The Daily Dish

July 11, 2017

Taxing the Rich

The new draft of the Senate Obamacare repeal and replace bill may be rolled out as early as this week, according to Sen. John Cornyn (R-TX). Cornyn noted that Senate Republicans have been in “continuous” discussion throughout the recess, and hopes to present their amended draft by the end of this week, with for a vote on the bill as early as next week.

On Sunday Treasury Secretary Steven Mnuchin stated that the Trump Administration is not considering a higher tax rate despite multiple reports claiming some in the Administration are pushing for an increase in the top tax rate. Mnuchin emphasized that according to the tax plan released by the White House in April, the top individual tax rate would actually decrease to 35 percent. Secretary Mnuchin said that tax reform remains a top priority for this administration and he fully expects tax reform to be completed this year.

Eakinomics: Taxing the Rich

What do health care reform and tax reform have in common? Both are attacked by opponents as simply “tax cuts for the rich” because the health care bills repeal the Affordable Care Act’s surtax on net investment income for high-income individuals, and tax reform proposals lower the top marginal income tax rate. This is, of course, a deliberate oversimplification for political purposes. It also suggests an under appreciation of some of the basic tradeoffs in tax policy.

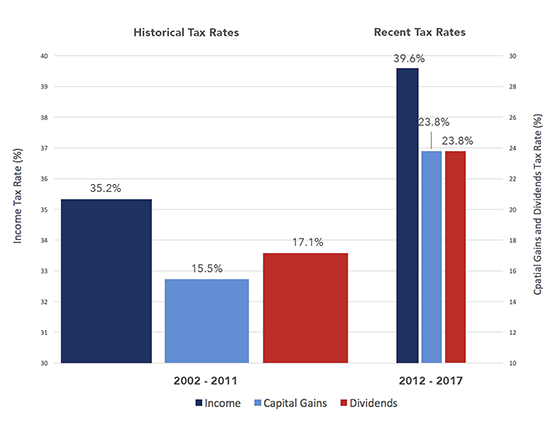

The goal of such attacks is to make the proposed reforms seem unfair. But there is no objective standard for fairness—it’s in the eye of the beholder. There is certainly nothing unusual about lower tax rates on high incomes, interest, dividends, and capital gains. Indeed, as the chart below indicates, it is the higher rates of the past four years that stand out as the exception to typical tax policy over the past 15 years.

Importantly, higher tax rates carry a cost, and tax rate reductions have hidden benefits. The cost is known as the “efficiency cost” or “deadweight loss” of the tax system; i.e., the loss above and beyond the fact that taxes make the private sector poorer. An easy example stems from the fact that my favorite food is Twizzlers. If the federal government were suddenly to impose a $20 tax on the classic 2-pound, resealable package of strawberry twists, I’d switch to surviving on Skittles. Notice that the government would raise exactly $0 in tax revenue from me, but I’d still be worse off: I’d be eating Skittles instead of my favorite. A similar impact happens on the production side of the economy. Taxes on capital and labor cause firms to invest and hire less than they otherwise would and, as a result, produce less as well. The deadweight loss in this case shows up as a smaller economy and poorer growth.

The loss in both cases stems from the incentive impacts of taxes, and as tax rates go higher the incentives get strong and more damaging. A recent survey puts the deadweight loss of the income tax at $388 billion in 2012, or over 28 percent of the actual income taxes collected. Finding ways to raise revenue with a broader base and lower marginal tax rates on wages, interest, dividends, and capital gains is fundamentally sound tax policy regardless of the context in which it occurs.

Fact of the Day

The per capita regulatory burden for 2017 is $449.