Research

July 2, 2018

Comparing Effectiveness of Climate Regulations and a Carbon Tax

Executive Summary

Since 2009, the federal executive branch has had clear legal authority to implement regulations to reduce greenhouse gas emissions. While the Trump Administration is unlikely to exercise this authority, a future administration almost certainly will.

There is thus value in determining the most efficient implementation of such policies. This research compares the effectiveness and economic impact of two commonly considered policies: a carbon tax and direct regulation. It finds that carbon taxes are significantly more cost-effective at reducing greenhouse gases than regulations, with regulations costing more than twice as much per metric ton of carbon dioxide abated while reducing far fewer emissions.

Both a carbon tax or regulations would impose significant economic burdens by raising the cost of energy consumption. The impact of a carbon tax could be mitigated, however, through a “revenue-neutral” approach, where its revenues are applied to reduce the most distortionary taxes. This research finds that such a swap could limit the policy’s economic impact.

Introduction

Two broad schools of thought have emerged as to how the government could address climate change. On one side are those who want to see more direct command-and-control regulation similar to what the Obama Administration implemented. On the other are those who want to see a more market-based approach, with the government imposing a price on carbon (such as with a carbon tax) and then letting the market reduce carbon emissions organically.

While few expect the Trump Administration to endorse or pursue any climate regulations, a future administration likely will, as the Environmental Protection Agency (EPA) and other agencies are required by law to regulate greenhouse gas emissions due to the 2007 Supreme Court Case (Massachusetts v. EPA) which led to the Bush Administration’s EPA preparing an unreleased Endangerment Finding. In 2009, the Obama Administration’s EPA published a finalized Endangerment Finding to the Federal Register cementing federal authority to regulate greenhouse gas emissions. Even in the near term, many states and cities are attempting to create their own climate regulations and policies. The debate over the best government response to climate change will continue to be relevant for years, if not decades.

This paper compares the effects on the economy and greenhouse gas emissions of two policy proposals: regulating greenhouse gas emissions through command-and-control executive actions (as President Obama did), and imposing a carbon tax. This paper finds, consistent with the literature, that a market-based mechanism reduces emissions at a greater level while burdening the economy less. This paper does not consider the environmental benefits from reducing carbon emissions, and thus it does not conclude whether a revenue-neutral carbon tax would be, on net, economically harmful or beneficial. However, this paper considers the possibility of swapping a carbon tax for other distortionary taxes, such as the corporate income tax, and concludes that such a swap could result in many of the environmental benefits of other climate actions with less negative economic consequences.

Setting a Climate Goal

A widely accepted goal for climate policy is to keep global temperatures under 2 degrees Celsius above pre-industrial temperatures. This target originates from an idea that global temperatures typically do not vary by more than 2 degrees, and thus the impact of an increase above that threshold is more difficult to predict. Simply put, one would expect the risks of temperatures rising from 2 to 3 degrees Celsius to present greater risks than rising from 1 to 2 degrees.

Typically, the standardized policy objective for keeping global temperatures under the 2-degree threshold have relied upon an estimate from the Intergovernmental Panel on Climate Change (IPCC) that suggests all developed nations should cut their emissions to 80 percent below their 1990 levels by 2050. In the United States, the target is often adapted to be from 2005 levels, as that is the peak emissions year and thus creates the easiest target. However, since the target is not based on total cumulative emissions, the target ignores the marginal benefits achieved each year under a long-term emissions-control policy. To address this, this research instead uses an estimate of the total global emissions that can be emitted to reach the 2-degree target plausibly, creating essentially a “carbon budget.” The IPCC estimated that having equal odds of meeting or exceeding a 2-degree target requires cumulative global emissions under 1.13 – 1.53 trillion metric tons, of which 520 billion metric tons has already been emitted, leaving a remaining budget of 0.61 – 1.1 trillion metric tons.

This research assumes that the United States will emit 16 percent of total global emissions between now and 2050 (which is the United States’ current share of global emissions). In a baseline projection of emissions, the United States would emit 225 billion metric tons of greenhouse gases between 2011 and 2050, and natural sinks would reduce that value by 30.2 billion.[1] The estimated “budget” for the United States over the same period is between 98.4 billion and 162.4 billion. Assuming no policy action until 2021, the United States would have to abate at least 63 billion metric tons of greenhouse gas emissions to meet the lower bounds of the carbon budget, which is in effect the easiest target to reach while still in line with stated global climate policy goals.

