The Daily Dish

April 24, 2019

Taking the Pulse of the Housing Sector

Eakinomics: Taking the Pulse of the Housing Sector

Housing plays a central role in U.S. economic life. New residential construction is a relatively small part (under 5 percent) of gross domestic product, but swings in building activity feed back into the manufacturing sector by affecting the demand for furnaces, air conditioners, washer, dryers, refrigerators, stoves, and other goods. Owner-occupied housing is typically the most important asset in a family’s portfolio. And probably no other economic good is subject to greater local, state, and federal regulatory, tax, and other policy attention.

Given its interconnectedness to the rest of the economy, 2018 was a disappointing year for the housing sector. Yet with continued strong employment growth, rising wages, and reduced prospects of higher interest rates, there is the possibility that 2019 will witness a bit of a rebound. (To follow housing conditions, take a look at AAF’s chart book.)

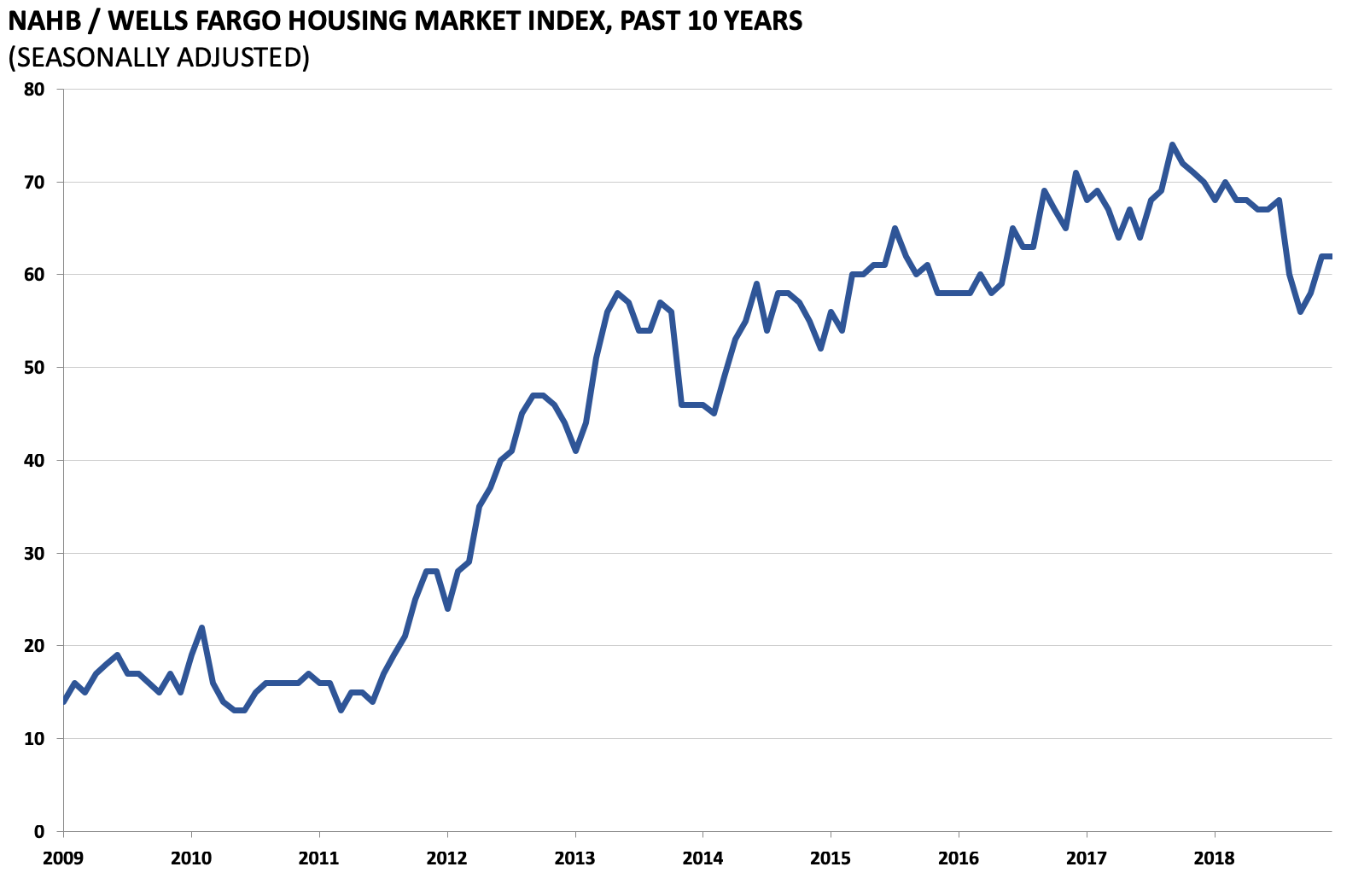

Indeed, as shown below, the National Association of Home Builders / Wells Fargo index of sentiment for the demand for housing picked up a bit in early 2019 but remains at roughly 2016 levels.

