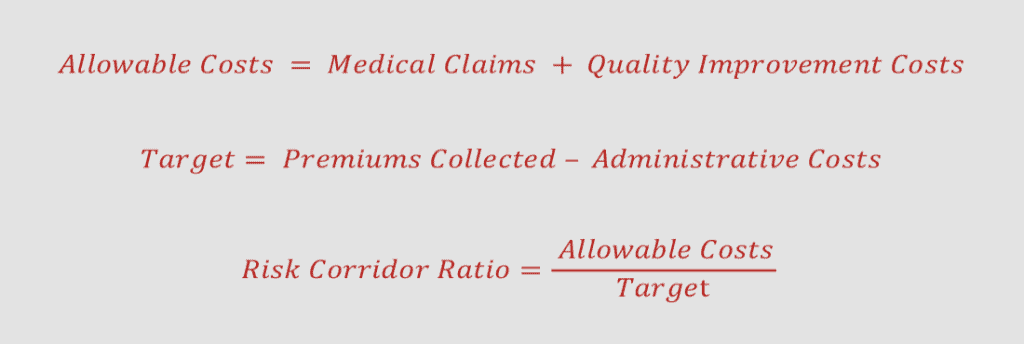

The risk corridors program is a temporary program from 2014-2016 protecting against pricing uncertainty by sharing gains and losses between plans and the federal government. The risk corridors program applies only to qualified health plans (QHPs) in the individual and small group markets. This program requires each plan issuer to calculate, for each QHP[‡], their allowable costs as well as a target amount. Allowable costs include claims and money spent on quality improvement, and the target costs include premiums collected minus a limited percentage of administrative costs.

If an insurer’s risk corridors ratio is below 97 percent, the insurance issuer presumably made a profit on that plan, and must share a portion of that profit with HHS. If the costs are above 103 percent of the target amount, the insurance issuer presumably took a loss on the plan, and HHS will cover some of that loss. When a plan’s costs are 92-97 percent, or 103-108 percent of the allowable amount 50 percent of the plan’s gain or loss is shared with HHS. If the costs are below 92 percent of above 108 percent, 20 percent of that gain or loss is shared. For 2015, these parameters will be shifted by two percentage points, increasing the ceiling payments and raising the floor on profits.[11]

Because the target costs and allowable costs are calculated via a specific formula, with caps on the administrative expenses, the risk corridor calculation is not necessarily reflective of the plan’s true profit or loss; a ratio of 100 percent does not mean the plan broke even.

Risk Adjustment

The risk adjustment provision in the ACA applies to ACA-compliant plans in both the individual and small group insurance markets (both on and off the exchanges), but unlike the previously described two mechanisms, will be permanent. The risk adjustment program will be operated by the federal government, or by states operating their own exchange, if they so choose. States that are operating their own risk adjustment program must use the federal methodology or develop an alternate methodology that is approved by HHS. [12]

Under the risk adjustment program, HHS or the exchanges will assess the actuarial risk of the insurance pool within each plan and compare it to the average actuarial risk of all plans in the state, including the large group plans. Plans that have an enrolled population with lower than average actuarial risk will make payments to those plans that have enrolled individuals with higher than average actuarial risk. However, it is important to note this is the only one of these three risk mitigation strategies that is determined by enrollee projections. The risk adjustment program only transfers funds between eligible plans, which will net to zero within a market, within a state.