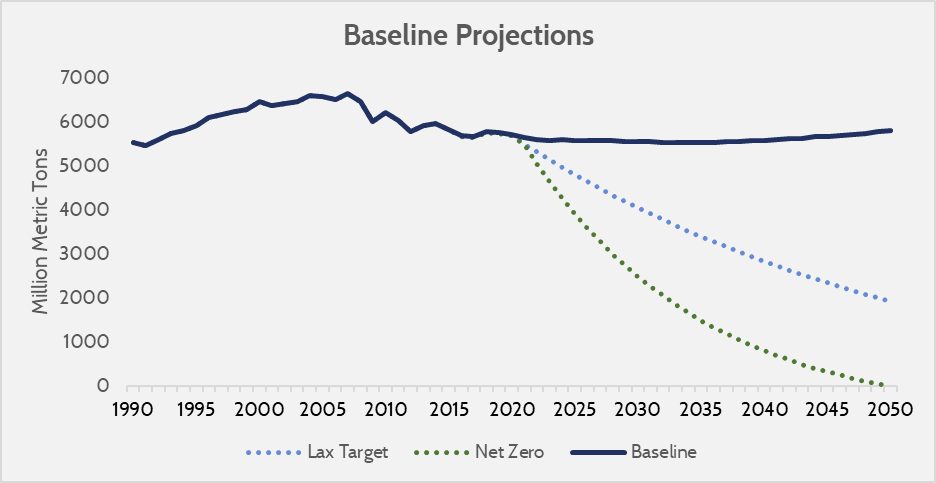

The chart below shows a baseline projection of the United States’ net greenhouse gas emissions (emissions minus sinks), the lower bound of the estimated carbon budget (“Lax Target”), and the emissions reductions needed to reach net zero emissions by 2050.

Source: AAF estimates based on EPA greenhouse gas inventories, projected future energy emissions, and IPCC estimates of temperatures at varying atmospheric greenhouse gas concentrations.

Effectiveness of a Regulatory Approach

From the baseline projection above, we can evaluate the effectiveness of command-and-control regulations for meeting the required emissions reduction. This analysis requires an estimate of how much hypothetical regulatory schemes would reduce emissions. In order to develop these projections, we used the list of sources from the EPA’s Draft Inventory of U.S. Greenhouse Gases Sources and Sinks: 1990-2016. For each source, we examined available resources from EPA, the Energy Information Administration (EIA), and academic literature to identify the highest percentage reduction possible for that emission source. We then assumed that a regulatory scheme could achieve this reduction, setting aside the practicality of implementation or political reality.

Cuts to fossil fuel combustion sources comprise the primary portion of our reduction projections, and electric power generation is the largest part of fossil fuel combustion. The regulatory scheme we projected beginning in 2021 is a rule similar to the Obama-era Clean Power Plan that is designed to reduce carbon dioxide emissions from electric power generation to 50 percent of 2005 levels by 2050. Combined with the regulatory schemes assumed for the other sub-sources of fossil fuel combustion, we project an emissions reduction of 39 percent from 2018 levels, the base year value. Reductions from fossil fuel combustion accounts for 72 percent of the projected emissions reduction from all hypothetical regulations.

Based on our projections, a regulatory approach could, at best, achieve emissions reductions that only reduce emissions by 59 percent of what AAF estimates is needed to stay within the carbon budget.[2] Such reductions would not be sufficient for the United States to achieve its share of the cuts necessary to prevent temperatures from reaching the 2-degree threshold.

Effectiveness of a Carbon Tax

As an alternative to a regulatory approach, some have proposed that the government put a price on greenhouse gas emissions. A tax on greenhouse gas emissions, known as a carbon tax, would be a type of “Pigouvian” tax: a tax that is implemented to correct for product costs not included in the price, known as externalities. There is little doubt that a carbon tax would be an effective mechanism for reducing emissions, because we know that raising the cost of a behavior discourages its use. The primary economic questions are how adaptable the affected industries are, and how responsive are consumers to price increases.

A tax has several advantages over more direct regulation. Taxes can capture a broader base of consumers and can encourage efficient opportunities for behavioral change. Carbon taxes also tend to be administratively simpler to implement than regulations. If a tax is applied upstream (at coal mine mouths or oil and gas wellheads), the taxed business will likely pass on most or all the tax in the cost of their product. This reality makes the policy far easier to implement than regulations or a cap-and-trade carbon pricing scheme, both of which would require far greater government intervention.

