The Daily Dish

June 2, 2023

May Jobs

Payroll growth in April came in close to expectations, reflecting a healthy gain in employment and further declines in unemployment. Both the regular and U-6 unemployment series were, with the exception of the recent past, plumbing historic depths. Employers in April added 253,000 jobs, with private-sector payrolls gaining 230,000 jobs, while the unemployment rate fell to 3.4 percent. The labor force participation rate remained at 62.6 percent.

Here is a brief summary of the major economic indicators since the last jobs numbers:

- The Producer Price Index for final demand increased 0.2 percent in April;

- The Consumer Price Index increased 0.4 percent in April;

- Real average hourly earnings increased one cent from March to April;

- Orders for durable goods (including defense and aircraft) increased 1.1 percent in April;

- New home sales increased 4.1 percent in April;

- The Price Index of U.S. imports increased 0.4 percent in April;

- ISM Services Index increased 0.7 percentage points to 51.9 percent in April;

- ISM Manufacturing Index decreased 0.2 percentage points to 46.9 percent in May;

- Consumer Confidence Index decreased 1.4 points from 103.7 to 102.3 in May;

- ADP reported private sector employment increased by 278,000 jobs in May.

Gordon’s Guesstimate: May Jobs

Not long ago, the United States was at risk of willingly throwing itself off an economic cliff for failing to raise the Treasury’s borrowing authority on time. That’s been taken off the table thanks to some bipartisan negotiating. But before that, the prevailing wisdom appeared to be that the Fed was likely to pause, such was the thinking on the balance between recession risk and inflationary pressure. Notwithstanding the late unpleasantness surrounding the debt limit, the U.S. economy seems somewhat healthier than conventional wisdom may concede.

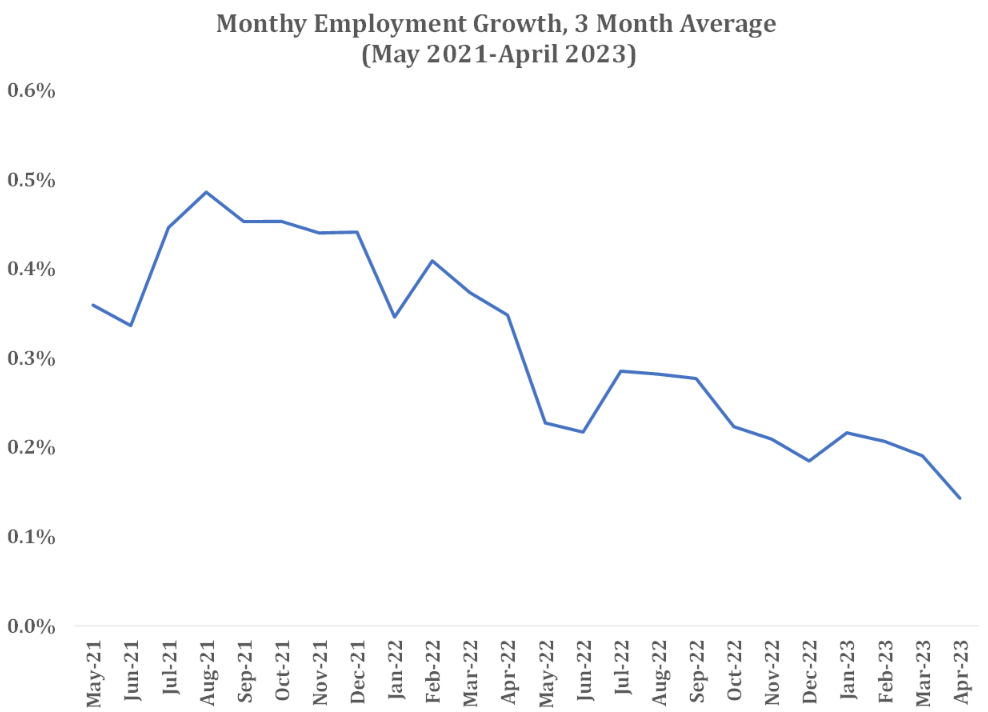

Specific to the labor market, there has been a fairly straightforward deceleration in the monthly rate of employment gain as unemployment has steadily fallen to historical lows.

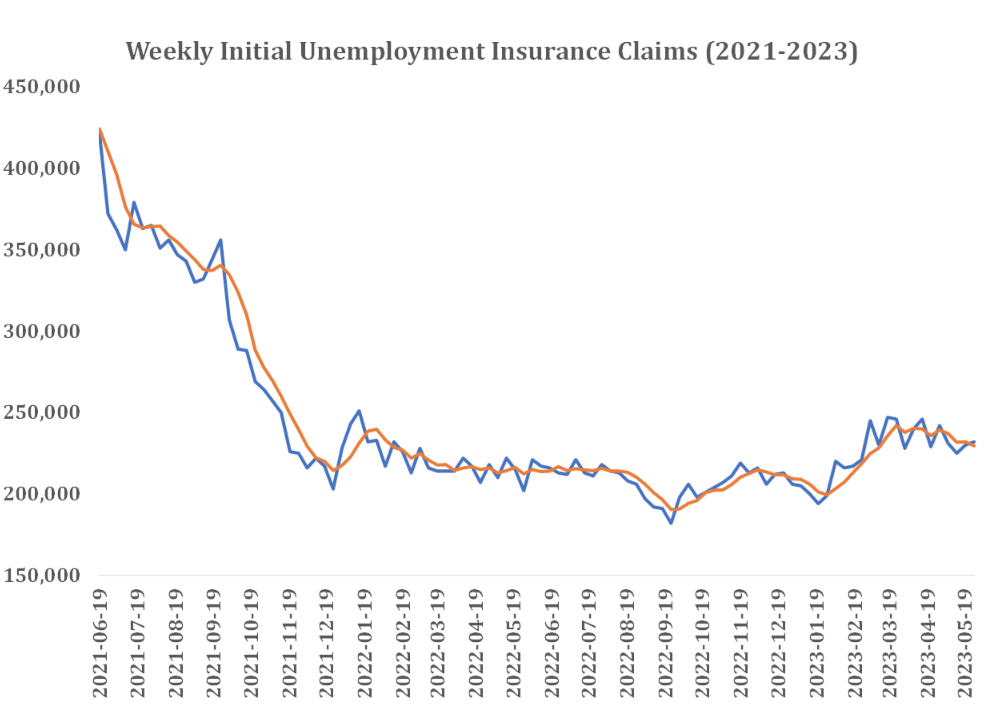

More recently, unemployment claims have inched up off the relative floor, but have somewhat settled in at a new level.

Somewhat in defiance of an orderly deceleration, Job Openings, as measured in the most recent JOLTS survey, rebounded to top 10 million again. The usual caveats attach to being led along by any one datum, but directionally, it is difficult to ignore. The ADP survey, which has gotten closer to the mark of late, similarly suggests continued health and stability in the labor market.

At some point, there will be a curveball, a hiccup, but there is little to suggest that we will see one this morning. This guesstimator is assuming a 245,000 employment gain, and expects the unemployment rate to hold steady at 3.4 percent, while average hourly earnings are expected to increase 11 cents, for a 4.4 percent yearly gain.

Fact of the Day

Since January 1, the federal government has published rules that imposed $360.1 billion in total net costs and 53.2 million hours of net annual paperwork burden increases.