Week in Regulation

August 31, 2020

EPA Scores Savings from Court Decision

In a relatively light week with just 11 rules published in the Federal Register with estimated economic impacts, the lone rule with net savings carried the week. An Environmental Protection Agency (EPA) final rule outweighed 10 other proposed and final rules to deliver net savings. Across all rulemakings, agencies published $113.9 million in total net cost savings and added more than 387,000 hours of annual paperwork.

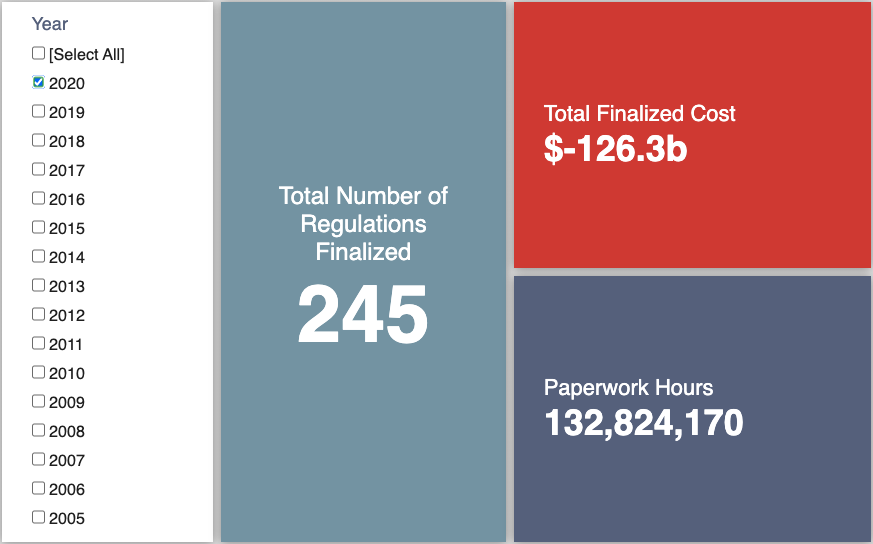

REGULATORY TOPLINES

- Proposed Rules: 35

- Final Rules: 68

- 2020 Total Pages: 53,572

- 2020 Final Rule Costs: -$126.3 billion

- 2020 Proposed Rule Costs: $8.2 billion

TRACKING THE REGULATORY BUDGET

A mere two final rules issued this week are subject to the Trump Administration’s fiscal year (FY) 2020 regulatory budget. Only one of those had estimated economic effects.

The EPA published a final rule dealing with the closure of landfills that receive coal combustion residuals. This rule implements a federal court decision that vacated certain provisions of a 2015 rule. EPA estimates the changes to result in $26.1 million in net savings annually over the life of the rule, or a net present value of about $373 million in savings that will accrue to the FY 2020 regulatory budget. This value is lower than the expected savings of $564 million estimated when the rule was proposed last year.

The Trump Administration expected to reach $51.6 billion in cumulative net savings in FY 2020. To date in the fiscal year, agencies have officially published 121 deregulatory actions and 41 regulatory actions, totaling $171 billion in quantified total net cost savings.

THIS WEEK’S REGULATORY PICTURE

This week, the Small Business Administration (SBA) outlines how small businesses can appeal adverse decisions on Paycheck Protection Program (PPP) loans.

Source: https://www.sba.gov/funding-programs/loans/covid-19-relief-options/paycheck-protection-program

On August 27 the SBA published the interim final rule (IFR) “Appeals of SBA Loan Review Decisions Under the Paycheck Protection Program.” The IFR spells out how “PPP borrowers and lenders of the process for a PPP borrower to appeal certain SBA loan review decisions under the PPP to the SBA Office of Hearings and Appeals.”

The IFR allows for appeals of decisions that either deemed the applicant or borrower ineligible 1) for a PPP loan; (2) for the PPP loan amount received or used the PPP loan proceeds for unauthorized uses; (3) for PPP loan forgiveness in the amount determined by the lender; and/or (4) for PPP loan forgiveness in any amount when the lender has issued a full denial decision to SBA.

Applicants or borrowers have 30 days from the date of their loan or forgiveness decision to file a petition seeking an appeal. Once the appeal record is closed, an SBA Office of Hearings and Appeals judge has 45 days to issue an initial decision. Any party can ask for a reconsideration of that decision, which must occur before seeking relief from a federal court.

The rule is the latest IFR issued related to the PPP. According to AAF’s COVID-19 Regulation Tracker, SBA has issued 23 IFRs on the PPP since it was enacted in March.

TOTAL BURDENS

Since January 1, the federal government has published $118 billion in total net cost savings (with $126.3 billion from finalized rules) and 154.2 million hours of net annual paperwork burden increases (with 132.8 million hours due to final rules). Click here for the latest Reg Rodeo findings.