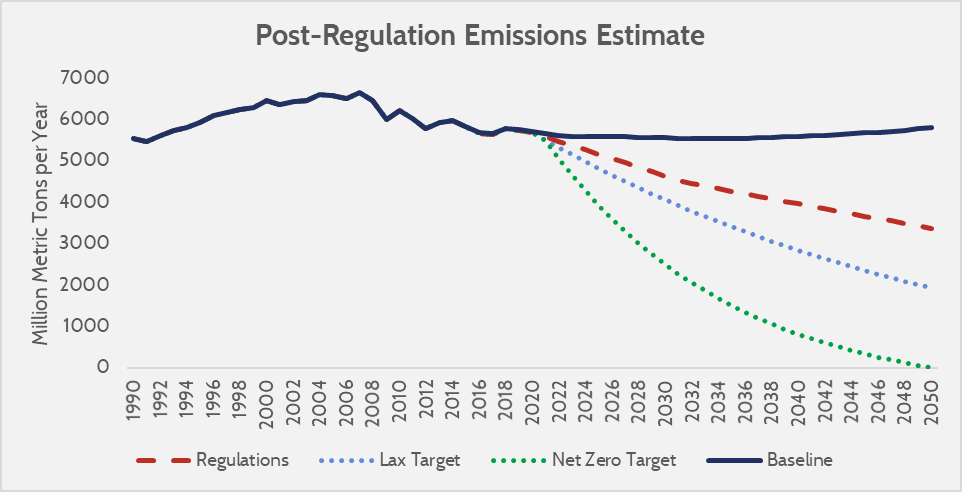

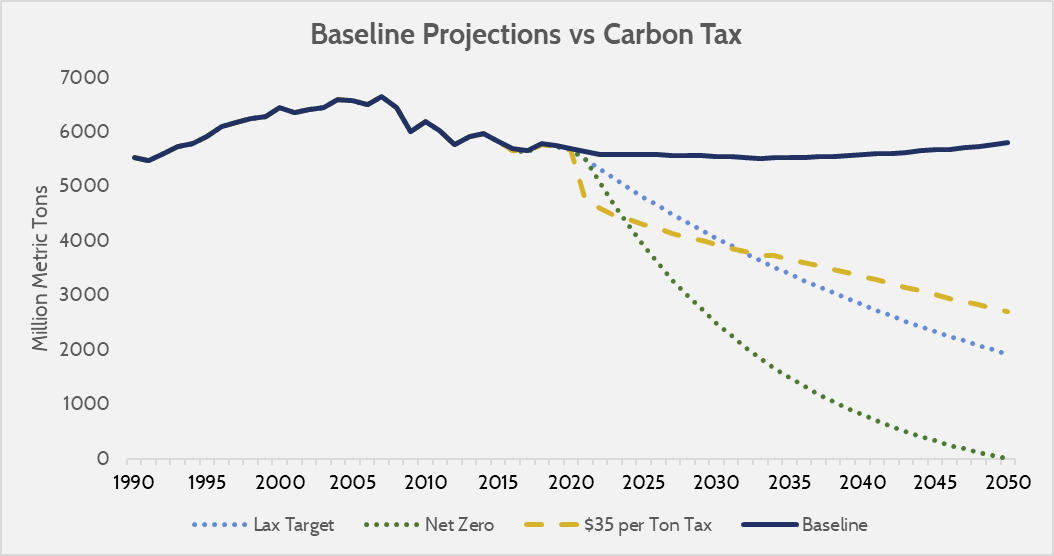

In terms of how effective a carbon tax could be, Marc Hafstead of Resources for the Future recently analyzed the expected energy emissions reductions at various tax levels. Extending his estimates of 2018-2030 reductions for an assumed policy scenario of 2021-2050, a $35 per-ton carbon tax introduced in 2021 would yield substantial emissions reductions below the baseline.

Carbon tax estimate extrapolated from Resources for the Future’s E3 Carbon Tax Calculator.

The net impact of this tax would be close to what would be required to meet the lower bounds of our estimated IPCC target. The carbon tax would reduce emissions by approximately 58 billion metric tons over a 30-year window, while meeting the least stringent assumption of the IPCC’s targets would require abating 63 billion metric tons. By comparison, the regulatory approach abates approximately 37 billion metric tons over a 30-year window, meaning the carbon tax could reduce emissions by approximately 57 percent more than regulations.

