Week in Regulation

May 10, 2021

HHS Rule Includes Modest Cost Savings

In an otherwise unremarkable week, a relatively standard Department of Health and Human Services (HHS) rule led the pack in terms of economic impact due to its cost-cutting provisions. The most significant cost-adding action was the Department of Labor’s (DOL) official withdrawal of the Trump-era rule on independent contractors. Across all rulemakings, agencies published $45.7 million in total net cost savings but added 96,365 annual paperwork burden hours.

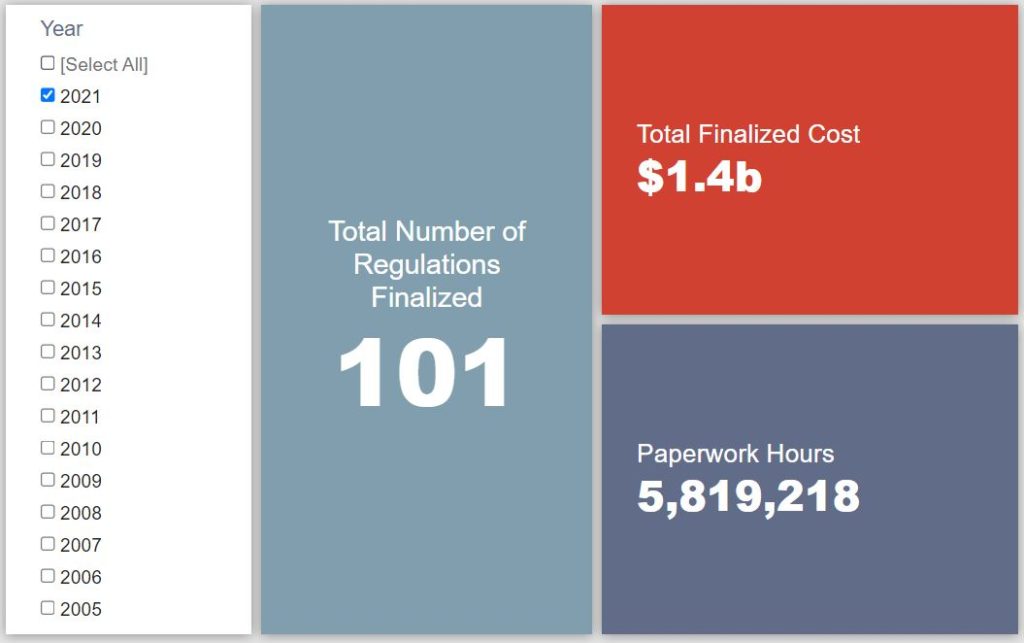

REGULATORY TOPLINES

- Proposed Rules: 35

- Final Rules: 55

- 2021 Total Pages: 24,655

- 2021 Final Rule Costs: $1.4 Billion

- 2021 Proposed Rule Costs: -$8.3 billion

NOTABLE REGULATORY ACTIONS

The HHS rule regarding “Notice of Benefit and Payment Parameters for 2022 and Pharmacy Benefit Manager Standards” was the most consequential action of the week. The benefits and payment parameters rules, as required under the Affordable Care Act (ACA), are a set of now-routine annual rules that generally have limited impact beyond some transfer payment adjustments. This iteration, however, building off of both a proposed version from last Demember and Biden Administration efforts to bolster the ACA, includes provisions that reduce certain verification requirements in the administration of the ACA exchanges. HHS estimates that eliminating these requirements will reduce administrative burdens for relevant respondents by roughly $31.6 million per year, or nearly $130 million over a five-year window.

The most significant regulatory action of the week was DOL’s rule regarding “Independent Contractor Status Under the Fair Labor Standards Act (FLSA): Withdrawal.” As the title makes clear, this action withdraws DOL’s prior rulemaking on the topic of independent contractor status. The rule being withdrawn was one of the last deregulatory efforts of the Trump Administration in its waning weeks. DOL estimates that the primary costs of this current rule are in regulatory familiarization costs, which it pegs at between $6.7 and $8.8 million per year.

CONGRESSIONAL REVIEW ACT UPDATE

On March 23, the first joint resolution of disapproval under the Congressional Review Act (CRA) of this term was introduced. CRA resolutions essentially seek to wholly rescind specific final rules within a set timeframe. The significance of these resolutions is discussed further here. In the interest of providing a public accounting of the potential economic impact of these actions should they pass, the American Action Forum (AAF) will provide a regular update of the rules being targeted and a concise summary of each rule’s purpose, economic impact, and why opponents may be targeting it.

TRACKING THE ADMINISTRATIONS

As we have already seen from executive orders and memos, the Biden Administration will surely provide plenty of contrasts with the Trump Administration on the regulatory front. And while there is a general expectation that the new administration will seek to broadly restore Obama-esque regulatory actions, there will also be areas where it charts its own course. Since the AAF RegRodeo data extend back to 2005, it is possible to provide weekly updates on how the top-level trends of President Biden’s regulatory record track with those of his two most recent predecessors. The following table provides the cumulative totals of final rules containing some quantified economic impact from each administration through this point in their respective terms.

![]()

The HHS rule’s cost reductions caused the Biden to-date total cost tally to fall just under the billion-dollar mark (after surpassing that level in the preceding week). Beyond that, however, there were not many conclusions to draw from any of the covered administrations; it was a relatively stable week for all three.

THIS WEEK’S REGULATORY PICTURE

This week, the Department of Homeland Security (DHS) delays implementation of the REAL ID program.

On May 3, DHS issued an interim final rule extending the last stage of the REAL ID program from October 1, 2021, to May 3, 2023. On that date federal agencies will no longer be allowed to accept a non-compliant driver’s license or state identification card (IDs) for identification purposes for government services or boarding airplanes.

The REAL ID program was created in 2005 with the enactment of a supplemental appropriations bill. The legislation required DHS to develop security standards for state-issued IDs to bolster security features on such cards in the wake of the September 11, 2001 attacks, and subsequent security concerns at federal facilities. It requires state-issued IDs to have features making cards difficult to counterfeit and be machine readable.

In 2008, DHS issued regulations phasing in the REAL ID requirements. The final stage, which prohibits federal agencies from accepting non-compliant IDs, was due to begin on May 11, 2011. Due to rollout issues, however, the final stage has been delayed several times. States and territories had trouble developing compliant IDs. Some 10 years after that initial deadline, 55 of 56 governments have finally received approval of their IDs, with American Samoa under review.

That is not the only challenge facing enforcement of the final stage, however. According to the rule, only 46 percent of eligible individuals were on pace to possess compliant IDs by the October 2021 deadline. Accordingly, the deadline has been extended into 2023. At a current issuance rate of just .5 percent, however, it seems unlikely at this point that all individuals will have compliant IDs by the new deadline.

TOTAL BURDENS

Since January 1, the federal government has published $6.8 billion in total net cost savings (with $1.4 billion in new costs from finalized rules) and 5.9 million hours of net annual paperwork burden reductions (with 5.9 million hours in increases from final rules).