Insight

June 19, 2018

Summary and Analysis: House Budget Committee FY2019 Budget Resolution

By the Numbers

Taxes: Compared to the Congressional Budget Office’s (CBO) baseline, the House Budget Committee’s (HBC) FY2019 Budget Resolution assumes no changes in nominal revenues. The House Budget Resolution assumes deficit reduction through macroeconomic feedback and higher economic growth than does the CBO baseline. Accordingly, revenue collection as a share of the Gross Domestic Product (GDP) levels assumed in the HBC Budget Resolution is relatively smaller. However, the primary channel by which the federal budget benefits from economic growth is through increased revenue collection, which should further increase the nominal revenue collection numbers assumed in the budget resolution.

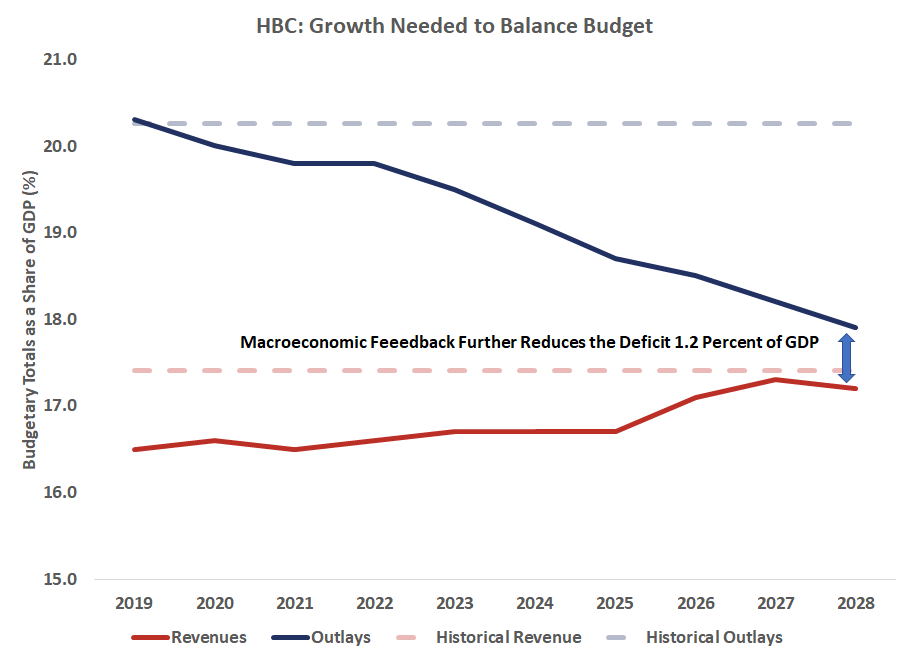

Spending: By the end of the budget window, the Budget Resolution would decrease spending by over $6.4 trillion over the next 10 years, sending spending over 2 percentage points below historic norms, as a share of GDP.

Deficits: The HBC FY2019 Budget Resolution assumes projected deficits decline substantially from 3.7 percent of GDP in FY2019 to a surplus of 0.4 percent of GDP. However, this is predicated on the assumption of higher economic growth stemming from the policies assumed in the budget resolution, which HBC estimates contributed to an additional 1.2 percent of GDP in deficit reduction in FY2028. This assumed feedback is sufficient to improve a static deficit of $238 billion in FY2028 to an assumed surplus of $142 billion.

Interest Payments: Interest payments on the debt will reach $734 billion in 2028 under the Budget Resolution. This reflects a more than tripling of debt service costs of $240 billion in FY2016 and demonstrates that interest costs, notwithstanding the substantial deficit reduction assumed in this budget, will grow significantly in the coming years.

Debt Held by the Public: Borrowing from the public would essentially stabilize as a share of the economy under the House Budget Resolution for the next 4 years, reaching 78.4 percent of GDP in 2020, before dropping to 64.0 percent of GDP – the lowest level of indebtedness as a share of GDP since 2010.

Other Provisions

The House Budget Committee Budget Resolution uniquely uses its own GDP assumptions, rather than those prepared by the CBO. While congressional Budget Resolutions have assumed alternative economic projections in the past, it remains a rarely invoked prerogative. The Budget Resolution assumes average annual real GDP growth of 2.6 percent over the period 2019-2028. Over the same period the CBO estimates real GDP will grow at 1.8 percent on average. The Office of Management and Budget (OMB) assumes annual real GDP growth of 3 percent in the administration’s budget. However, it should be noted that at the time of its release, the OMB forecast was also well above those prepared by the Federal Reserve and by the Blue Chip panel of forecasters.

To help achieve the $6.4 trillion in spending reductions, the budget will include reconciliation instructions to provide fast-track procedures for considering at least $302 billion in deficit reduction. The instructions are directed at 11 committees, which are charged with submitting policy changes achieving deficit reduction of at least the amounts specified below:

- $150 billion from the Committee on Ways and Means

- $45 billion from the Committee on the Judiciary

- $32 billion from the Committee on Oversight and Government Reform.

- $24 billion from the Committee on Financial Services

- $20 billion from the Committee on Energy and Commerce

- $20 billion from the Committee on Education and the Workforce

- $5 billion from the Committee on Natural Resources

- $3 billion from the Committee on Homeland Security

- $1 billion from the Committee on Agriculture

- $1 billion from the Committee on Armed Services

- $1 billion from the Committee on Veterans Affairs

Finally, the Budget Resolution was largely silent on budget process reforms. The Budget Resolution contains a number of procedural and related matters that have been routinely included in previous budget resolutions but appears to defer any significant changes on budget process to the ongoing work of the Joint Select Committee on Budget Process Reform.