Week in Regulation

October 30, 2017

Significant Paperwork Reductions Proposed

The past week represented notable regulatory cuts on both the legislative and administrative levels. The Senate passed the 15th Congressional Review Act (CRA) resolution of 2017, nullifying a Consumer Financial Protection Bureau (CFPB) rule on arbitration agreements. And while net regulatory costs increased by nearly $130 million, agencies published roughly 650,000 hours-worth of net cuts in paperwork burdens. The per capita regulatory burden for 2017 is $286.

Regulatory Toplines

- New Proposed Rules: 34

- New Final Rules: 57

- 2017 Total Pages of Regulation: 49,961

- 2017 Final Rules: $32.9 Billion

- 2017 Proposed Rules: $58.8 Billion

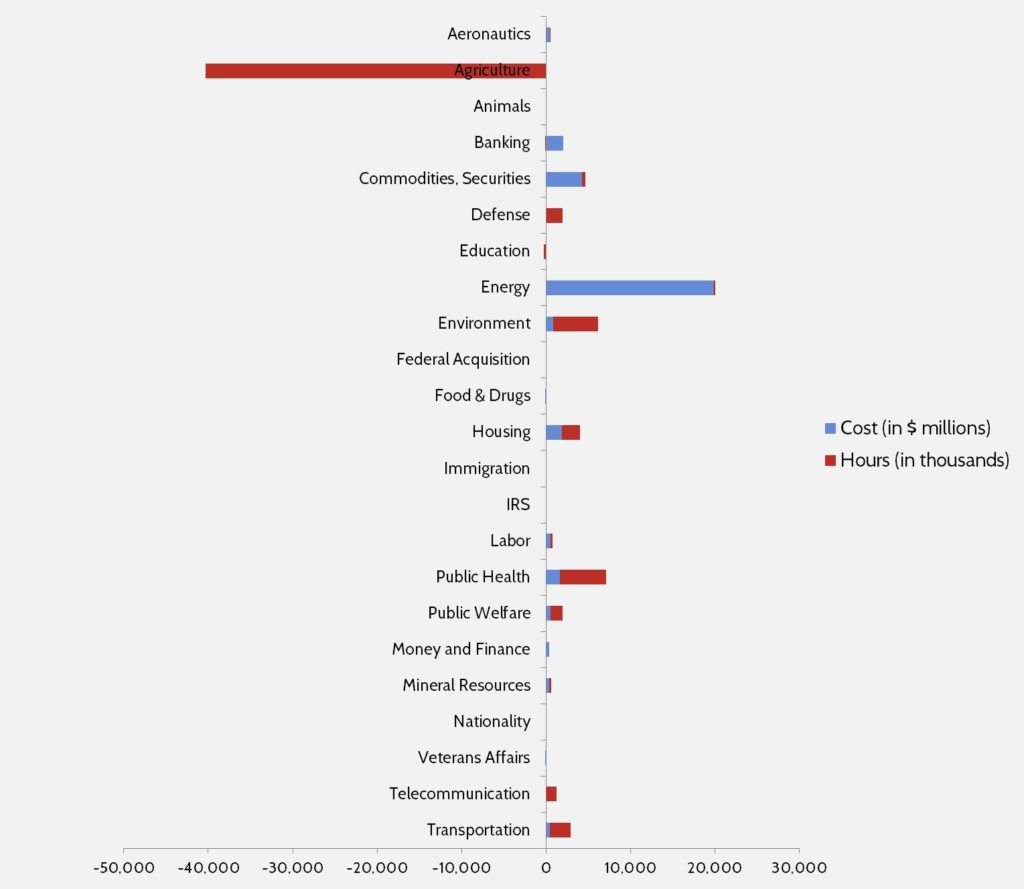

The American Action Forum (AAF) has catalogued regulations according to their codification in the Code of Federal Regulations (CFR). The CFR is organized into 50 titles, with each title corresponding to an industry or part of government. This snapshot of final rules (a change from earlier versions) will help to determine which sectors of the economy receive the highest number of regulatory actions.

Tracking Regulatory Modernization

The most notable deregulatory action of the week came from the halls of Congress. On October 24th, the Senate narrowly approved a CRA resolution by a vote of 51-50 (Vice President Pence provided the tie-breaking vote) that would repeal CFPB’s rule on arbitration agreements. The original rule brought $380 million in costs. Furthermore, the Department of Treasury (Treasury) issued an earlier report on other notable impacts of the rule. The resolution now heads to the White House and President Trump’s expected signature. Upon final passage, it will continue 2017’s historic pace as the 15th successful CRA resolution on the year.

On the administrative side, there were two notable deregulatory actions – one proposed and one final. The proposed rule is a joint rulemaking from Treasury, the Federal Reserve, and the Federal Deposit Insurance Corporation seeking to simplify the certain reporting requirements for affected financial institutions. The difference between the proposed paperwork levels and those already on the books comes out to net savings of more than 760,000 hours across the three agencies. The final rule comes from the Department of Education (ED) and brings more than $9.2 million in cost savings and roughly 250,000 fewer hours of paperwork for affected entities. These savings can go towards ED’s “regulatory budget” for Fiscal Year 2018 under Executive Order 13,771.

Click here to view the administration’s progress under the “one-in, two-out” executive order through the end of Fiscal Year 2017 (which ended on September 30).

Affordable Care Act

Since passage, based on total lifetime costs of the regulations, the Affordable Care Act has imposed costs of $53 billion in final state and private-sector burdens and 176.9 million annual paperwork hours.

Dodd-Frank

Click here to view the total estimated revised costs from Dodd-Frank; since passage, the legislation has produced more than 74.8 million final paperwork burden hours and imposed $38.9 billion in direct compliance costs.

Total Burdens

Since January 1, the federal government has published $91.7 billion in compliance costs ($32.9 billion in final rules) and has cut 18.4 million paperwork burden hours (due to 22.6 million in reductions from final rules). Click below for the latest Reg Rodeo findings.