Research

October 15, 2021

Cost and Coverage Implications of Build Back Better’s Health Insurance Provisions

Executive Summary

- Congressional Democrats and the Biden Administration are seeking to permanently extend the American Rescue Plan Act of 2021’s enhanced premium tax credits for individual market coverage under the Affordable Care Act while also closing the Medicaid coverage gap in non-expansion states as part of the Build Back Better legislative proposal.

- The American Action Forum’s Center for Health and Economy (H&E) finds that the proposal to make permanent the enhanced premium tax credits and related individual market policies would result in an increase in the number of people insured in the individual market in 2031 of 3.1 million relative to current law, and would have a net cost of $209 billion for the taxpayer between 2022 and 2031.

- H&E further finds that Build Back Better’s provisions aimed at closing the Medicaid coverage gap in non-expansion states would increase the number of people insured through Medicaid in 2031 by 3.9 million relative to current law, and would have a net cost of $622 billion for the taxpayer between 2022 and 2031.

- In total, these provisions would reduce the uninsured population by 7 million in 2031 relative to current law, but would have a net cost to the taxpayer of $831 billion between 2022 and 2031.

Introduction

Congressional Democrats and the Biden Administration are working around the clock to reach a deal on the president’s Build Back Better agenda. In September, House committees marked up legislative language for a $3.5 trillion spending package they hoped to move through the reconciliation budget process to avoid a Senate filibuster. Since then, it has increasingly become clear that the final package will need to be scaled back to alleviate the concerns of moderate Democratic members who are uncomfortable with such a high top-line spending figure. It is unclear at this point which policy provisions will ultimately survive intact, which will be curtailed, and which will be jettisoned altogether.

Included in the legislative text marked up by the House Energy and Commerce and Ways and Means Committees were a number of health policy provisions impacting the individual health insurance market and attempting to extend Medicaid coverage to individuals residing in states that have not taken up the Affordable Care Act’s (ACA) Medicaid expansion. The American Action Forum’s Center for Health and Economy (H&E) has modeled these provisions in order to ascertain their likely impact on health insurance coverage and federal spending. Specifically, H&E modeled provisions making permanent the enhanced individual market subsidies established for 2021 and 2022 by the American Rescue Plan Act of 2021 (ARP) and seeking to close the ACA’s Medicaid expansion coverage gap, as well as the impact of extending the enhanced subsidies on the Biden Administration’s recent rulemaking allowing for year-round open enrollment for those at or below 150 percent of the federal poverty level (FPL), and new reinsurance funding. H&E does not include in this analysis the cost of policies aimed at expanding Medicare fee-for-service to cover vision, dental, and hearing services.

H&E finds that permanently extending the enhanced premium tax credits, creating a new (entirely federal) Medicaid-like program to cover the Medicaid coverage gap population, and providing temporary individual market coverage for that population in the interim will cost $831 billion between 2022 and 2031, and would result in 7 million more insured individuals in 2031 than under current law relative to the H&E baseline.

Provisions Analyzed by H&E

Making Permanent the Enhanced Individual Market Subsidies

Under the ACA, an individual or family’s subsidy is adjusted based on their household income and the cost of the second-lowest cost Silver plan in their rating area. An individual’s subsidy must be large enough to ensure that he or she does not pay more than a specified percentage of income (detailed in columns 2 and 3 of Table 1), based on household income relative to FPL. The ARP reduced these percentages to increase the size of the premium subsidy for 2021 and 2022 as shown.

Table 1.

| Income | 2021 (pre-ARP) | 2021 & 2022 (Current Law) |

| < 133% FPL | 2.07% | 0% |

| < 150% FPL | 3.1% – 4.14% | 0% |

| < 200% FPL | 4.14% – 6.52% | 0% – 2% |

| < 250% FPL | 6.25% – 8.33% | 2% – 4% |

| < 300% FPL | 8.33% – 9.83% | 4% – 6% |

| < 400% FPL | 9.83% | 6% – 8.5% |

| > 400% FPL | N/A | 8.5% |

Under the ACA, subsidies are only available to those making up to 400 percent of FPL; however, the ARP also allowed households with income above 400 percent of FPL to receive ACA subsidies in 2021 and 2022. The Build Back Better proposal would make these enhanced subsides permanent starting in 2023.

Closing the Medicaid Coverage Gap

The ACA, as enacted, expanded state Medicaid programs to cover anyone at or below 138 percent of FPL. The federal government absorbed 100 percent of the expansion population cost initially, eventually phasing down to a 90 percent share. The Supreme Court ruled in NFIB v. Sebelius in 2012 that the federal government could not mandate that states expand their programs, making Medicaid expansion voluntary at the discretion of the states. Currently, there are 12 states that have elected not to expand Medicaid. In those states, individuals between 100 percent and 138 percent of FPL can enroll in subsidized individual market coverage, but those below 100 percent FPL who were not already eligible for Medicaid are without subsidized options.