Comparing a Tax to Regulation

Virtually all economic literature that compares carbon taxes to climate regulation conclude that a carbon tax is more economically efficient than regulation. However, comparing such hypotheticals is very difficult as we can only speculate on the implementation mechanisms of future regulations. Such analyses typically will make presumptions of perfect implementation (of emissions trading schemes or the like), and the resulting comparisons show regulations in a much more positive light than is realistic.

For this research, AAF took a different approach to comparing policy effectiveness. Instead of estimating future regulatory burdens, AAF seeks to compare the effectiveness of existing regulations to a hypothetical scenario where a carbon tax has been implemented. There is far more literature on effectiveness and burdens of hypothetical carbon taxes than on hypothetical regulations, so this comparison should offer more reasonable insight for future climate policy considerations.

To compare the effectiveness of regulations versus that of a carbon tax, a distinction needs to be made between total reductions and reductions due to policy effectiveness. As an example, if one compares emissions projections before and after President Obama’s tenure, projected emissions fell substantially—but most of this emissions decline is attributable to the Great Recession, and the weak economic performance in its wake (which results in much lower energy use). The proper measure of policy effectiveness is not bulk emissions reduced, but emissions reduced without forgoing economic benefits. In theory, an environmental regulation that is effective is one that has a marginal benefit from reduced pollution that exceeds the marginal cost to the regulated polluter, so there should be a net benefit to economic activity. However, if regulations imposed greater costs than benefits, they impose economic harm and not an efficient regulation or application of policy.

If a climate policy reduces emissions simply by slowing the economy (and thus reducing energy usage), those reductions cannot rightly be claimed to make the economy cleaner or improve output relative to pollution. To gauge this policy effectiveness, AAF estimates “carbon intensity,” which is a measure of emissions relative to economic output.

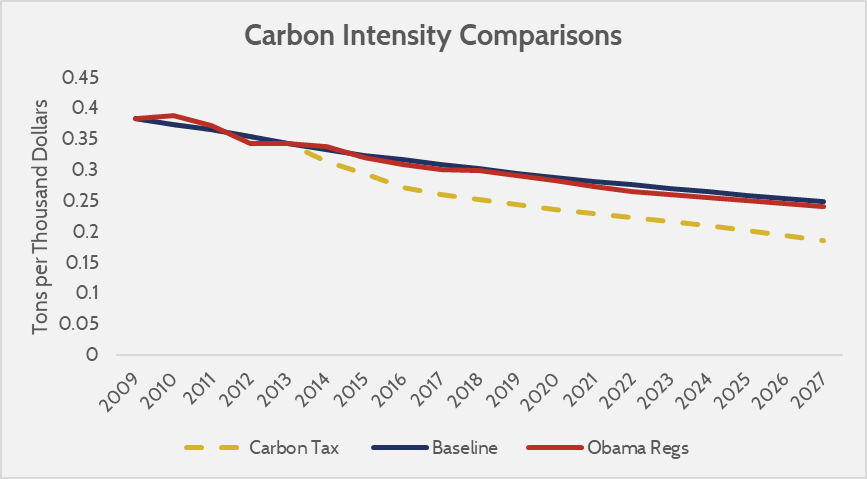

Source: AAF estimates from EIA Annual Energy Outlook Reports (2009 – 2018)

For this comparison between regulations and a carbon tax, AAF observes three values: The first is projected carbon intensity before any of President Obama’s regulations took effect, the second is a measure of carbon intensity after President Obama’s policies took effect, and the third is a measure of carbon intensity if there had been a carbon tax. All these estimates are derived from the EIA’s Annual Energy Outlook (AEO) reports, which offer projections of emissions and estimated GDP. Thus, measuring carbon intensity merely requires dividing emissions by GDP for the 2009 AEO, the 2018 AEO, and the carbon tax side case of the 2013 AEO.

For clarity, AAF applies the estimated improvements in carbon intensities to a uniform metric of GDP as estimated by the Congressional Budget Office (CBO) (through 2027) to produce a consistent comparison. This uniform GDP eliminates any influence of business cycles on emissions, and any estimate of emissions reduced from an activity becoming non-economic due to regulation. Simply, the below graph shows what carbon dioxide emissions would have been if: the recession and weak recovery still occurred, but President Obama had implemented no climate policies (blue line), emissions as estimated from what regulations actually occurred projected outward (red line), and what emissions would have been had there been a $25 per-ton carbon tax implemented in 2014 (yellow dashed line).

