Insight

June 29, 2021

Renewable Fuel Standard Program Exemption Extension

Executive Summary

- The United States Supreme Court ruled last week in favor of allowing refineries to receive extensions of renewable fuel standard exemptions after their previous extensions had lapsed.

- The decision preserves the ability of refiners to seek exemptions when they would otherwise experience disproportionate economic hardship by following the letter of the statute.

- Allowing exemptions prevents the unnecessary inflation of consumer prices and preserves domestic refining capability when market prices are unfavorable.

Introduction

On Friday, the United States Supreme Court ruled in HollyFrontier Cheyenne Refining, LLC v. Renewable Fuels Association. The case centered on the extension of exemptions granted to small refineries under the renewable fuel standard (RFS) program, which requires domestic refineries and importers to blend renewable fuels into the traditional fuels they produce. Under the RFS, gasoline and diesel consumed domestically are blended with renewable fuels, or alternatively refiners purchase Renewable Identification Numbers that serve as credits to fulfill their obligation. Small refineries, however, may petition to be exempted due to market conditions, as complying could make operating uneconomical. Each year exemptions equal no more than 10 percent of domestic transportation fuel production.

The Court held that an extension may be granted to a small refinery that received a hardship exemption in the past even if that exemption had lapsed, determining that continuity was not required to extend an exemption. The decision allows small refineries that are unable to meet the blending requirement due to market conditions to forgo blending for at least two years. Had the Court ruled that continuity was necessary to retain the exemption, only those small refineries that had maintained the exemption without lapse would be able to continue applying it moving forward. Instead, the decision allows small refineries that would be overly burdened by the mandate to rely on the exemption when necessary and blend when it would not threaten their continued operations.

Renewable Fuel Blending

In 2005, Congress passed the Energy Policy Act, which tasked the Environmental Protection Agency (EPA) with enforcing a volumetric RFS mandate in an effort to reduce dependence on foreign oil and eventually improve the environmental impact of transportation fuels. It provided a blanket exemption until 2011 for small refineries (those that produce fewer than 75,000 barrels per day on average in a calendar year). Exemptions could be extended beyond 2011 should the refiner experience “a disproportionate economic hardship” in meeting the RFS mandate. In 2007, the Energy Independence and Security Act (EISA) further defined the target volumes of each type of renewable fuel that should be blended with traditional fuels and thus created artificial demand for renewable fuels.

The EPA is responsible for enforcing the blending rules for refiners and importers of gasoline or diesel fuel (obligated parties). By considering projections of gasoline and diesel production in the coming year, the EPA determines how many gallons of renewable fuels should be mixed with traditional fuels nationally and allots facilities annual renewable volume obligations (RVOs) to meet the total target.[1] Historically, the EPA’s annual targets for renewable fuel blending fell below the values proposed by Congress in EISA, suggesting that the mandate has failed to incentivize the development of more renewable fuels.[2]

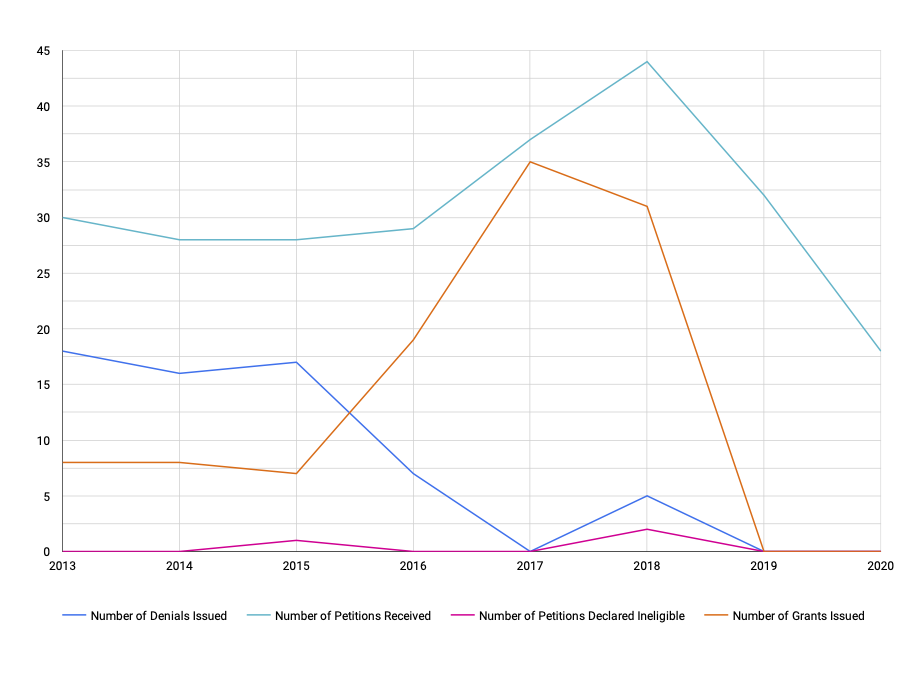

Companies can comply by blending renewable fuels into traditional fuels or by acquiring Renewable Identification Numbers (RINs) to meet an RVO. Each gallon of renewable fuel produced is associated with a unique RIN, which acts as a credit. RINs can be created in one year and saved until the following year to meet obligations. Should a company be unable to meet its obligation one year, the deficit can be carried over into the next year. Alternatively, if the VRO proves to be a disproportionate economic hardship, the obligated party may petition to be exempt, as demonstrated in the chart below.[3]

