The Daily Dish

February 20, 2018

Inflation Fears

Eakinomics: Inflation Fears

Inflation is the trendy economic boogeyman. A sudden and sharp increase in inflation is associated with three popular story lines. The first is an indictment of the Fed for having kept monetary policy too easy for too long. The second is a critique of the recently passed tax bill as an inappropriately large fiscal stimulus for an economy near full employment. (Obviously, these are not mutually exclusive.) The final is a “here comes the next doomsday” scenario in which rising inflation forces a sharp monetary contraction, financial market disruption and a repeat of the financial crisis and Great Recession. (Again, this is could be consistent with either of the first two notions.)

The common feature in each of these stories is that inflation is suddenly a threat. What are the facts?

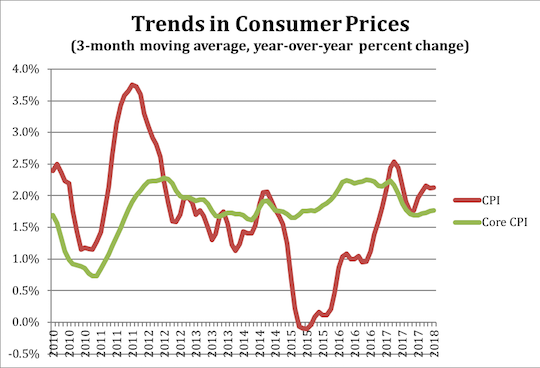

The chart below shows the trends in consumer prices as measured by the Consumer Price Index (CPI) for all items (red line) and the “core” prices measured by all items less the volatile food and energy categories (green line). Clearly the top-line CPI has fluctuated more dramatically (up in 2011 and 2012; down in 2014 and 2015). The core CPI has remained relatively close to the Fed’s 2 percent target.

The first thing that jumps out is that these measures are notably below the Fed’s 2 percent target, even though both show an uptick in the latter part of 2017. The second lesson is that the uptick is just that: an uptick. There is little evidence of a sustained trend toward higher inflation.

Of course, the key issue is future inflation, and one can’t rule out a constellation of factors that generate upward pressure on inflation. But historically, inflation pressure takes time to build; it’s hard to see this as a significant 2018 problem. The Fed has time to lean against inflation pressure as needed. Moreover, it has a bit of cushion before inflation reaches its target.

Inflation pressures are worth watching. But the data suggest that the United States is a long way from the point of pushing the panic button.

Fact of the Day

Total R&D funding per patent produced by the National Labs is around $7.6 million, nearly twice the R&D investment outside the labs of $4 million per patent. However, the Labs spend $16.4 million per revenue-generating license agreement, while outside the labs it is nearly four times higher at $63.9 million.