Table 2: Overview of the Reinsurance, Risk Corridors and Risk Adjustment Provisions

| Program, and Statutory Authority | Operated by | Administered | Time Span | Costs Involved | Plans Participating | Protects Against |

| Reinsurance, PPACA Section 1341 | State or Federal Government | Third Party entity, required to be a non-profit. | 2014-2016 | 2014: $10 billion ($12b including admin costs) 2015: $6 billion ($8b including admin costs) 2016: $4 billion ($5b including admin costs) | Issuers of major medical coverage make reinsurance payments, ACA-compliant plans in the individual market (inside and outside of the exchanges) are eligible to receive reinsurance payments

|

Individuals with high medical claims costs |

| Risk Corridors, PPACA Section 1342 | Federal Government | Secretary of HHS | 2014-2016 | TBD | Qualified health plans in the individual and small group markets | Uncertainty in rate setting and costs associated with pricing for a new risk pool |

| Risk Adjustment, PPACA Section 1343 | States who established exchanges, Federal exchange | States who established exchanges, Federal runs the others (methods for all developed by HHS Secretary) | 2014 and beyond | Plan transfers net to zero within a market, within a state | Qualified health plans in the individual and small group markets | Adverse selection among Qualified Health Plans |

Budgetary Impact

According to their latest estimate, the Congressional Budget Office (CBO) projects these provisions to be budget neutral.[13] Despite CBO projections, there is a concern that more plans may need payment from the risk mitigation provisions and, as a result, the amount paid out to plans will exceed the amount paid into the programs. Furthering this concern, the administration’s decision to allow reinstatement of 2013 plans – plans that would have otherwise been cancelled – may limit the number of healthy people signing up on the exchanges and make the new exchange pools disproportionately sicker. Since health plans set premiums based on assumptions about who will enroll, the transitional policy could have major impacts on the risk mitigation programs.

In addition, it is worth noting that the provisions keeping premiums lower will also reduce federal spending on the exchange subsidies. In the absence of the risk mechanisms, higher health insurance premiums would result in more households qualifying for subsidies and increased cost for those who are subsidized. So while it is possible that payments may need to come from general revenue to make up any funding deficits, repealing these provisions is unlikely to be budget neutral.

Risk Corridors

While the risk adjustment and reinsurance programs are funded by transfers between health plans, the risk corridors program has no similar funding mechanism. Since risk is shared between health plans and the federal government, the risk corridors program could ultimately represent a net gain or a net loss to the federal government. According to a CBO analysis of the ACA, the risk corridor collections will equal payments, and the risk adjustment and reinsurance collections and payments will be equal as well. However, reinsurance and risk adjustment payments will be made prior to all collections received, and thus the outlays are $1 billion more than receipts in the 2014-2016 budget window.[14]

HHS signaled in early 2014—after premiums for the 2014 benefit year had already been set—that they were planning to operate the risk corridors program in a budget neutral way.[15] In other words, that the risk corridors formula would be adjusted so that it required payments to health plans with risk corridors ratios above 103 percent to equal payments from plans with risk corridors below 97 percent. This likely represented a significant departure from the health plans expectations when they incorporated the impact of the risk corridors program into premiums. Ultimately, HHS acknowledged through regulation that while it believes the program will be budget neutral, it recognizes the requirement of the ACA to make payments to those issuers with risk corridors ratios above 103 percent. HHS indicated in final regulation that the ACA requires HHS to provide payments in-full to issuers, and the final rule states that the agency will provide other sources of funding if the program’s funds are insufficient – according to “the availability of appropriations”.[16]

More recently, however, the 2015 Cromnibus bill, which narrowly passed both houses of Congress, denied any additional appropriations or transfers to fund risk corridors, and instead limited risk corridor payments to money available through the program’s revolving fund.[17]

History of Risk-Mitigation Provisions

The ACA’s exchanges are not the first federal entitlement program to use risk-spreading mechanisms to protect participating health insurance issuers. When the Medicare Part D drug benefit launched in 2006 participating insurers were pricing plans with a high degree of uncertainty. Similar to the exchange environment, plans did not know who would enroll and what their prescription drug needs would be. Part D features three risk mitigation programs that were the model for those included in the ACA: a permanent risk corridors program where CMS shares in gains or losses with Part D plans, a risk adjustment program where the subsidies paid to plans are adjusted based on patient characteristics, and a permanent form of reinsurance that protects Part D sponsors from unexpectedly high prescription drug costs.[18]

Other programs like Medicaid Managed Care and Medicare Advantage also use risk adjustment to determine payments from the entitlement program to the private insurance plans, but these calculations are based on the risk projections of the population, rather than actual claims information.