Source: AAF estimates based on expected carbon intensity from EIA projections

This chart shows that the majority of the emissions reductions from the Obama Administration’s regulations are due to weak economic performance, not regulatory efficiency. Basically, the reduction in carbon intensity because of regulations was marginal, and a large share of estimated emissions reductions are merely from reduced economic output. In the case of the carbon tax, the total emissions reduced through a carbon intensity-based comparison show less emissions reduced via the tax than would occur because GDP would be lower under a carbon tax.

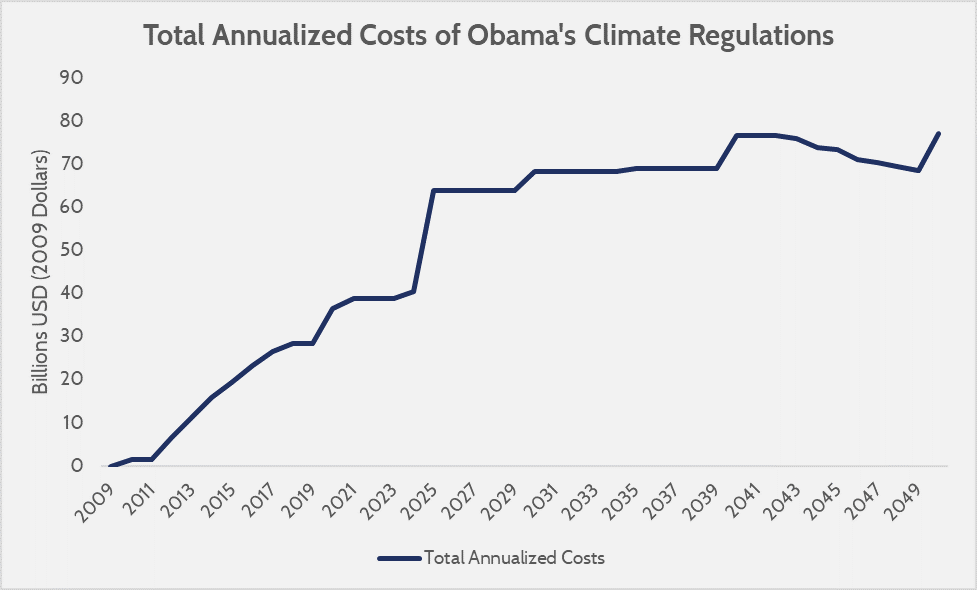

The above comparison examines the reduction in emissions, but the other part of comparing policy effectiveness is the cost incurred to achieve those reductions. To measure these costs, one should compare the total burdens of the imposed regulations, and the total burdens imposed by a hypothetical carbon tax, over the projected window of policy effectiveness (2009-2027). The chart below shows the total annualized burdens of President Obama’s regulations (excluding the Clean Power Plan, which was halted).

Source: AAF estimates based on official regulatory impact analyses from the Department of Energy and EPA.

