Insight

May 24, 2017

The FY2018 Budget and Competing Baselines

The first step in crafting federal budgets, be they Congressional or presidential, is to establish a baseline. A baseline is a starting point, a measuring stick by which fiscal policy changes can be measured. Federal budget agencies, the Congressional Budget Office (CBO) and the Office of Management and Budget (OMB) have these responsibilities for the legislative and executive branches, respectively. Each agency is bound by a different set of rules and norms that can greatly influence how fiscal policy is evaluated and presented in budgets. This difference is particularly apparent upon the release of the President’s Budget, which uses a much more favorable set of economic assumptions than those used by the CBO. This brief examines the role of these budget agencies in developing budget baselines, and how differences in those baselines can present very different budgets.

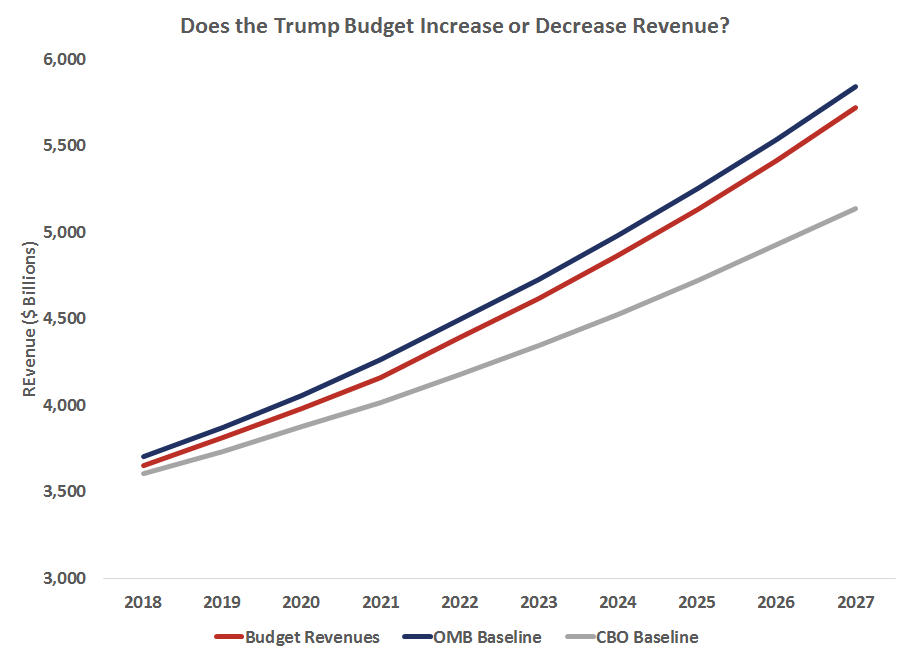

Figure 1: Baselines and the Budget (2018-2027)

