The Daily Dish

November 16, 2018

Progress at the FHA

Eakinomics: Progress at the FHA

Fannie Mae and Freddie Mac are the poster children of the housing bubble, bust, and bailout era. But the Federal Housing Administration (FHA) was an important participant as well. The FHA provides mortgage insurance, just as Fannie and Freddie do, but is targeted to lower-income and less-qualified borrowers. It is, in effect, the nation’s largest sub-prime lender. Not surprisingly, the condition of the FHA’s primary fund — the Mutual Mortgage Insurance Fund (MMI Fund) — deteriorated dramatically in and after the financial crisis. Yesterday, the Department of Housing and Urban Development (HUD) released the FHA’s annual report to Congress on the state of the MMI Fund.

The good news is that the MMI Fund’s fiscal 2018 capital ratio is 2.76 percent. This ratio is 0.58 percentage points higher than one year earlier and represents the 4th straight year that the the capital ratio exceeded the statutory minimum of 2.0 percent. (For the record, the statutory minimum does not represent an economically rational lower bound.) The even better news is that FHA indicated that it had no plan to lower its premiums. In similar situations, the previous administration would cut premiums, leading to two undesirable effects. Mechanically, it reduced the inflows to the MMI Fund and, other things being equal, worsened the financial outlook. Worse, it attracted to the MMI Fund those borrowers who could not get a private-sector mortgage — i.e., the worst of the private sector risk pool.

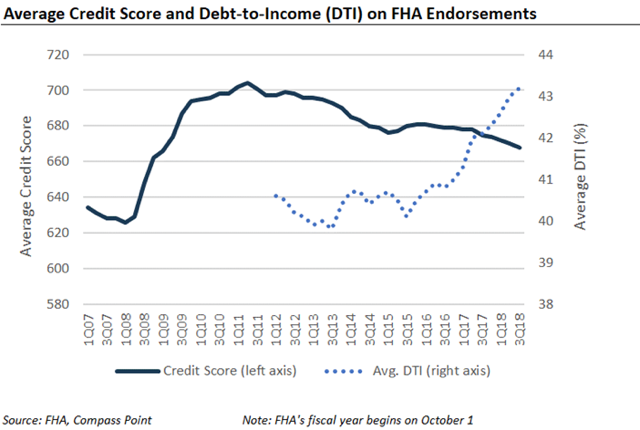

Lowering premiums would be an error, because the FHA report already highlights its concern over the quality of its new business. In particular, it cited declining credit scores and rising debt-to-income ratios among its newest borrowers. (See the chart below courtesy of Isaac Boltansky at Compass Point Research and Trading). The average credit score declined to 668 from 679 and the average debt-to-income ratio jumped from 40.8 percent to 43.2 percent. Moreover, the “risky tail” — the fraction of loans with ratios over 50 percent – is up to 25 percent.

The FHA can expect a grilling from the new majority in the House of Representatives over its “failure” to make home ownership more affordable aggressively. That’s too bad. It’s nice to see someone who has not forgotten the lessons learned in the crisis.

Fact of the Day

Before the financial crisis, Fannie Mae and Freddie Mac held investment portfolios of $900 billion each, while today that figure is in the region of $250 billion each.