As of January 2021, an estimated 2.2 million individuals under 100 percent of FPL reside in non-expansion states and did not have access to any government assistance for health coverage. An additional 1.8 million individuals between 100 percent and 138 percent of FPL live in non-expansion states and could sign up for subsidized individual market coverage under the ACA but have not done so.[1]

In order to extend coverage to these populations, Democrats are proposing to establish a new, entirely federally funded and operated Medicaid-like program beginning in 2025 to cover the expansion population in the 12 states that have not expanded.[2] The proposal also includes a maintenance of effort requirement to prevent states that have expanded Medicaid from reversing course to take advantage of the new federal program.

In the interim, for plan years 2022, 2023, and 2024, the proposed legislative language would extend eligibility for zero-dollar premium, individual market coverage to the 2.2 million individuals in non-expansion states who are not eligible for Medicaid and are below 100 percent of FPL.

Continuous Individual Market Open Enrollment

In September, the Biden Administration finalized rulemaking effectively establishing year-round open enrollment for anyone at or below 150 percent of FPL who is eligible for fully subsidized individual market coverage through the federal or state-based health insurance exchanges. Under the rule, anyone signing up for coverage through the federally facilitated exchange who meets the qualifications will be able to sign up at any point during the plan year for coverage beginning the following month. In 2021, 15 states are operating their own state-based exchanges; under the rule those states will have discretion in whether to allow year-round enrollment.[3] The existence of these zero-dollar premium plans is a direct result of the enhanced premium tax credits, and so this open enrollment option will expire at the end of 2022 in the absence of congressional action. By permanently extending the enhanced premium tax credits, however, the proposed legislative language would also effectively extend this open enrollment policy, and its impact on the overall individual market risk pool, into 2023 and beyond.

Reinsurance

Under the proposed legislation, beginning in 2023, Congress would provide $10 billion in annual funding to the 50 states and the District of Columbia to be used either to establish a state reinsurance program or to provide financial assistance to reduce out-of-pocket costs. States would be automatically approved for funds unless the Department of Health and Human Services (HHS) otherwise intervenes, and approval would last for five years unless revoked by HHS for unapproved use. If a state does not apply, HHS would operate a reinsurance program in the state. Non-Medicaid expansion states would not be able to apply for this funding for 2023 or 2024, but HHS would operate reinsurance programs during those plan years.