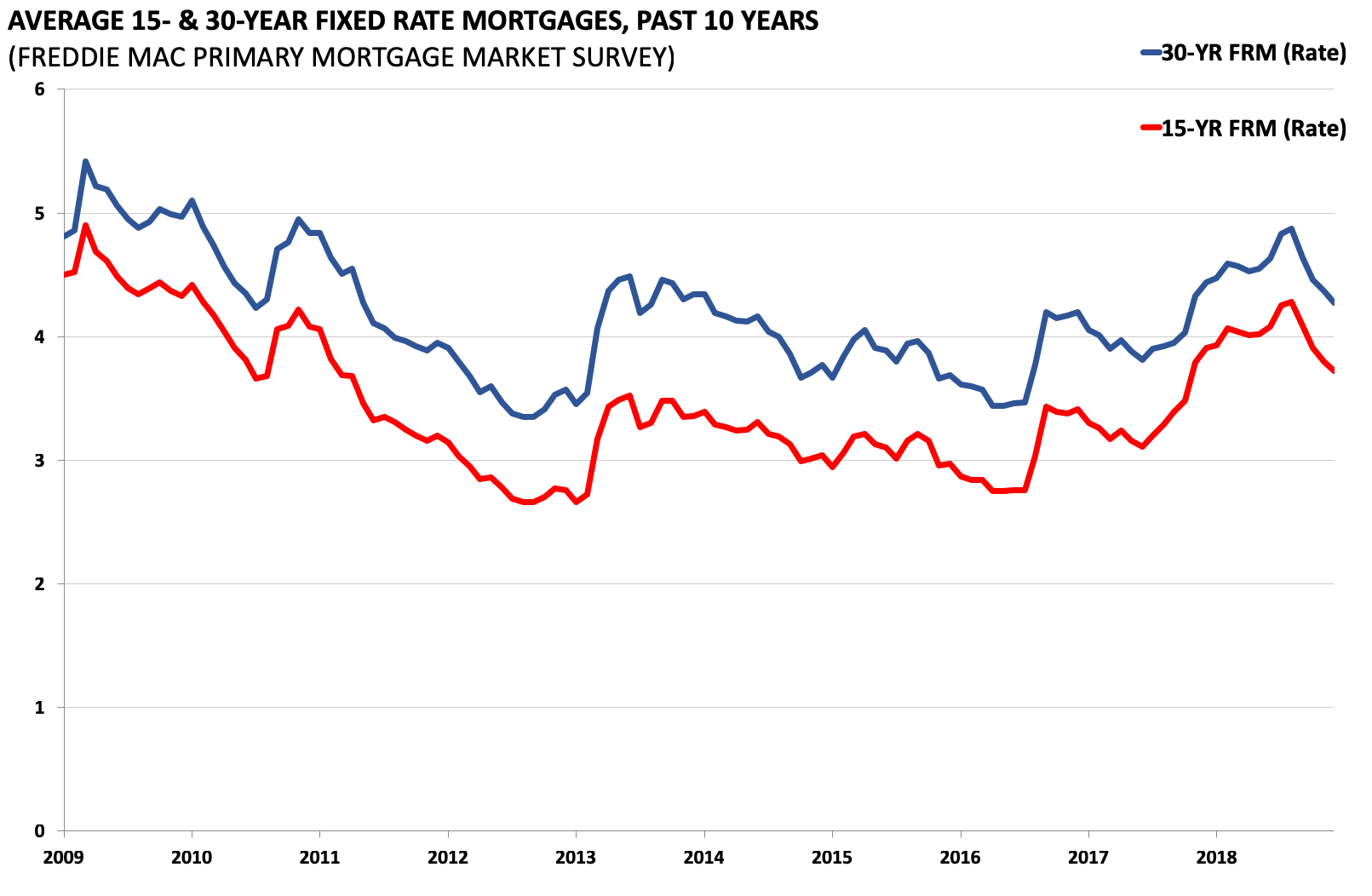

This uptick likely reflects in part the downshift in mortgages interest rates (below) after they rose steadily in 2017 and most of 2018.

