The Daily Dish

May 23, 2017

Tax Reform and the Election

The Congressional Budget Office (CBO) released a new report which determined that it will cost the federal government $6 million to implement new cybersecurity legislation which passed the House Science Committee. The bill would require the National Institute of Standards and Technology (NIST) to provide resources to businesses to help them guard against cyber attacks.

On Friday a federal appeals court struck down a 2015 Federal Aviation Administration (FAA) drone registration rule. The FAA rule sought to require toy drone users to register their drone with the federal government. The rule was an interim rule and had not been officially finalized. The court argued that under the FAA Modernization and Reform Act of 2012 the FAA was barred from creating any rule pertaining to model toy drones.

Eakinomics: Tax Reform and the Election

The first complete Trump Administration budget will be released this morning. Based on a variety of new reports, it’s projected to reach balance over the next 10 years, in large part because of $1.7 trillion or so in reduced mandatory spending. Given the president’s pledge to leave Social Security and Medicare untouched, one should expect this to be concentrated in the Medicaid and Supplemental Nutrition Assistance Program (SNAP).

In addition to savings on debt service, the other major component of deficit reduction will be more rapid economic growth, averaging roughly 3 percent over the 10 years. This, in turn, will stem in large part from revenue neutral tax reform, although the budget will be silent on the details.

This raises the immediate question: will tax reform get done? The House has continued to work on its Blueprint, including holding a hearing today on the controversial proposal to “border adjust” the reformed tax. The Senate has shown little public progress – although there is doubtless work underway – and the White House has – until today’s Budget – displayed a preference for tax cuts over tax reform. Clearly, there is less than unanimity on the surface.

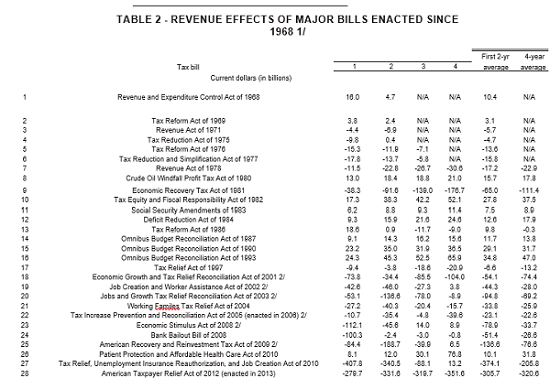

Meanwhile the clock has been ticking. Indeed some pundits have argued that tax reform has to be done in 2017, because 2018 is a midterm election year and “nothing gets done in an election year.” Well, no so fast. The table below (reproduced from here) shows the revenue effects of the major tax bills in the past 50 years. But the most important numbers are actually the years themselves. Again and again tax bills – including the 1986 Tax Reform Act – are passed in election years.

This suggests that the window to do tax reform may be wider than some think. This would be a real benefit, as the U.S. desperately needs real tax reform.

Fact of the Day

On April 28th, President Trump signed the America First Energy Executive Order which allows for the expansion of drilling for oil and gas in waters off certain coasts in the United States.