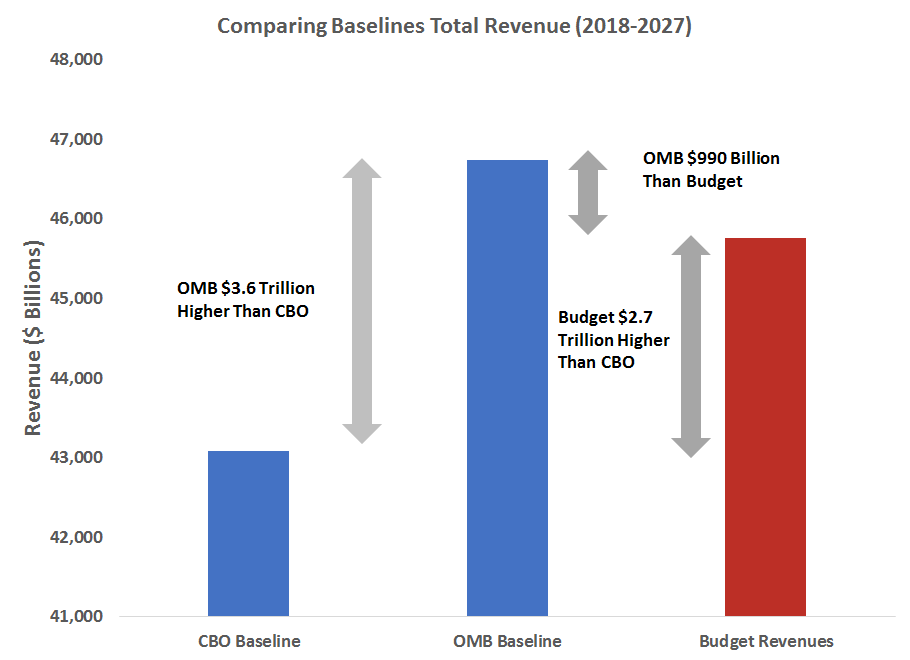

The importance of baselines can be illustrated by posing the simple question about the President’s Budget: does it raise or lower tax revenue? Compared to OMB baseline, the President’s Budget proposes reducing revenues by $990 billion over the next ten years. Compared to CBO’s baseline, the President’s Budget increases revenue by nearly $2.7 trillion. Increases and decreases are relative measurements¸ that is they are measurements of changes compared to a fixed standard or yardstick. With respect to budgets, this yardstick is the baseline, a counterfactual scenario in the absence of the changes proposed in the budget. So, to understand why the budget can look very different depending on the yardstick, it’s important to understand how those yardsticks are constructed.

CBO constructs its baseline according to requirements set forth in law and rules developed over time, the most fundamental of which is the assumption of current law in its budget and economic projections. Thus, when lawmakers in Congress write budgets, they typically start (though they are not required to) with CBO’s baseline and builds in assumptions about the policies they want changed.

OMB essentially follows the same process; they start with a current-law baseline and build in changes to that baseline to reflect policy choices that the administration wants to pursue. However, unlike CBO, OMB also has considerably more discretion to adjust the current law-baseline and the underlying economics that underpin the baseline and the budget. Typically, President’s Budgets incorporate policy assumptions in the baseline itself and move the baseline from a “current law” baseline to a “current policy.” These adjustments often extend temporary policies into permanence. With these temporary policies assumed in the baseline, the administration doesn’t have to present the costs of those policies in their budget proposals. This is also not a new development with the Trump Administration, but rather common practice by both Republican and Democratic administrations.

OMB also has considerable discretion with respect to the economics that underpin the baseline and the president’s budget as a whole – and this discretion can really matter. Specifically, the FY2018 President’s Budget has different growth assumptions than does the CBO. In large part this is based on OMB’s assumption of full enactment of the president’s proposed policies, and salutary growth effects stemming from those policies. This is also not a new development, but rather long-standing practice at OMB. In the case of the FY2018 President’s Budget, the administration assumes real GDP growth will average about 1.1 percentage points higher than does CBO. This assumption has significant budgetary consequences and explains why OMB assumes $3.6 trillion in higher revenue collection than CBO over the next ten years. Thus, the Trump Administration’s budget can propose a revenue loss of $990 billion and still show higher revenue collection, by about $2.7 trillion than the CBO baseline.

Figure 2: Baselines and the Budget Side-By-Side

To answer the question as to whether the budget increases or decreases revenues requires knowing which yardstick measure against. CBO’s baseline is widely used and well understood. It has significant limitations, but those limitations in part reflect the rigidity of the rules governing its construction. This rigidity insulates CBO, in part, from charges of manipulation or bias. OMB on the other hand has more discretion to create a baseline that is arguably more realistic than CBO’s, but this discretion leaves OMB more vulnerable to charges of gaming the numbers than CBO. Both baselines are 10-year projections and are inherently uncertain, and both rely on assumptions that introduce even greater uncertainty. Wise budget observers would do well to understand how the Trump budget compares to both standards, and why.