Research

January 25, 2017

Tax Topics: Border-Adjustments and Tax Avoidance

The new administration and Congress have signaled their intention to undertake fundamental tax reform in the coming months. Lawmakers will need to weigh the costs and benefits of numerous policy trade-offs as they undertake this effort. Among the most visible debates already underway concerns “border adjustability,” or moving the U.S. tax code to a cash-flow tax with a destination-basis.[1]

This reform, as proposed in the House Republican Tax Reform Blueprint, moves the U.S. toward a consumed-income tax base.[2] Under this proposal, the current system of depreciation for capital investment would be swapped for full expensing, while the current deductibility of interest expense would be repealed. Levying this tax on a destination basis would remove exports from the tax base, while fully taxing imports.

The latter element has sparked considerable debate among policymakers, industry, and other observers. On its face, the reform appears to favor exports over imports, a misperception that the reform’s proponents and detractors both seemingly feed. This view ignores the consensus in the economics literature that such a reform would be trade-neutral, owing to currency appreciation.[3] Leaving this effect out of the debate provides as incomplete a picture as ignoring the tax rate or other key elements of the reform.

This potential reform would chart a significant departure from current U.S. tax policy and should be scrutinized carefully. This policy brief seeks to build on existing analysis of this potential reform and provide additional examples of how this proposal would work in practice, in this instance by demonstrating how a destination-based system with border adjustments eliminates the need for complicated tax planning through manipulation of a multinational firm’s internal costs (transfer prices).[4]

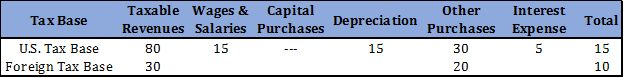

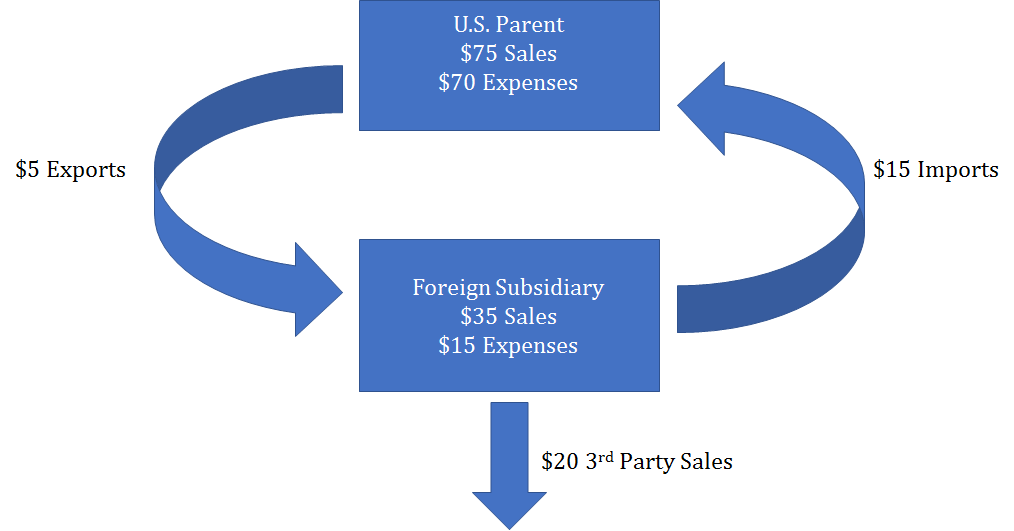

Table 1: Example Multinational Firm Under Current Law

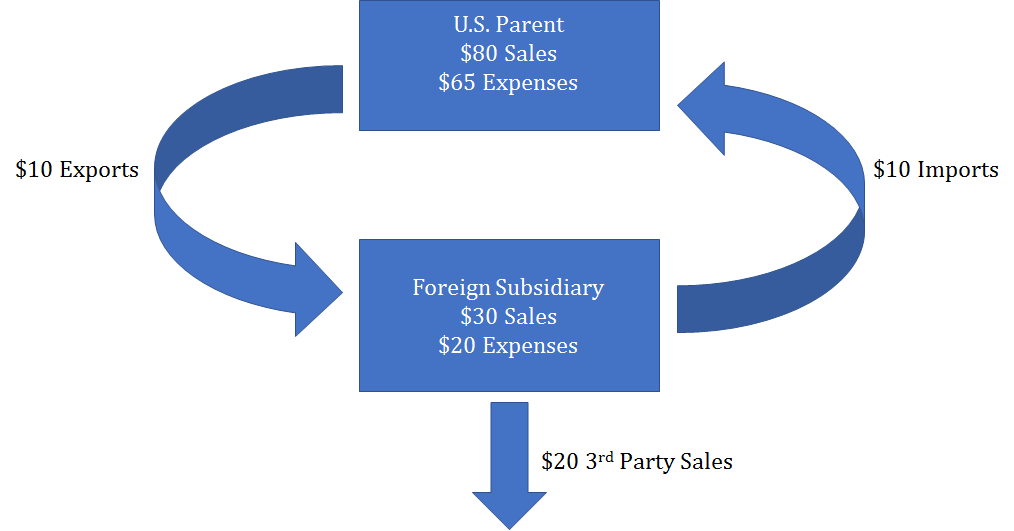

In this example, consider a multinational U.S. firm under current law. The U.S. parent has $80 in revenues, $10 of which comes from exports. It has $65 in deductible expenses: $15 in wages and salaries, $15 in depreciation allowances for certain business investments (such as machines or equipment) $5 in deductible interest (such as loans to finance its machines) and $30 other deductible business expenses, of which $10 are imported. This leaves a $15 taxable profit.