Cost and Coverage Impact

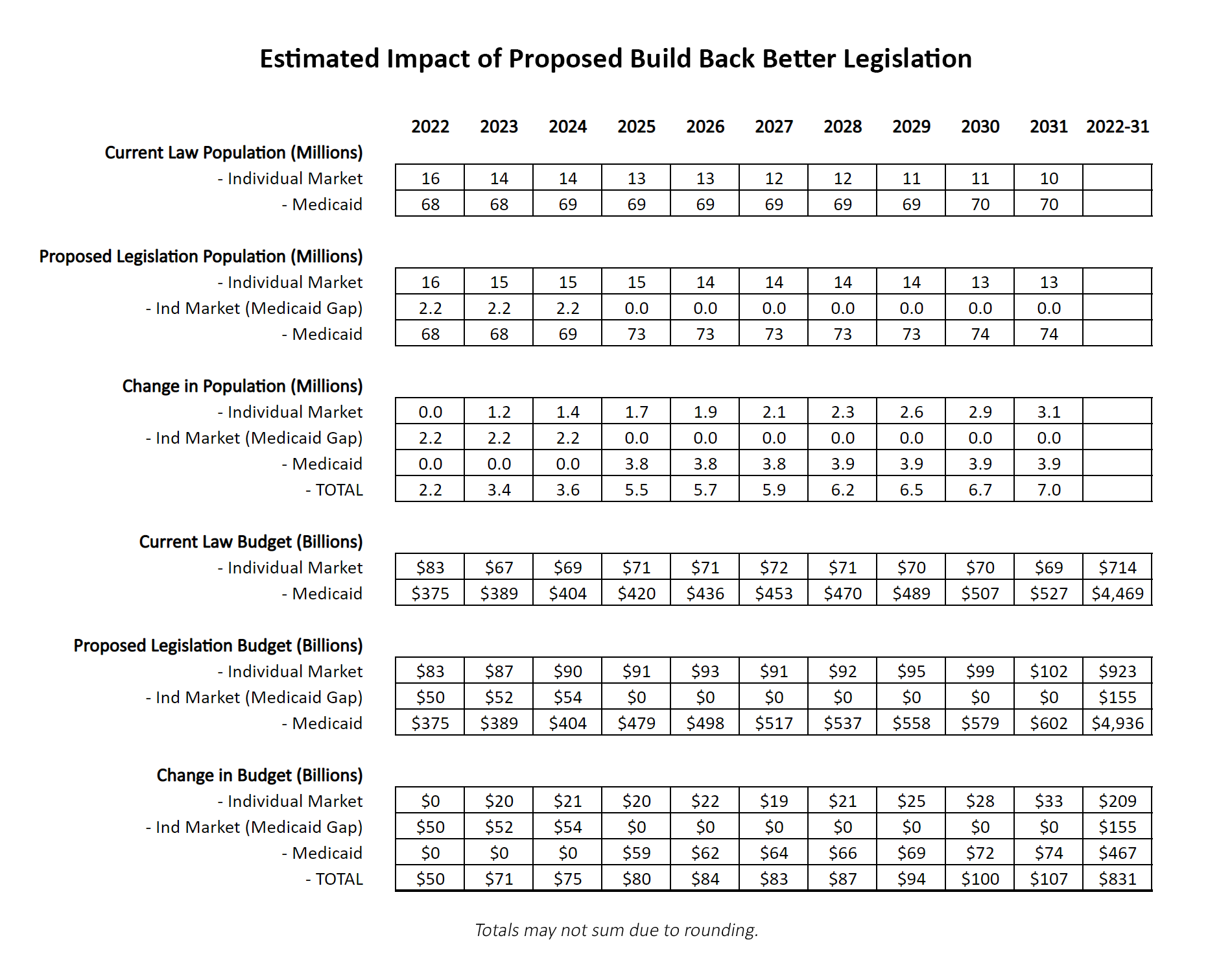

As shown in Table 2, H&E finds that making the enhanced premium tax credits permanent, the continuation of year-round enrollment for those under 150 percent of FPL, and the new reinsurance funds would result in an increase in the number of people insured in the individual market of 3.1 million in 2031 relative to current law. H&E also projects that these provisions would result in an increase in federal spending of $209 billion between 2022 and 2031.

Additionally, H&E finds the temporary extension of subsidized individual market coverage to those below 100 percent of FPL in non-expansion states in 2022, 2023, and 2024, will result in an increase in federal spending of $155 billion, assuming full enrollment of the coverage gap population. Further, the establishment of a new, entirely federal Medicaid program in non-expansion states would increase the number of insured people by 3.9 million in 2031 relative to current law, at a cost of $467 billion between 2022 and 2031. Combined, Build Back Better’s provisions aimed at closing the Medicaid coverage gap are projected to increase federal spending by $622 billion between 2022 and 2031.[4], [5]

In total, the Build Back Better provisions considered in this analysis would lead to an increase in the number of insured people in 2031 of 7 million relative to current law, at a net cost of $831 billion between 2022 and 2031.

Table 2.[6]

Permanently expanding the ARP’s enhanced premium tax credits, providing new reinsurance funding, and closing the Medicaid coverage gap as proposed under Build Back Better would reduce the number of uninsured by 7 million in 2031 relative to current law, but at a cost of $831 billion in the first 10 years. As Congress and the White House endeavor to scale back Build Back Better to bring down the overall spending levels, policymakers will have to evaluate whether those coverage gains are sufficient to justify the level of spending required.

[1] https://www.kff.org/medicaid/issue-brief/the-coverage-gap-uninsured-poor-adults-in-states-that-do-not-expand-medicaid/

[2] In Table 2 H&E includes the population covered by this new program in enrollment totals for Medicaid, but technically they will be in a parallel program. At this time the specifics of the program are unclear, other than that it is to mirror Medicaid benefits.

[3] H&E assumes for purposes of modeling this policy that roughly half of the state-based exchanges will elect to offer year-round open enrollment, and half will not.

[4] For purposes of modeling the temporary extension of subsidized individual market coverage to the Medicaid coverage gap population, H&E assumes that all 2.2 million individuals below 100 percent of FPL in non-expansion states will enroll in subsidized individual market coverage. In reality, there is likely to be some segment of this population that does not elect to enroll in coverage. Similarly, H&E assumes that none of the 1.8 million individuals between 100 percent and 138 percent of FPL residing in non-expansion states who are currently eligible for subsidized individual market coverage will enroll in coverage between 2022 and 2024. In actuality, there may well be some woodwork effect, where attention paid to the extension of coverage causes some previously eligible to take it up.

[5] H&E also assumes most of the 1.8 million individuals currently forgoing subsidized individual market coverage in non-expansion states will be enrolled in the new federal Medicaid program when it becomes available in 2025.

[6] In 2022, 2023, and 2024 the 2.2 million people in the coverage gap population would receive coverage through individual market. To avoid confusion, Table 2 separates out that enrolment, and the costs associated with it, under the header “Ind Market (Medicaid Gap).”