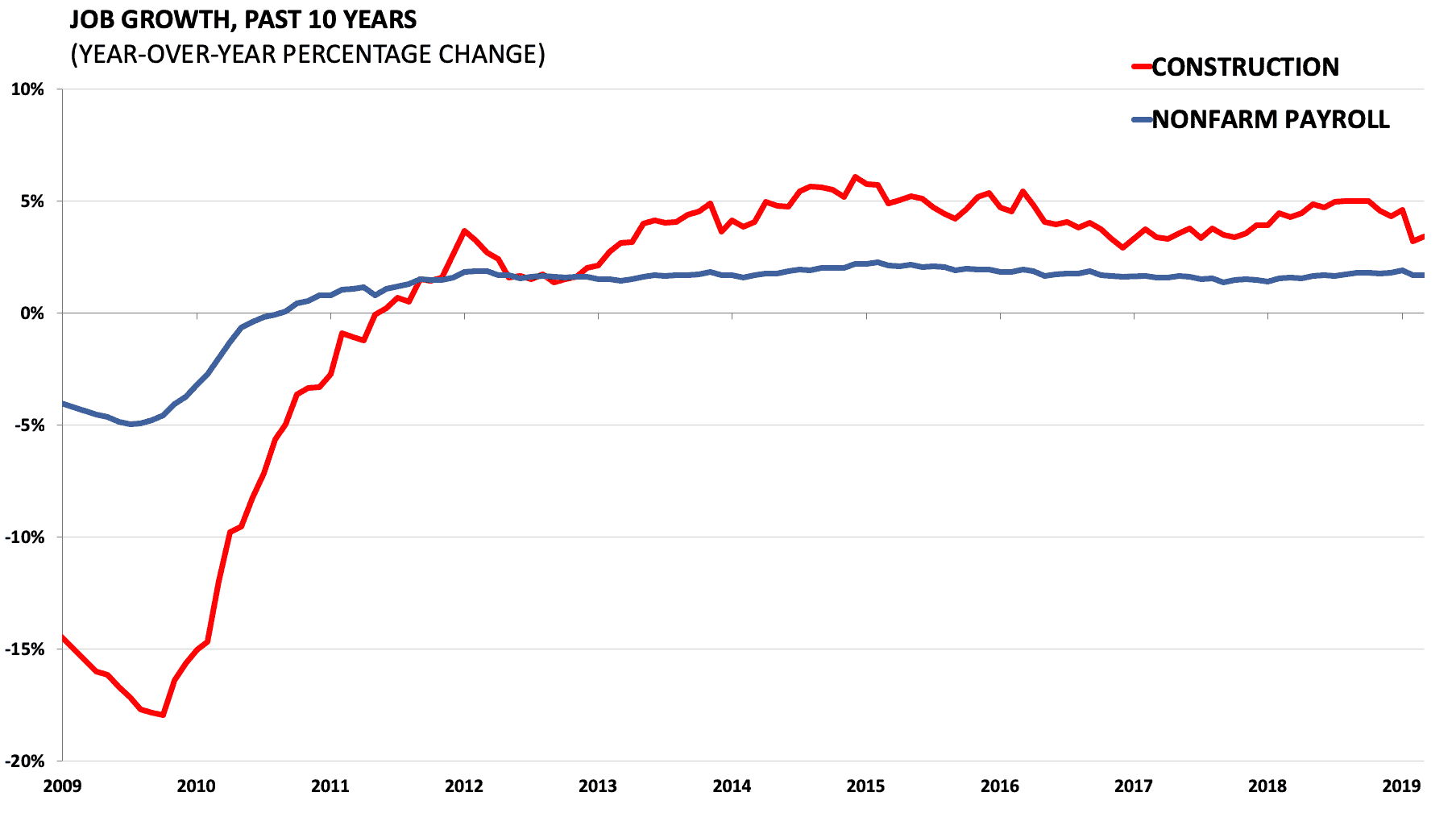

It also is consistent with the strong labor market. The blue line (below) shows the strong year-over-year growth in overall employment. The red line, however, indicates a sharp decline in the growth of construction jobs that is reflective of the weak supply conditions.