Its foreign subsidiary has $30 in revenues, of which $10 are sold to the U.S. parent while $20 are sold to other firms abroad. It also has $20 in deductible purchases, of which $10 are the $10 in exports from the U.S. parent.

Figure 1: Example Multinational Firm Under Current Law

Now consider the firm’s tax base in a move to a destination-based cash-flow tax.

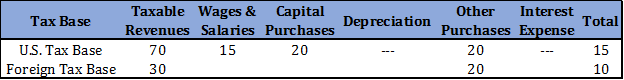

Table 2: Example Multinational Firm Under a Destination-Based Cash-Flow Tax without Currency Effects

Under the new tax system, a few things change. First, the move to a cash flow tax also replaced the current system of depreciation and interest deduction in favor of full expensing. For the sake of this example, we assume these are equivalent in dollar terms. More significantly for this example and consistent with a destination-based or border adjusted tax system, we exclude the $10 in exports sales from the firm’s revenues and exclude the $10 in imports from the firm’s deductible expenses. What is left is still a tax base of $15. For the purpose of illustration, the example firm’s new tax base calculation is shown without consideration of currency appreciation that should occur consistent with the economics literature.

Table 3: Example Multinational Firm Under a Destination-Based Cash-Flow Tax with Currency Effects

Factoring in the effects of currency appreciation alters the prices of imports and exports vis-a-vis the foreign subsidiary. These effects are not reflected in the U.S. parent’s taxable sales or deductible expenses, because the exports are excluded from sales and the imports are not included in the firm’s deductible expenses.

Figure 2: Example Multinational Firm Under a Destination-Based Cash-Flow Tax with Currency Effects

The currency effects are reflected in the transactions between the parent and subsidiary and in the dollar-value of goods sold abroad in foreign currency by the foreign subsidiary. However, the U.S. tax base remains the same. $15 in this example.