Petitions for Exemption

Source: EPA

Source: EPA

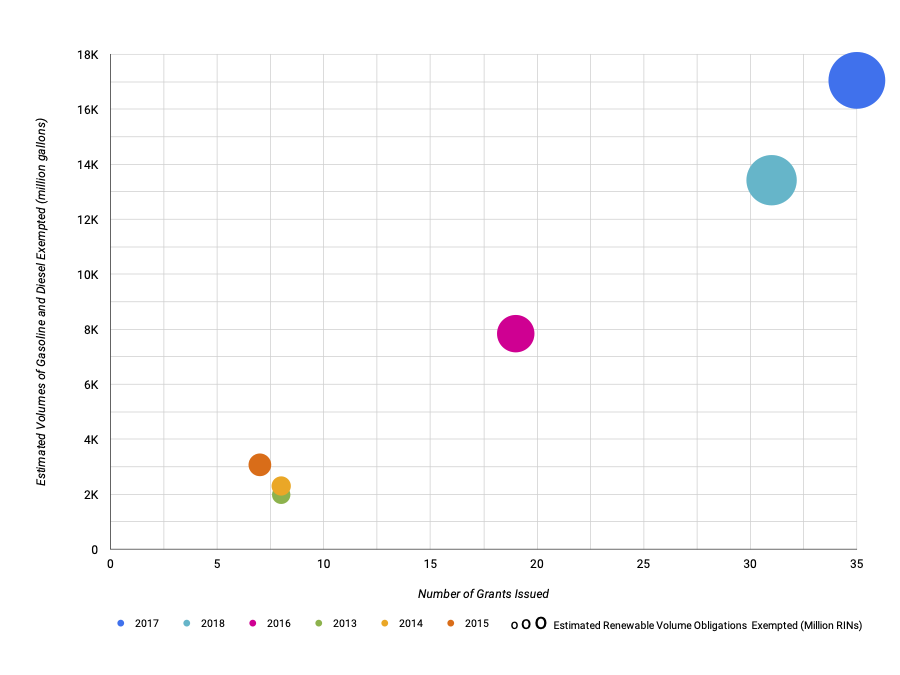

In 2017, when the most exemptions were issued, the United States produced over 166 billion gallons of gasoline and diesel.[4] The exemptions resulted in the production of 17 billion gallons without blending, 10 percent of total production. The chart below demonstrates the number of exemptions granted and related volumes and RINs on an annual basis. Due the impact of the COVID-19 pandemic on fuel consumption, the EPA delayed compliance for 2019 and 2020 because RIN prices escalated while fuel demand declined, highlighting the sensitivity of mandate-imposed markets to real world conditions. EPA issued a rule in March extending 2019 compliance until November 2021 and compliance for January 2020 until 2022.[5]

Exempted Volumes and Renewable Volume Obligations

Source: EPA

Source: EPA

The purchase of RINs creates additional costs and contributes to the forces that drive consumer prices. The EPA found that when comparing fuels sold with RINs under the RFS to those in markets without RINs, “obligated parties were generally able to increase the price they charge for the RIN obligated petroleum products they sell for use as transportation fuel in the United States to help recover their compliance costs under the RFS program.”[6] The impact of RVOs and RINs on the price varies as the price of feedstock crude oil or the proportion of renewable fuel blended changes, among other factors. Gasoline and diesel prices are subject to market conditions that are only further complicated by the addition of RINs. In turn, the ability to grant exemptions is a valuable tool in reducing regulatory impact on consumer prices.

Statutory Interpretation

The arguments before the Supreme Court centered around the interpretation of the term “extension” as it pertains to the issuance of exemptions. In particular, three small refineries initially received an exemption, which lapsed for some time, and then petitioned for an exemption again, which the EPA granted. A group representing renewable fuel producers objected to the “extension” of the exemption and the Tenth Circuit vacated the EPA’s decisions due to the lapsed period.

While the statutory language fails to define “extension,” the Supreme Court explained that it does allow for small refineries to apply for an exemption “at any time.” In addition, the plain meaning of the word does not require continuity nor does the statutory language use qualifying language, such as “consecutive,” to suggest that is its intention. And the extension of exemptions is in keeping with the statute’s other provisions aimed at lessening the potential negative impacts of the mandate, such as the issuance of waivers in the case a renewable fuel is not available in sufficient quantities or the mandate “would severely harm the economy or environment” of a state or region.

Conclusion

The EPA’s RFS program requires that transportation fuels incorporate renewable fuels and, in turn, imposes costs on obligated parties and consumers alike. The Supreme Court’s decision to allow exemptions to be extended to obligated parties following a lapse is in keeping with the realities of the market. By avoiding disproportionate economic harm through a waiver, small refineries are able to continue operating and communities and consumers can avoid unnecessary price spikes, all while helping the United States achieve the goals of increased energy independence and reduced environmental impact.

[1] https://www.epa.gov/fuels-registration-reporting-and-compliance-help/annual-compliance-data-obligated-parties-and

[2] https://www.americanactionforum.org/research/renewable-fuel-standards-policy-failures-economic-burdens/

[3] https://www.epa.gov/renewable-fuel-standard-program/overview-renewable-fuel-standard

[4] https://www.epa.gov/fuels-registration-reporting-and-compliance-help/annual-compliance-data-obligated-parties-and

[5] https://subscriber.politicopro.com/article/2021/03/epa-extends-rfs-compliance-deadlines-as-scotus-ponders-exemption-eligibility-2043423?source=email

[6] https://www.regulations.gov/document/EPA-HQ-OAR-2016-0004-3714