Conclusion

The ACA brings a tremendous amount of uncertainty to the private insurance market. The risk spreading provisions were designed to stabilize the individual and small group market and allow companies to compete on the exchanges without excessive risk during the initial years of implementation. Certainly entering the new market is not without risk; the reinsurance and risk corridors only partially reimburse plans for their costs above specific points. In 2015, health policy researchers will better understand budgetary impacts and whether taxpayer funded general revenue was needed to make up excessive losses sustained by the insurers in the first year of exchange implementation.

* An earlier version of this Primer was written by Emily Egan, formerly AAF Senior Health Policy Analyst.

[‡] The Robert Wood Johnson Foundation’s “Analysis of HHS Final Rules On Reinsurance, Risk Corridors And Risk Adjustment.” Released April, 2012 specifies that risk corridors will be calculated on a plan-specific level rather than looking at the insurer’s entire book of business in each state. (http://www.rwjf.org/content/dam/farm/reports/issue_briefs/2012/rwjf72568). The Health Affairs Blog also notes that it will be done at the plan benefit level (http://healthaffairs.org/blog/2012/03/16/implementing-health-reform-the-reinsurnace-risk-adjustment-and-risk-corridor-final-rule/). However, CMS documents use plan and insurance issuer interchangeably when referring to risk corridor calculations. (http://www.cms.gov/cciio/resources/files/downloads/3rs-final-rule.pdf)

[1] 42 USC 18061

[2] 79 FR 13779

[3] http://www.gpo.gov/fdsys/pkg/FR-2013-03-11/pdf/2013-04902.pdf; http://www.cms.gov/Newsroom/MediaReleaseDatabase/Fact-sheets/2014-Fact-sheets-items/2014-03-05-2.html

[4] Id.

[5] Id.

[6] 79 FR 13773

[7] http://www.cbo.gov/sites/default/files/cbofiles/attachments/45010-breakout-AppendixB.pdf

[8] http://www.cms.gov/CCIIO/Resources/Fact-Sheets-and-FAQs/Downloads/faq-risk-corridors-04-11-2014.pdf

[9] http://www.cms.gov/CCIIO/Resources/Files/Downloads/hie3r-ria-032012.pdf

[10] http://www.cms.gov/Newsroom/MediaReleaseDatabase/Fact-sheets/2014-Fact-sheets-items/2014-03-05-2.html

[11] https://www.federalregister.gov/articles/2014/05/27/2014-11657/patient-protection-and-affordable-care-act-exchange-and-insurance-market-standards-for-2015-and#p-164

[12] 45 CFR §153.330

[13] http://www.cbo.gov/sites/default/files/cbofiles/attachments/45231-ACA_Estimates.pdf

[14] http://www.cms.gov/CCIIO/Resources/Files/Downloads/hie3r-ria-032012.pdf; collections lag by a quarter any may net zero over time, http://www.gpo.gov/fdsys/pkg/FR-2014-11-26/pdf/2014-27858.pdf.

[15] https://www.federalregister.gov/articles/2014/03/11/2014-05052/patient-protection-and-affordable-care-act-hhs-notice-of-benefit-and-payment-parameters-for-2015#p-590

[16] https://www.federalregister.gov/articles/2014/05/27/2014-11657/patient-protection-and-affordable-care-act-exchange-and-insurance-market-standards-for-2015-and#p-377

[17] http://www.gpo.gov/fdsys/pkg/CPRT-113HPRT91668/pdf/CPRT-113HPRT91668.pdf

[18] ”Learning from Medicare Advantage and Part D: Lessons for the individual insurance market under ACA,” Milliman Healthcare Reform Briefing Paper. August 2013. Available at: http://publications.milliman.com/publications/healthreform/pdfs/learning-from-medicare-part-d.pdf