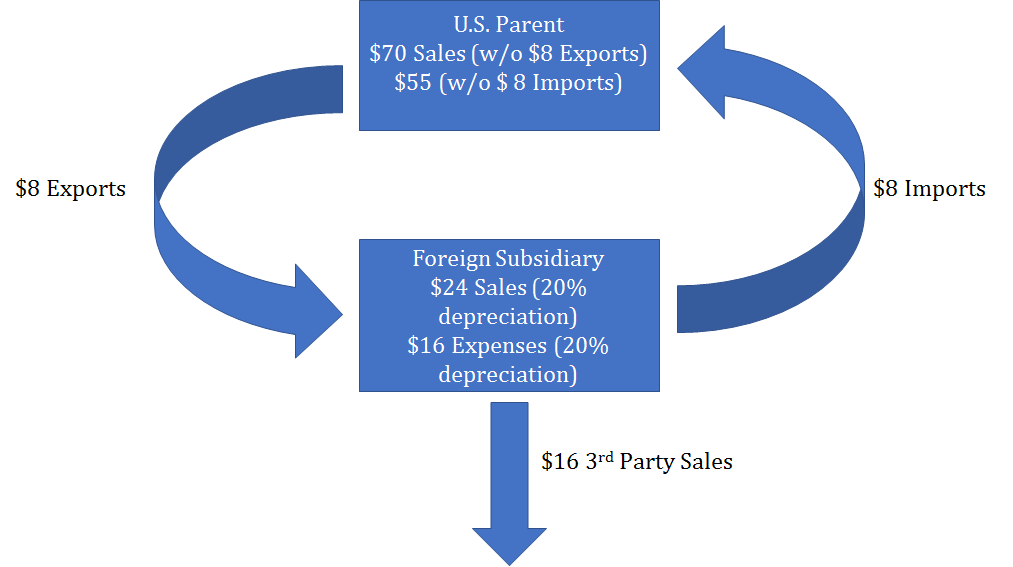

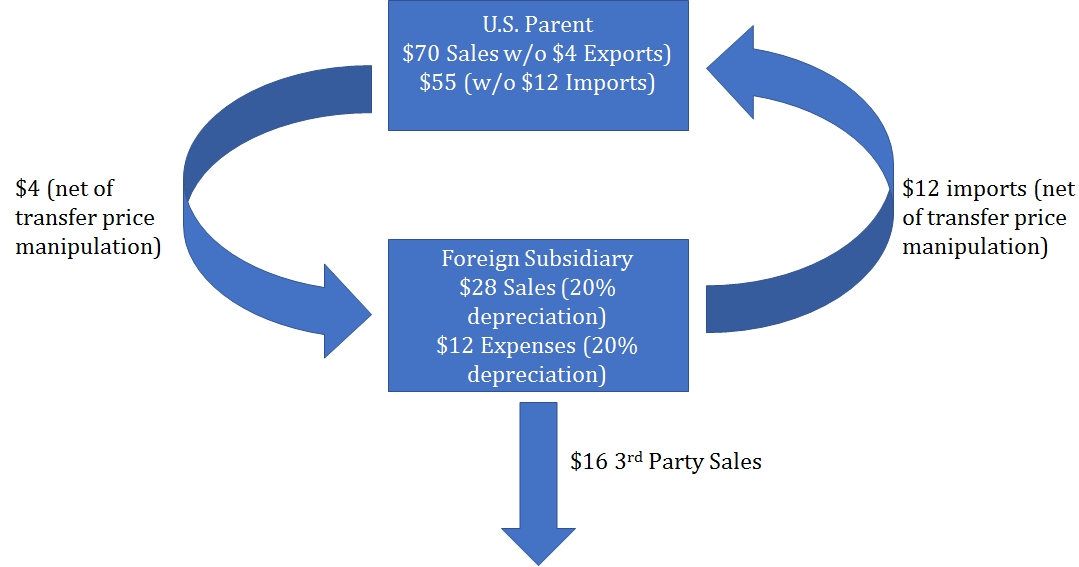

Table 4: Example Multinational Firm Under Current Law with Manipulated Transfer Prices

In this example, we consider the same multinational firm under current law, but with manipulated transfer prices. Multinational firms engage in sophisticated tax planning and avoidance strategies to shift income to lower tax jurisdiction. In this instance, we assume that the firm artificially undervalues its exports to its subsidiary and inflates the value of its imports by $5. The result is a higher tax base in the low-tax foreign jurisdiction.

Figure 3: Example Multinational Firm with Manipulated Transfer Prices Under Current Law

While simplistic, this illustration reflects the underlying goal of these tax strategies and the incentive under current law to shift income to lower-tax jurisdictions overseas and shift costs to the U.S.

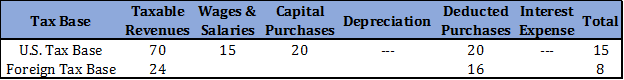

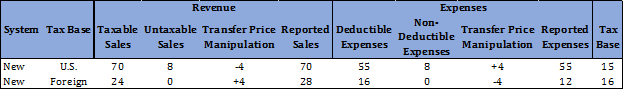

Table 5: Example Multinational Firm Under a Destination-Based Cash-Flow Tax with Currency Effects and Manipulated Transfer Prices

Table 5 illustrates how manipulating transfer pricing simply does not work under a destination-based cash flow tax system. The artificially lower exports (-$4) are excluded from tax, regardless of their value, as are the artificially inflated import costs, which are not deductible, leaving the original vales of $70 and $55 for taxable sales and expenses, respectively, and thus the original $15 U.S. tax base, and a higher foreign tax base of $16.[5]

Figure 4: Example Multinational Firm Under a Destination-Based Cash-Flow Tax with Currency Effects and Manipulated Transfer Prices.

Under a destination-based cash-flow tax, manipulating transfer prices ultimately leaves the multinational worse-off, by leaving the U.S. tax base untouched, while increasing the foreign tax base.

Conclusion

These examples demonstrate that the switch to a border adjusted tax system, accounting for associated currency appreciation, does not result in a material change to a typical company’s U.S. tax base. Furthermore, this transition would remove the incentive for firms to manipulate transfer pricing, ensuring that the U.S. tax base remains intact. Discussions of a change to this kind of cash-flow tax with a destination basis should take these important considerations into account.

[1] https://www.americanactionforum.org/insight/tax-topics-destination-vs-origin-basis/

[2] https://abetterway.speaker.gov/_assets/pdf/ABetterWay-Tax-PolicyPaper.pdf

[3] See Alan J. Auerbach, “The Future of Fundamental Tax Reform” American Economic Review 87, 2 (1997): 143–46 and artin Feldstein and Paul Krugman, “International Trade Effects of ValueAdded Taxation,” in A. Razin and J. Slemrod, eds., Taxation in the Global Economy (Chicago, IL: University of Chicago Press, 1990), 263–82. Also see https://www.aei.org/publication/border-tax-adjustments-wont-stimulate-exports/ for a further review of the literature.

[4] https://www.americanactionforum.org/research/14344/

[5] Note that this example by design ignores the effects of moving from the current high rate to a lower rate and the positive economic effects of expensing for the purpose of isolating the implications of moving to a destination-based tax system.