Insight

June 30, 2017

CBO June Update: A Good Lesson in Percentages

The Congressional Budget Office (CBO) recently updated their January budget and economic projections. For the most part, the nation’s fiscal and economic outlook remains unchanged: sub-two percent trend economic growth and growing indebtedness. This shouldn’t come as a surprise to observers or policymakers, as there has been little in the way of legislation or surprise economic tailwinds that would fundamentally alter this trajectory since January. Indeed, but for one exception, the myriad tweaks to CBO’s budget outlook reflected in today’s report are so small as to be swamped by the uncertainty of 10-year budget projections. But there is one line item in CBO’s update worth examining: interest costs.

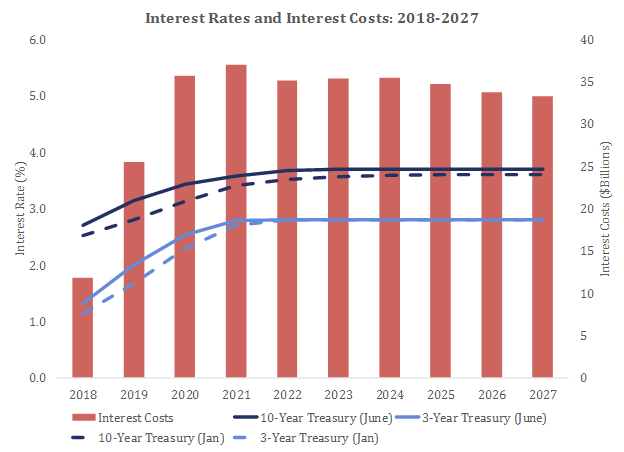

The single largest change in CBO’s budget outlook is a $318 billion increase in projected interest costs over 2018-2027, driven by slightly higher interest rate projections. On average, CBO’s June economic forecast assumes rates on 10 and 3-Year Treasury securities to be 0.2 and 0.1 percentage points higher over the next 10 years, respectively.

This is hardly an interest rate shock, but the U.S. debt load is sufficiently large enough that a small percentage increase in interest rates leads to large increases in borrowing costs. The U.S. has benefited from low interest rates, allowing the federal government to borrow large sums relatively cheaply. However, as Thursday’s report makes clear, due to the size of the U.S. debt portfolio, the federal budget is highly sensitive to interest rate fluctuations. If a policymaker of either party proposed a $300 billion tax or spending bill budget minders would take immediate notice. But interest costs are virtually on autopilot , reflecting market rates and past decisions that gave rise to the current debt load. Unless policymakers take proactive steps to reduce the overall debt, the U.S. will continue to face interest rate risks – risks that would make $300 billion look modest by comparison.