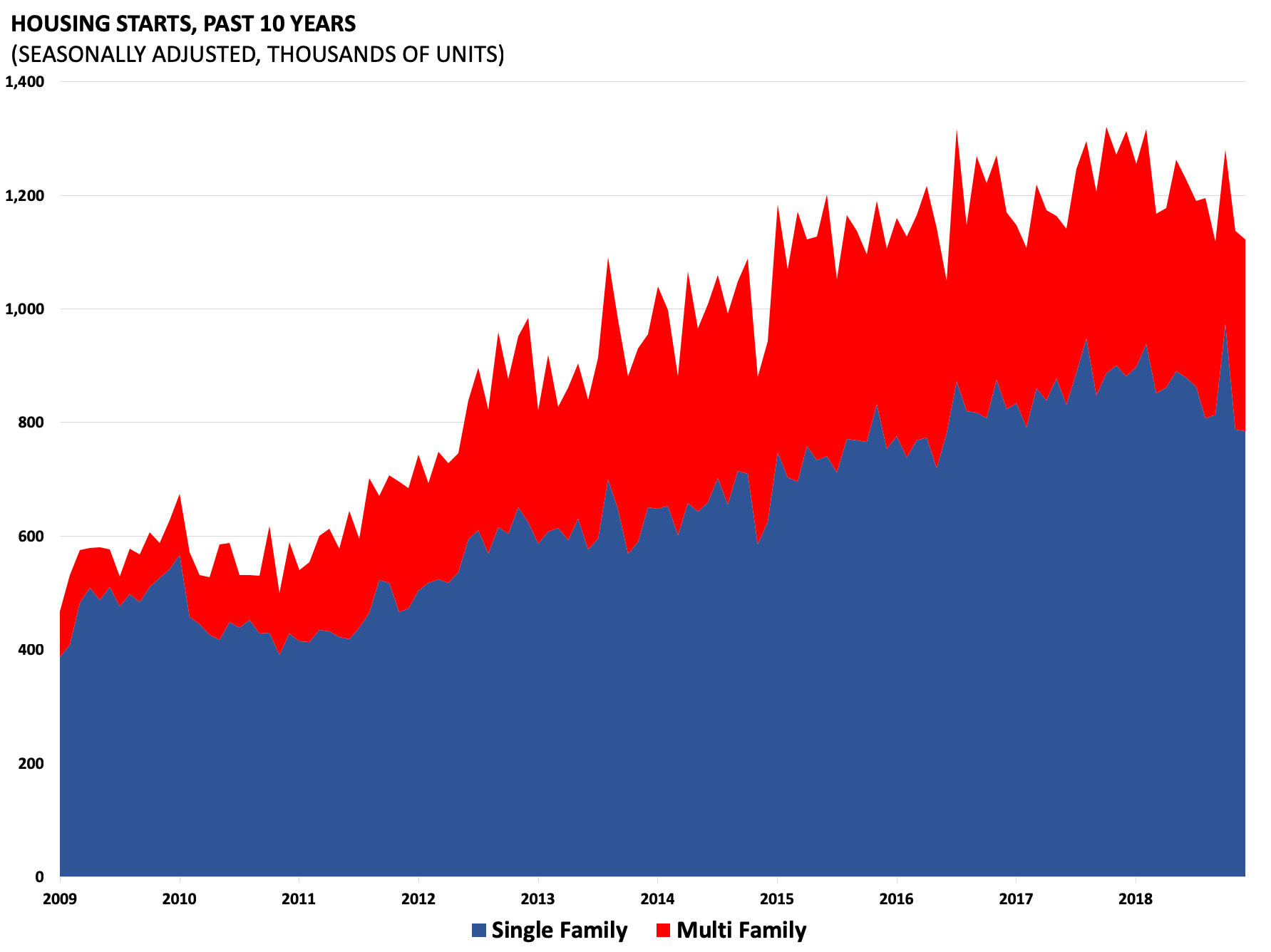

Two of the best indicators of the supply side are housing permits and housing starts. Housing permits remain well below their 2018 peaks. In March 2019, permits were 7.8 percent below their level one year earlier.