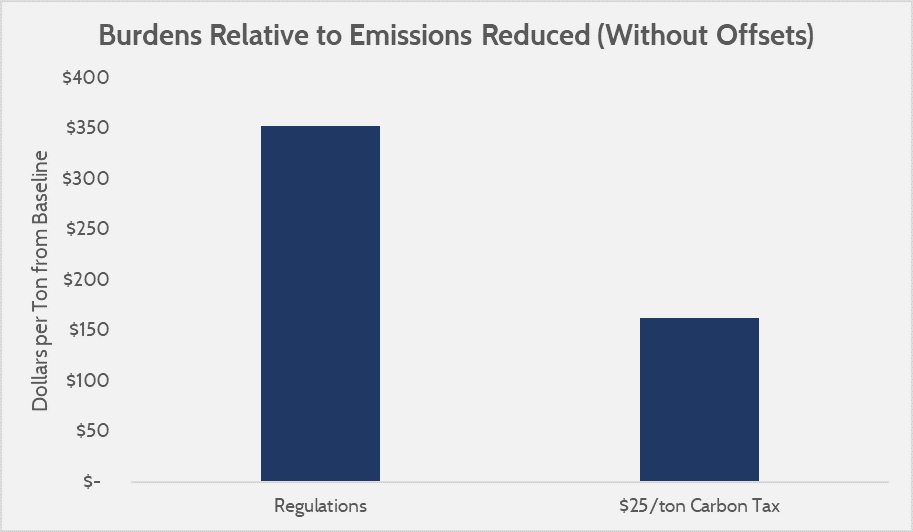

The above shows an estimate of a total regulatory burden of $548 billion between 2009-2027, which represents the window of comparison between past regulations and a hypothetical carbon tax. In contrast, a carbon tax—set at $25 per ton, increasing by 5 percent per year, and applying to all energy consumption—would raise $2 trillion in revenue from 2014-2027, which can be thought of as $2 trillion in economic burdens. However, the carbon tax yields substantially greater emissions reductions, resulting in a better per-dollar policy effectiveness. The graph below compares the burdens imposed from each policy relative to emissions reduced due to policy effectiveness (i.e. emissions changes only due to changes in carbon intensity).

Source: AAF estimates

In a comparative estimate, the carbon tax is more than twice as cost-effective than the regulations (for an estimate of absolute effectiveness of climate regulation, view AAF’s past research). Note that this estimate is before any off-setting provision to mitigate economic impacts; it presumes that the burdens of a tax are simply absorbed as they would be for a regulation. In reality, provisions that offset the burdens of the tax would further widen the gap between the effectiveness a carbon tax over regulation. Even this assessment may be too conservative, as one would expect future regulations to be more burdensome (based on the assumption that eliminating the last ton of emissions is more expensive than eliminating the first). The above findings show that regulations are a far less cost-effective means of reducing emissions.

Revenue-Neutral vs. Revenue-Raising Carbon Taxes

While there is little doubt that a carbon tax on its own would negatively impact the economy, there is a substantial difference between a carbon tax on its own and a “revenue-neutral” carbon tax where revenues are used to reduce other particularly distortionary taxes. On its own, a carbon tax reduces incentives to work and invest, so using the revenues to reduce or eliminate other taxes that reduce incentives to work or invest should mitigate the economic impact of the tax. In this way, the negative economic effect of the carbon tax is not the impact of the tax on its own, but rather the difference in distortion between the carbon tax and the taxes that it replaces.

Understanding how taxes distort the economy is important. The CBO notes that a carbon tax would raise the production costs of new physical capital and reduce profits of capital owners (reducing incentives to invest), and increase the price of goods, which decreases after-tax purchasing power (reducing incentives to work).[3] The harm caused by a carbon tax is effectively a tax on investment and work, though it should be noted that some would disagree with CBO’s assumption of changes to incentives, since as a consumption tax a carbon tax should have no net change to economy-wide incentives to invest—it would merely affect the capital allocation in affected industries.

Other taxes, though, have similar consequences as a carbon tax. The Corporation Income Tax (CIT) reduces incentives to invest by reducing the after-tax reward of investment and is thus a tax on capital. Payroll taxes and income taxes (taxes on labor) reduce incentives to work. The presence of the taxes means that economic activities that are less profitable than the tax or not worth the costs no longer take place, and consequently economic activity is less than what it would have been. The degree of impact from a tax depends on how it alters incentives to work and invest in the industries subject to the tax.

As a principle of tax policy, new taxes should minimize distortions to incentives, and ideally replace more distortionary taxes to minimize (or improve) the efficiency of the tax system. To measure the economic loss associated with a tax, economists observe the “deadweight” loss of the tax (the amount that GDP declines because of the tax as a percentage of revenue raised by the tax). The tax that many consider having the highest deadweight loss is the CIT, due to its creation of double taxation (a business’ profits get taxed at the business level, and then when the profits are disbursed to business owners they are taxed again as personal income). An ideally efficient implementation of a carbon tax should use all funds to replace the most inefficient tax—the CIT—for a revenue-neutral policy.

This concept—offsetting a carbon tax with cutting other distortionary taxes—is often lost in the climate policy debate. The term “revenue-neutral” is frequently applied to carbon tax proposals that would spend or rebate the revenues in ways that do not offset the change in incentives introduced by the carbon tax. As an example, a common proposal for a “revenue-neutral” carbon tax is to tax carbon and then return the revenues directly to households via a rebate. Such a proposal would not create any new incentives to work or invest, however, because the households would receive the rebate regardless of any change in their hours worked.

