The Daily Dish

January 19, 2017

Inflation Update

On Tuesday the Obama Administration announced they made a $500 million payment to the Green Climate Fund (GCF), an international climate change adaptation fund. The Obama Administration has now made $1 billion in payments to the GCF despite explicit GOP opposition to the U.S. funding the GCF. While Congress previously refused to appropriate money to the GCF, it did not ban the State Department from finding funds elsewhere. In 2014 President Obama promised $3 billion to the GCF.

Yesterday the American Action Forum (@AAF) released new research showing that regulations from the Affordable Care Act (ACA) are costing small business employees at least $19 billion each year in lost wages. The research goes on to find that ACA regulations have cost 295,030 jobs and 10,130 small business establishments.

Eakinomics: Inflation Update

Yesterday the Department of Labor (DOL) announced that the Consumer Price Index (CPI) increased 0.3 percent in December, while the so-called core CPI (the index for all items less food and energy) rose 0.2 percent. The news that inflation was running between 2.4 and 3.6 percent at an annual rate raises obvious questions about whether the Federal Reserve has reached its dual mandate of roughly 2 percent inflation and unemployment below 5 percent. If so, one should expect that monetary policy should (quickly) move to normal. How fast should the Fed be moving?

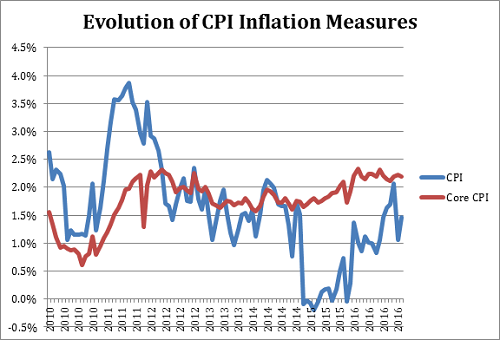

The chart below shows the recent history of two measures of inflation based on the CPI – the CPI and the core CPI. In each case, the data are monthly, year-over-year inflation rates. The CPI itself has fluctuated widely – a tribute to the energy component in particular. Based on this, inflation is running somewhere in the 1.5 to 2 percent range at the moment. The core CPI, however shows a relatively steady acceleration since 2014 and appears to be solidly above the 2 percent line.

Given that monetary policy works with a lag, this would suggest that the Fed might be significantly behind the curve in raising rates, and that inflation might drift substantially higher over the next 18 months or so.

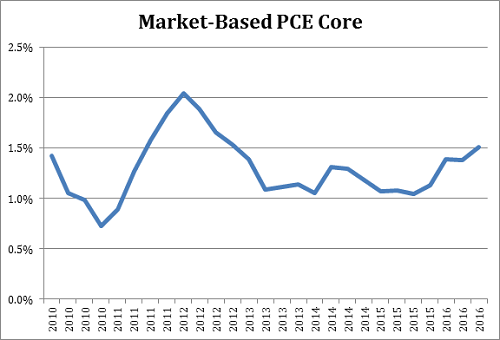

But not so fast. The Fed prefers another measure of inflation – the price index for Personal Consumption Expenditures (PCE) prepared by the Bureau of Economic Analysis. In particular, it focuses on a special version that uses only market prices; i.e., it does not use any prices that are imputed by the statistical agency (e.g., what does it “cost” to rent your owner-occupied house to yourself).

This is shown below and tells a story that is similar – a steady acceleration in recent years – and different – the inflation rate remains below the Fed’s 2 percent target. This suggests that the Fed may be timing its return to normal to match up with reaching its target over the next 18 months or so.

In the end, the bottom line is simple: inflation and interest rates are going higher. The only question is how high and how fast.

Fact of the Day

ACA regulations and rising premiums have reduced employment by more than 350,000 jobs nationwide.