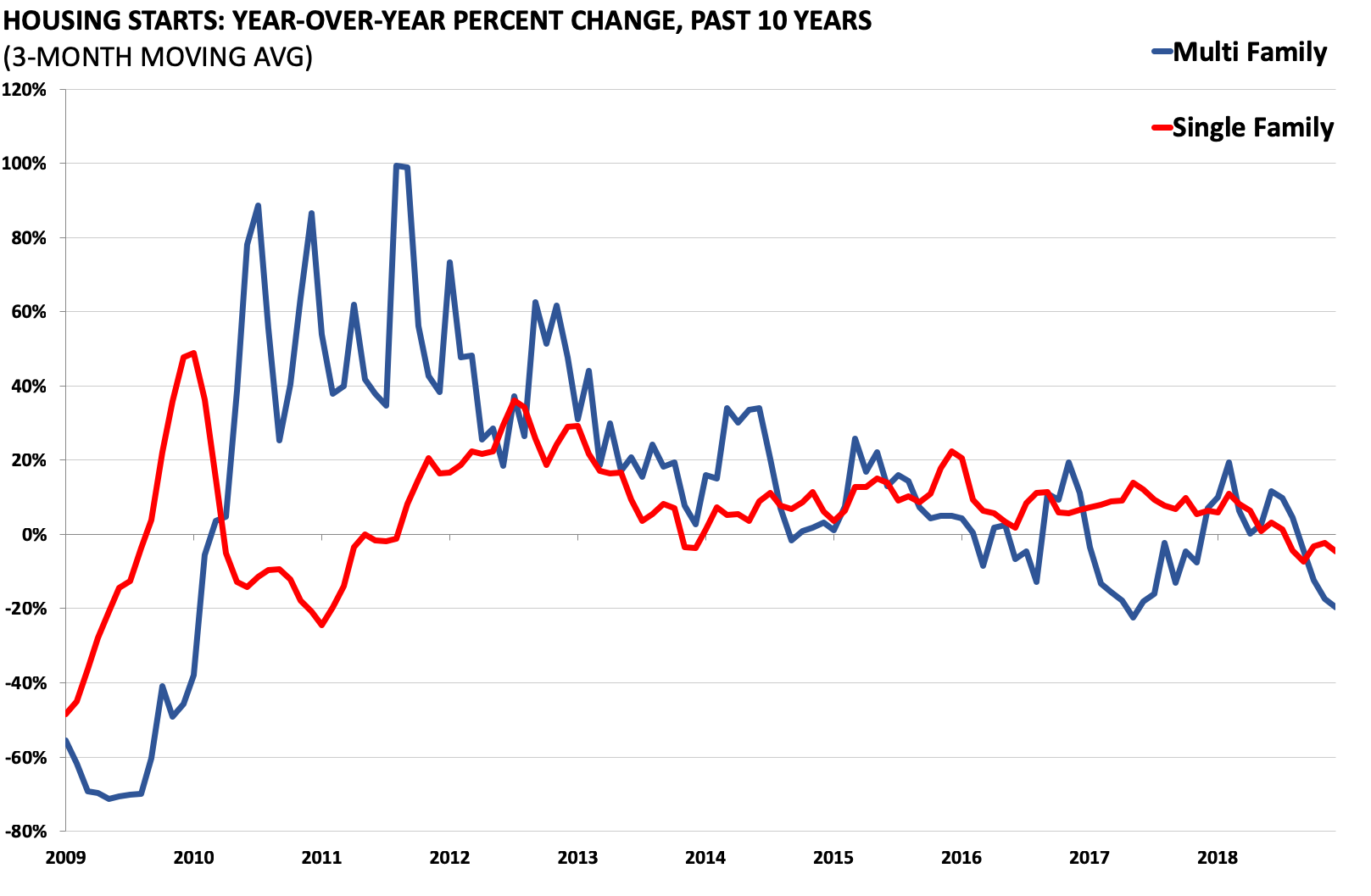

Similarly, housing starts have not yet shown much of a recovery. Single-family starts are 11 percent below March 2018, while multi-family starts were 21.8 percent lower in March 2019 than in March 2018.

The bottom line is that one-fourth of the way through 2019, one cannot make the case that the housing market is clearly firming. While there are early signs of progress on the demand side, the same cannot be said of supply conditions.

Fact of the Day

The 2019 Social Security Trustees Report finds that the program will go bankrupt in 2035.