Similarly, some members of Congress have proposed “revenue-neutral” carbon taxes that would use only a small portion of the revenues to reduce other taxes and use the bulk of the revenues for additional spending on programs that, for example, assist low-income households or subsidize clean energy investments. Again, as such policies would not offset the negative incentives of the tax, GDP would still drop.

The ideal tax swap should instead focus on the most distortionary taxes: taxes on capital, and primarily the CIT. A political concern with this approach is that the impacts of the carbon tax are assumed to be regressive (by raising prices for staple goods) while the CIT is assumed to be progressive, and the resulting tax swap would raise taxes on the poor while lowering taxes on the rich. However, recent literature challenges such assumptions. A study of 322,000 families in the United States found that if estimates of regressivity are broadened to include changes to consumption behavior as well as statutory transfers, a carbon tax is progressive. Nevertheless, there will likely be a political impetus to address perceived regressivity, making a pure swap of a carbon tax for the CIT politically difficult.

A more likely policy would use the revenue from a carbon tax to reduce both the CIT and personal income taxes. This swap would allow for the distribution of tax burdens to remain unchanged, while reducing incentives to pollute and retaining incentives to work and invest.

Economic Impact of a Carbon Tax Swap

To estimate the economic impacts of a carbon tax swap, one can observe economic costs of imposing a carbon tax (as measured in the EIA’s side cases) and compare this to estimated costs imposed by other taxes (and the estimated benefits of cutting them).

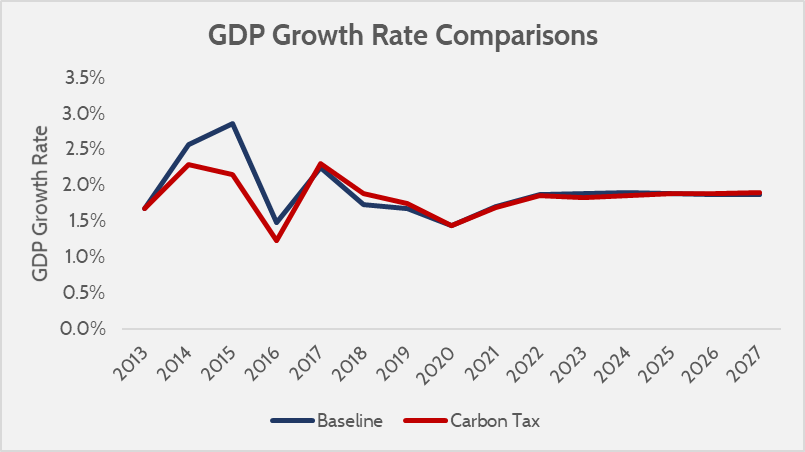

In the EIA’s estimate of a $25 per-ton carbon tax, it assumed that GDP falls by 1 percent after 10 years (with a peak impact of 1.2 percent in the third year). The $25 per-ton carbon tax, rising at 5 percent per year in the EIA case, would reach $35 per-ton by 2021. Therefore, introducing a $35 per-ton carbon tax rising at 5 percent would have a similar impact on GDP to that of the $25 per-ton tax modeled by the EIA.

Source: 2013 EIA Annual Energy Outlook, Reference Case and $25/ton Carbon Tax Case

In considering a revenue-neutral policy, one would assume the growth impacts would be lessened, but to what degree? A carbon tax of $25 per ton raising at 5 percent per year and applied to all energy consumption would raise approximately $1.6 trillion over a 2018-2027 window, meaning $1.6 trillion of existing taxes could be reduced. Also, in the estimated timeframe, GDP is reduced by $1.8 trillion, meaning that on average every $1 of carbon tax reduces GDP by $1.12, which is a “deadweight” loss of the tax of 112 percent.

In thinking of taxes to replace, one would seek to replace taxes with equal or greater deadweight losses. For the obvious choice, the CIT, there are widely diverging estimates of deadweight losses, depending on assumptions of how easy or difficult it is for capital to flee the tax base. President Obama’s former Council of Economic Advisors Chairman Austan Goolsbee estimated in 1997 that the deadweight loss of the CIT was 5-10 percent of its revenue. On the other end of the spectrum, in 2010, economists Christina Romer and David Romer estimated the deadweight loss of the CIT to be 300 percent. In short, the CIT’s momentary deadweight loss is difficult to know for sure, but it is reasonable to assume that the negative impacts of a carbon tax and a corporate income tax are similar enough that a pure tax swap would produce relatively small economic impacts, even before considering the economic benefits of reduced pollution.

