Week in Regulation

July 12, 2021

Paperwork Takes the Spotlight During Short Week

As is often typical, a holiday-shortened week saw a limited haul of regulatory actions hit the pages of the Federal Register. The most notable action of the week was a rule implementing the “Agreement Between the United States of America, the United Mexican States, and Canada (USMCA)” that included substantial new paperwork burdens. Across all rulemakings, agencies published roughly $23.3 million in total net costs and added 8.5 million annual paperwork burden hours.

REGULATORY TOPLINES

- Proposed Rules: 27

- Final Rules: 48

- 2021 Total Pages: 36,421

- 2021 Final Rule Costs: $5.9 billion

- 2021 Proposed Rule Costs: -$13.4 billion

NOTABLE REGULATORY ACTIONS

The most significant rulemaking of the week was a joint interim final rule from the Departments of Homeland Security and the Treasury (the agencies) that updates a host of regulatory provisions to conform to the policies established under the USMCA. In terms of quantifiable impact, the rule adds nearly 8.5 million annual hours of paperwork on net. As the agencies state, they do not have to include a quantified cost-benefit analysis since “Rules involving the foreign affairs function of the United States are exempt from” the relevant executive orders on cost-benefit estimates. Applying simply the most recent Bureau of Labor Statistics estimate of average “Cargo and Freight Agents” hourly wages to that total would, however, yield roughly $192 million in annual administrative costs.

TRACKING THE ADMINISTRATIONS

As we have already seen from executive orders and memos, the Biden Administration will surely provide plenty of contrasts with the Trump Administration on the regulatory front. And while there is a general expectation that the new administration will seek to broadly restore Obama-esque regulatory actions, there will also be areas where it charts its own course. Since the AAF RegRodeo data extend back to 2005, it is possible to provide weekly updates on how the top-level trends of President Biden’s regulatory record track with those of his two most recent predecessors. The following table provides the cumulative totals of final rules containing some quantified economic impact from each administration through this point in their respective terms.

![]()

The aforementioned USMCA rule provided the bulk of movement in the Biden Administration’s paperwork tally, further widening its lead over its predecessors by millions of hours of paperwork. Across all three administrations, however, there were only limited shifts beyond that. The Obama Administration saw a modest increase is costs, due largely to a Food & Drug Administration rule on salmonella in eggs that imposed nearly $170 million in total costs.

THIS WEEK’S REGULATORY PICTURE

This week, the Consumer Financial Protection Bureau (CFPB) signals it will closely monitor how landlords and credit agencies report rental information as COVID-19 federal eviction protections near their end.

On July 7, the CFPB published a compliance bulletin in the Federal Register on “Consumer Reporting of Rental Information.” The bulletin serves as a warning to landlords and credit reporting agencies that the agency plans on scrutinizing housing rental-related debt information that appears on credit reports over the next several months to ensure it is accurate. The action comes as the Centers for Disease Control and Prevention’s eviction moratorium is due to end, with no further continuation, on July 31.

According to the bulletin, the CFPB is concerned that landlords and property management companies will incorrectly report late payments made through federal relief programs as outstanding debts or late payments, which could negatively affect renters’ credit ratings. Similarly, the agency will pay particular attention to whether credit reporting agencies do their due diligence to insure they correctly match information to the correct renters, and the agency will investigate disputes lodged by consumers.

The CFPB argues that as more evictions happen once the moratorium concludes at the end of the month, the risk of long-term financial damage to consumers if damaging, but incorrect, information remains on credit reports could lead to a potential renting crisis. Landlords and management companies typically rely on credit reports when evaluating renters, and as more renters move once the moratorium ends, many renters could be adversely affected by inaccurate information.

The CFPB’s authority in this area stems from the Fair Credit Reporting Act, which carries penalties requiring violators to pay actual damages and legal fees to those harmed and additional damages of up to $1,000 in egregious cases.

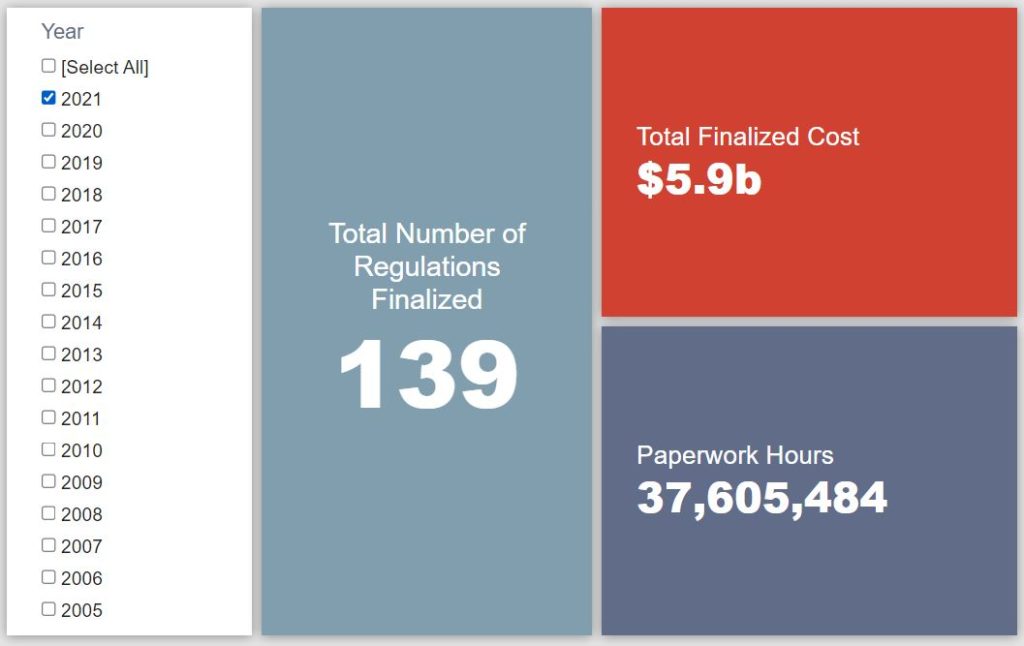

TOTAL BURDENS

Since January 1, the federal government has published $7.5 billion in total net cost savings (with $5.9 billion in new costs from finalized rules) and 25.9 million hours of net annual paperwork burden increases (with 37.6 million hours in increases from final rules).