Week in Regulation

October 17, 2016

SEC Does Benefit-Cost Analysis

The Securities and Exchange Commission (SEC) led the week, with two rules that monetized both costs and benefits. In total, regulators published $272 million in costs; annual burdens were $246 million, compared to $1.2 billion in benefits, and new paperwork was minimal. Regulators also finalized $170 million in costs they had previously proposed in 2016. The per capita regulatory burden for 2016 is $501.

Regulatory Toplines

- New Proposed Rules: 30

- New Final Rules: 53

- 2016 Total Pages of Regulation: 71,324

- 2016 Final Rules: $113.08 Billion

- 2016 Proposed Rules: $49.3 Billion

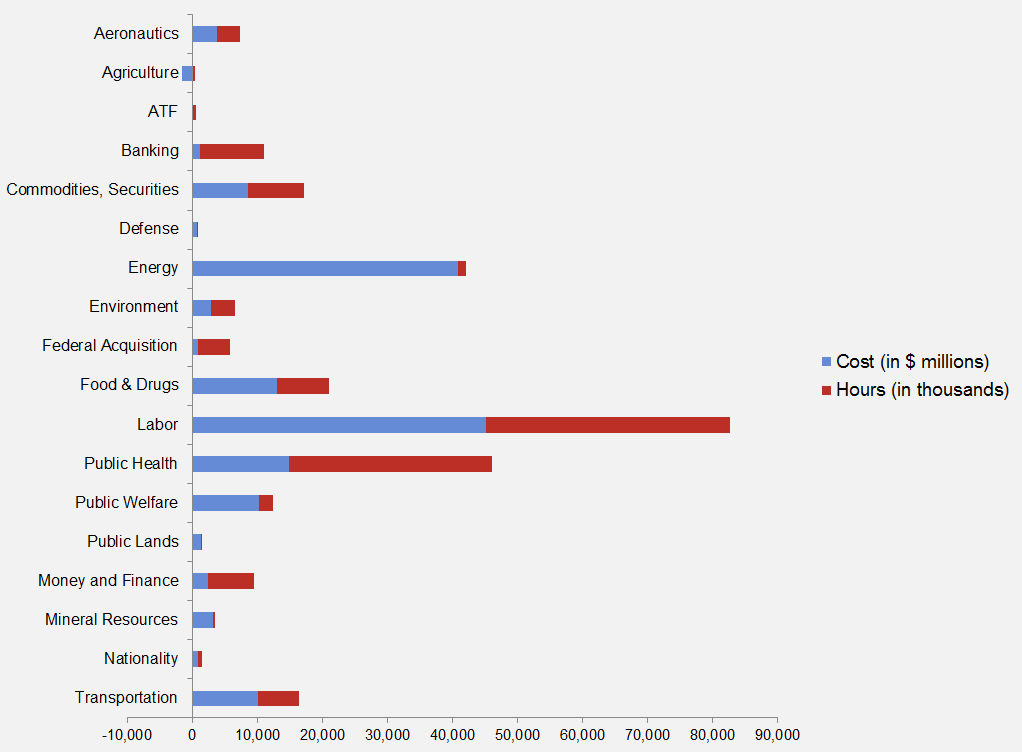

The American Action Forum (AAF) has catalogued regulations according to their codification in the Code of Federal Regulations (CFR). The CFR is organized into 50 titles, with each title corresponding to an industry or part of government. This snapshot will help to determine which sectors of the economy receive the highest number of regulatory actions.

The Commodity Futures Trading Commission (CFTC) finalized a rule to establish clearing requirements. The measure expands the existing requirement for interest rate swaps and imposes new margin requirements. The initial margin “costs” are $167 million, roughly $30 million less than the proposed rule. This was a somewhat quick rulemaking. Regulators released the proposed rule on June 16. The final major rule was published on October 14, for a rulemaking length of just 188 days. Estimating from initial publication in the Unified Agenda, the total rulemaking length was 683 days or 1.8 years.

Affordable Care Act

Since passage, based on total lifetime costs of the regulations, the Affordable Care Act has imposed costs of $51.6 billion in final state and private-sector burdens and 173.4 million annual paperwork hours.

Dodd-Frank

SEC led the week with a final rule for clearing agencies and a proposed definition of a covered clearing agency. Annually, they will impose more than $209 million in costs, but it was remarkable that this pair of regulations monetized the benefits of financial regulation. Based on AAF’s research, this is the first time since at least 2005 that SEC has monetized benefits. Could it be a response to the Commission’s court loss in Business Roundtable v. SEC?

The “Standards for Covered Clearing Agencies” rule estimates the cost to recruit new directors, bear the burden of new liquidity resources, and establish financial risk management systems could exceed $200 million. SEC also estimated the benefits of the rule. According to its analysis, SEC is now able to quantify, “the impact of [Qualifying Central Counterparty] status of OCC to non-U.S. bank clearing members at OCC. This benefit comes as a result of lower capital requirements.” SEC monetized this figure at $1.2 billion, but it is somewhat unclear how they arrived at this figure.

Click here to view the total estimated revised costs from Dodd-Frank; since passage, the legislation has produced more than 74.8 million final paperwork burden hours and imposed $36.5 billion in direct compliance costs.

Total Burdens

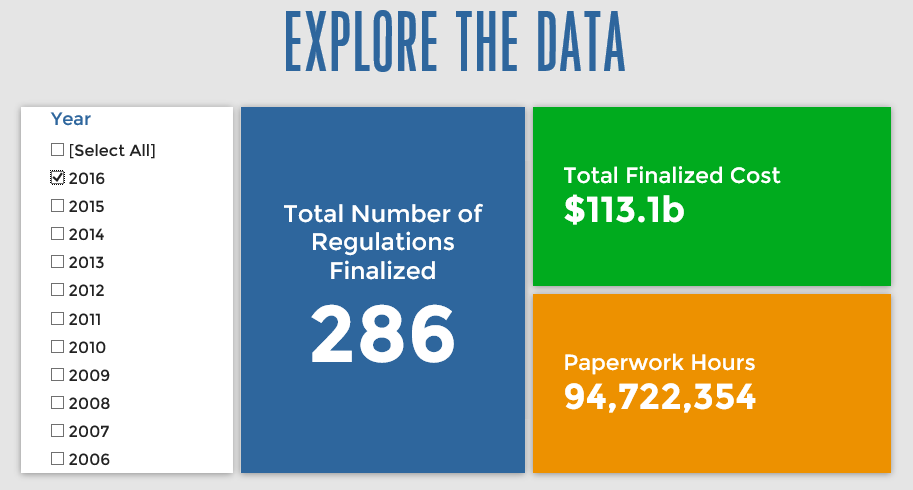

Since January 1, the federal government has published $162.3 billion in compliance costs ($113.08 billion in final rules) and has imposed 129.9 million in net paperwork burden hours (94.7 million from final rules). Click below for the latest Reg Rodeo findings.