To put numbers to this point, one could compare a hypothetical carbon tax swap with the recent tax reform. The Joint Committee on Taxation (JCT) estimates that reducing the CIT from 35 percent to 21 percent loses $1.35 trillion of revenue; not too different than the $1.6 trillion in revenue that a carbon tax could raise. Considering the tax reform only moved the United States’ corporate tax rank from #35 to #26, there are likely benefits still to be had in further improving the competitiveness of the U.S. tax rate. In the JCT’s dynamic score of the new tax reform law, it assumed that the business provisions of the reform would improve GDP by 0.7 percent. If one assumes the EIA’s model of a carbon tax reducing GDP by 1-1.2 percent, and that the revenues would be used in a similar fashion to the business provisions from the tax reform, then the negative GDP impacts of the carbon tax of 1-1.2 percent could be offset by a positive impact of 0.7 percent, resulting in a net change of negative 0.3-0.5 percent.

Critics of the JCT’s growth estimates, such as the Tax Foundation, assume significantly higher growth benefits from reducing the corporate tax rate. The Tax Foundation estimated that the reform’s reduction in the CIT would increase GDP by 2.6 percent—much greater than the EIA’s estimated 1-1.2 percent reduction of GDP—meaning in theory a carbon tax could improve GDP. However, in practice, analyses that see capital taxes dragging heavily on the economy would also score a carbon tax harshly for its impacts on capital investment incentives.

Simply put, a directly imposed, purely additive carbon tax could have harsh economic consequences, but a revenue-neutral carbon tax designed to minimize such consequences (i.e. via a corporate tax swap) could result in GDP changes that are only marginally detrimental, if not beneficial.

Conclusion

Similar to other literature on the subject, this comparison of a carbon tax to both hypothetical future regulations and past regulations shows that a market-based mechanism is substantially more effective in terms of both total abatement opportunities and cost-effectiveness. If policymakers try to impose command-and-control regulations to eliminate emissions, the resulting policies will almost certainly impose a drastic drag on the economy while failing to reach their proposed emission reduction targets. Similarly, a carbon tax that fails to offset its own negative incentives may achieve its target emission reductions, but fail to mitigate any resulting economic harm.

In contrast, a well-designed carbon tax would have much of the benefits of the above policies, with fewer costs. By offsetting the carbon tax by reducing other distortionary taxes, policymakers could discourage the emission of carbon while maintaining overall economic health. Such a policy would have only a fraction of the economic impact of a conventional carbon tax.

[1] Carbon sinks, such as forests or other components of the environment that absorb carbon, are assumed by AAF to have the same average effectiveness in the future as they had in the past. Though it should be noted that the effectiveness of different types of sinks may vary depending on the concentration of CO2 in the atmosphere.

[2] AAF’s estimated reductions mostly come from the EPA’s stated potential policies to reduce greenhouse gas emissions (EPA’s Sources of Greenhouse Gases Emissions website), particularly in the energy, agriculture, and waste source categories. For example, the site estimates that reductions of 15-30 percent are readily achievable from the treatment of wastewater. We then assumed that a regulatory scheme would be promulgated that achieved a 30 percent reduction from wastewater treatment at both residential and commercial sources.

In all cases where there was a usable estimate of potential emissions reductions, AAF assumed the highest potential reduction would be achieved, and over an aggressive phase-in period of 10 years. The phase in period for fossil fuel combustion regulations is over 30 years, which would more than achieve the goals of the Obama Administration’s Clean Power Plan by 2030, and aggressively pursue further reductions through 2050.

In cases where there were no usable projections, AAF used information from the EIA and academic literature to develop assumptions of potential emissions reductions from policy mandates. If AAF could not find any basis for projection, however, we did not create a projection.

Critically, it was AAF’s intention to err on the side of overstating the reduction capabilities of a regulatory approach to carbon emissions reductions.

[3] “Effects of a Carbon Tax on the Economy and the Environment” Congressional Budget Office (May 2013 : Washington, DC). https://www.cbo.gov/sites/default/files/113th-congress-2013-2014/reports/44223_Carbon_0.pdf