Insight

June 29, 2016

Should GSE Fees Be Lower?

Last week, twenty-five groups, including the American Bankers Association, the NAACP, and the U.S. Mortgage Insurers, sent a letter to Federal Housing Finance Agency (FHFA) Director, Mel Watt encouraging him to reduce the Loan-Level Price Adjustments (LLPAs) imposed by Fannie Mae and Freddie Mac (the GSEs). LLPAs, along with ongoing guarantee fees, are paid by the mortgagee either as part of their up-front closing costs, as part of their monthly payment, or a combination of the two.

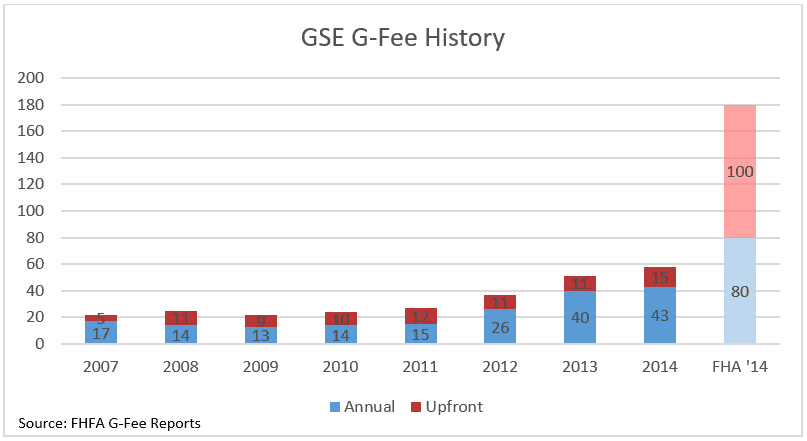

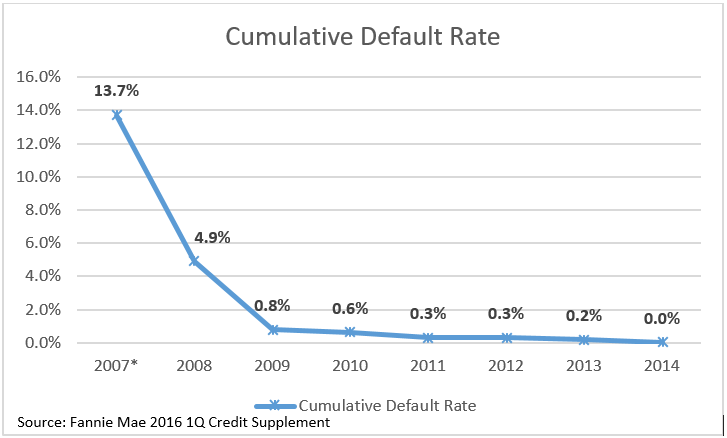

LLPAs can range from 0 percent to 4 percent depending on factors like the mortgagee’s credit score and the loan-to-value (LTV) ratio. Combined with guarantee fees, which have tripled for some borrowers over the past 5 years, these fees can become quite burdensome, especially for low-income and first time homebuyers. Interestingly, as the GSEs continue to raise fees on borrowers, the cumulative default rate has fallen to almost 0 percent.

When the fees are combined across a range of credit scores and loan-to-value ratios (LTV), an interesting pattern forms wherein the lowest credit score categories coupled with a mid-range LTV end up paying the most in fees, but the lowest credit scores with the highest LTV pay slightly less, all of which have seen significant increases since 2010, as shown in the examples below.

At the same time, the Federal Housing Administration (FHA) mortgage fees have remained relatively constant during the same timeframe. Between 2010 and 2014 FHA up front insurance premiums stayed at 1 percent with a brief spike up to 1.3 percent while the annual premiums went from a low of 0.5 percent to a high of 1.35 percent and back down to 0.8 percent. Even at their low point, FHA fees remain substantially higher than the lowest fees at the GSEs, especially when just considering guarantee fees. There’s a simple explanation for that: the GSEs allow for some participation of private mortgage insurance – or a sharing of the risk with the private sector – whereas FHA does not.

As the data shows, the highest fees from the GSEs are charged to the borrowers with the lowest credit scores – generally, the lowest-income households. When those borrowers are faced with a choice between the highest echelon of fees at Fannie and Freddie or possibly lower fees at FHA, those borrowers will choose the FHA mortgage every time. And while that may be good for them, that is bad for the taxpayers – FHA mortgages are 100 percent backed by taxpayer dollars, whereas mortgages from the GSEs are backed at least in part by private mortgage insurance, taking much of the weight off of the taxpayers who have already had to bailout these mortgage giants.

When private mortgage insurance is allowed to take on some of the risk presented by riskier mortgages, the GSEs don’t have to charge as much in fees to cover any potential losses. And when the GSEs are able to charge lower fees on riskier mortgages, they are able to achieve FHFA’s goal of expanding access to mortgage credit for low and middle-income households. Not only does that help the borrowers, but that helps the taxpayers when more of the riskier borrowers choose GSE loans over FHA loans.

Ultimately, even though the GSEs’ rates are lower than FHA’s, they are still too high. With low default rates as a result of new regulations and underwriting standards, Fannie and Freddie should lower their fees, allow for more participation from private mortgage insurance, and really expand mortgage credit availability.