Week in Regulation

July 6, 2020

Cost-Cutting Defense Acquisition Rules Highlight Short Week

Last week swung back in the deregulatory direction in decisive fashion. A trio of Federal Acquisition Regulations (FARs) issued jointly by the Department of Defense, General Services Administration, and National Aeronautic and Space Administration (FAR agencies) provided the bulk of the savings. Additionally, yet another notable decision came down from the Supreme Court as its term continues to wind down. Across all rulemakings, agencies published $1.2 billion in total net cost savings but added 97,141 hours of annual paperwork.

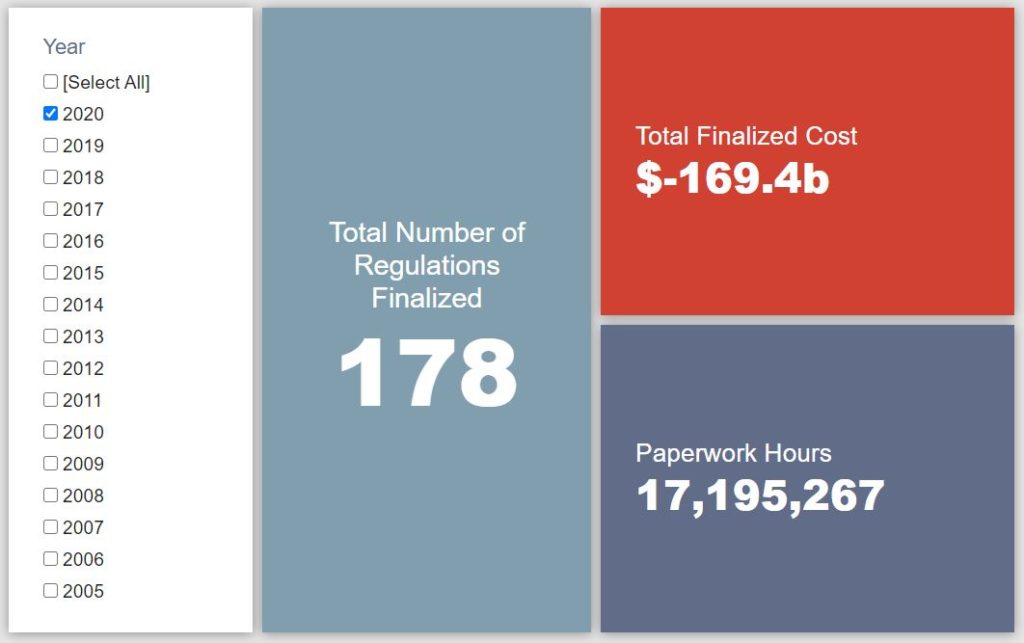

REGULATORY TOPLINES

- Proposed Rules: 39

- Final Rules: 57

- 2020 Total Pages: 40,032

- 2020 Final Rule Costs: -$169.4 billion

- 2020 Proposed Rule Costs: $7 billion

TRACKING THE REGULATORY BUDGET

A series of FARs from last week provided most of the week’s savings for the purposes of the fiscal year (FY) 2020 regulatory budget. The rules primarily implement reform provisions from either the FY 2017 and FY 2018 National Defense Authorization Acts, covering such topic areas as: “Increased Micro-Purchase and Simplified Acquisition Thresholds,” “Evaluation Factors for Multiple-Award Contracts,” and “Modifications to Cost or Pricing Data Requirements.” Altogether, the FAR agencies estimate that such changes could provide affected contractors roughly $1.3 billion in present value savings.

The Trump Administration expected to reach $51.6 billion in cumulative net savings in FY 2020. To date in the fiscal year, agencies have officially published 104 deregulatory actions and 35 regulatory actions, totaling $171.3 billion in quantified total net cost savings.

THIS WEEK’S REGULATORY PICTURE

This week, the U.S. Supreme Court rules the director of the Consumer Financial Protection Bureau (CFPB) can be removed at the will of the president.

Source: https://www.supremecourt.gov/opinions/19pdf/19-7_n6io.pdf

On June 29, the Supreme Court issued its decision in the case of Seila Law LLC v. Consumer Financial Protection Bureau. The case raised two questions. The first was whether the structure of the CFPB unconstitutional because it is led by a single director that can only be removed by the president for cause. The second was, if so, then does that render the entire CFPB unconstitutional.

In a 5-4 opinion written by Chief Justice John Roberts, the court found that the director must be able to be removed by the president at will but that the rest of the statute authorizing the CFPB could be severed from that provision, allowing the agency to remain intact. AAF’s Thomas Wade offered an excellent analysis of the decision and its implications.

Beyond allowing the director to be removed at will, the decision has little impact on CFPB. The agency will continue to function in the same way it has since its inception. It will continue regulating in the same way.

The ruling could have broader implications on independent agencies. It opens the door for the president to exert more direction over the leadership at these agencies. The Federal Housing Finance Administration (FHFA), for example, is similarly structured to the CFPB with a sole director removable only for cause. Though the Seila Law decision implies that FHFA does not wield as much power as CFPB and therefore is a different issue, its structure is now more likely to be challenged.

Even independent agencies whose leadership is made up of multi-person bipartisan commissions, like the Federal Trade Commission, Federal Communications Commission, and the Consumer Product Safety Commission, could potentially be subject to challenge since these commissioners are currently only allowed to be removed for cause.

The long run end result of the Seila Law case is that the president is likely to expand their control over the leadership of independent agencies.

TOTAL BURDENS

Since January 1, the federal government has published $162.3 billion in total net cost savings (with $169.4 billion from finalized rules) and 34.7 million hours of net annual paperwork burden increases (with 17.2 million hours due to final rules). Click here for the latest Reg Rodeo findings.