Week in Regulation

April 26, 2021

American Rescue Plan Measure Leads the Week

After roughly a month of relatively muted activity, there were at least some signs of life in the pages of the Federal Register. The main driver in this uptick? The American Rescue Plan (ARP). An interim final rule (IFR) implementing its elementary and secondary school funding program was the most consequential rulemaking of the week. Across all rulemakings, agencies published $259.1 million in total net costs and added nearly two million annual paperwork burden hours.

REGULATORY TOPLINES

- Proposed Rules: 47

- Final Rules: 65

- 2021 Total Pages: 21,879

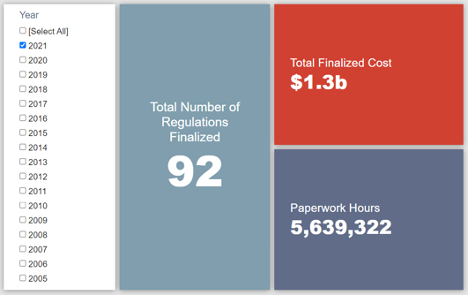

- 2021 Final Rule Costs: $1.3 Billion

- 2021 Proposed Rule Costs: -$8.3 billion

NOTABLE REGULATORY ACTIONS

The most significant rule of the week was the Department of Education’s IFR implementing the Elementary and Secondary School Emergency Relief (ESSER) Fund provisions included in the ARP. The most economically impactful aspect of the rule is its dispersal of roughly $122 billion in transfer payments to state and local school authorities. The rule also establishes certain administrative requirements for these authorities to “promote accountability, transparency, and the effective use,” of the ESSER funds. These requirements impose roughly $261 million in new costs and two million hours of paperwork.

CONGRESSIONAL REVIEW ACT UPDATE

On March 23, the first joint resolution of disapproval under the Congressional Review Act (CRA) of this term was introduced. CRA resolutions essentially seek to wholly rescind specific final rules within a set timeframe. The significance of these resolutions is discussed further here. In the interest of providing a public accounting of the potential economic impact of these actions should they pass, the American Action Forum (AAF) will provide a regular update of the rules being targeted and a concise summary of each rule’s purpose, economic impact, and why opponents may be targeting it.

TRACKING THE ADMINISTRATIONS

As we have already seen from executive orders and memos, the Biden Administration will surely provide plenty of contrasts with the Trump Administration on the regulatory front. And while there is a general expectation that the new administration will seek to broadly restore Obama-esque regulatory actions, there will also be areas where it charts its own course. Since the AAF RegRodeo data extend back to 2005, it is possible to provide weekly updates on how the top-level trends of President Biden’s regulatory record track with those of his two most recent predecessors. The following table provides the cumulative totals of final rules containing some quantified economic impact from each administration through this point in their respective terms.

This past week’s modest jump in activity didn’t just stand out from recent Biden Administration trends, it also zagged away from recent cross-administration trends. Recent weeks have seen the Biden activity languish while comparable time windows in the Trump and Obama eras saw – at the very least – relatively steady paces of new rulemaking activity. The roles reversed this week. Due to the ARP ESSER fund rule, the Biden paperwork total lunges far ahead of the comparable Trump total. In contrast, neither the Trump nor Obama Administrations saw any new paperwork from their rulemakings in a similar week. Furthermore, there was only $1.7 million in combined economic impact across those predecessor administration’s weeks.

THIS WEEK’S REGULATORY PICTURE

This week, the Supreme Court curtails the Federal Trade Commission’s (FTC) use of its injunction authority to obtain restitution.

On April 22, the Supreme Court unanimously ruled against the FTC in a case over the agency’s ability to bypass authorized processes to expedite grants of restitution against companies it believes has engaged in unfair or deceptive practices.

As explained in more detail in this preview of the case from November 2020, the FTC has two congressionally granted methods for it to obtain restitution. One is through a rulemaking process. The second is if a company violates a cease-and-desist order. These processes are time consuming, so FTC has adopted the practice of seeking a restitution order concurrently when a cease-and-desist order is granted. While the practice saves time for the FTC, it also leads to an infringement of due process rights.

In its opinion, the Supreme Court ruled that the practice is not authorized and that the provision of law the FTC relied on, known as Section 13(b), only allows for the FTC to receive a permanent injunction – it does not allow the simultaneous granting of restitution. Writing for the court, Associate Justice Stephen Breyer said that the “language and structure of §13(b), taken as a whole, indicate that the words “permanent injunction” have a limited purpose—a purpose that does not extend to the grant of monetary relief. Those words are buried in a lengthy provision that focuses upon purely injunctive, not monetary, relief.”

The decision is important in upholding limits on agency authority to those granted by Congress, not extrapolated as a matter of convenience. Crucially, the Supreme Court’s decision in no way lets companies guilty of deceptive practices off the hook, it merely affords them the opportunity to mount a defense before a monetary penalty is assessed.

TOTAL BURDENS

Since January 1, the federal government has published $7 billion in total net cost savings (with $1.3 billion in new costs from finalized rules) and 6.1 million hours of net annual paperwork burden reductions (with 5.6 million hours in increases from final rules).