Week in Regulation

March 2, 2020

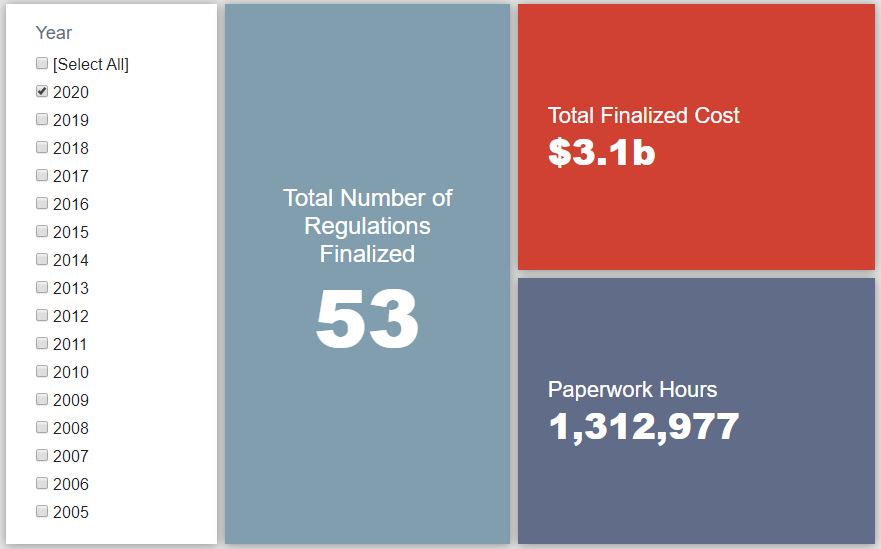

Slight Edge to the Deregulatory Side

Estimated regulatory costs and paperwork burdens both decreased a tad thanks to last week’s batch of rulemakings. There were not, however, many individual rulemakings that stood out. Perhaps the most consequential action of the week was the one that did not require a quantitative economic analysis: the joint employer ruling. Across all rulemakings, agencies published $44.4 million in total net cost savings and cut 85,152 hours of annual paperwork.

REGULATORY TOPLINES

- 2020 Proposed Rules: 57

- 2020 Final Rules: 86

- 2020 Total Pages: 12,184

- 2020 Final Rule Costs: $3.1 billion

- 2020 Proposed Rule Costs: $3.5 billion

TRACKING THE REGULATORY BUDGET

Despite the nominally deregulatory trend, last week’s rulemakings did little to move the needle on the fiscal year (FY) 2020 regulatory budget. This is largely because the most substantial actions were either from independent agencies and/or were proposed rules – both outside the scope of Executive Order 13,771. For instance, the most notable action was a Securities and Exchange Commission proposal regarding financial data reporting requirements that reduced the relevant annual paperwork burden by more than 70 thousand hours (or $13 million in annual costs).

The Trump Administration expects to reach $51.6 billion in cumulative net savings in FY 2020. To date in the fiscal year, agencies have finalized 58 deregulatory actions and 17 regulatory actions, totaling $2.1 billion in quantified total net costs.

THIS WEEK’S REGULATORY PICTURE

This week, the National Labor Relations Board (NLRB) finalizes a rule defining joint employer status.

Source: https://www.federalregister.gov/documents/2020/02/26/2020-03373/joint-employer-status-under-the-national-labor-relations-act

The NLRB published a final rule in the February 26 edition of the Federal Register defining joint employer status under the National Labor Relations Act (NLRA). This comes one month after the Department of Labor (DOL) finalized a joint employer rule under the Fair Labor Standards Act. Both rules set out to clarify in what situations two or more separate companies engaged in a business relationship jointly affect the “terms and conditions” of employment of a group of employees.

Despite these terms and conditions being critical to determining joint employer status, they have never been defined in the regulatory code. For most of the last several decades, this has not caused much uncertainty. The NLRB relied on precedent from its rulings on individual cases to set a de facto definition, mainly that in order to be a joint employer the company in question had to have direct control and exercise that control over another company’s employees for things such as wages, hours, and benefits.

That all changed in 2015, when the NLRB issued a ruling that went against precedent. That decision, known as Browning-Ferris, held that a company could be deemed a joint employer if its control over the terms and conditions of another business’s employees was “indirect, limited and routine, or contractually reserved but never exercised.” This had major implications under the NLRA, as a non-union company that contracted with a union company for workers would potentially be forced to collectively bargain, subject to picketing, and liable for the union company’s actions.

In 2018, the NLRB, under new leadership, determined that rather than issue another ruling simply re-establishing previous precedent, it would provide more certainty by putting a definition into regulatory code. The final rule published this week for the first time defines the terms and conditions of joint employment, as well as “direct and immediate control.” Terms and conditions are defined as “wages, benefits, hours of work, hiring, discharge, discipline, supervision, and direction.” Direct and immediate control means that an employer exercises, or actually makes, determinations on those terms and conditions.

The rule will go into effect April 27, 2020. A lawsuit seeking to overturn the rule is likely; this week 17 states and the District of Columbia sued over DOL’s joint employer rule.

TOTAL BURDENS

Since January 1, the federal government has published $6.6 billion in total net costs (with $3.1 billion in finalized costs) and 14.1 million hours of net annual paperwork burden increases (with 1.3 million hours due to final rules). Click here for the latest Reg Rodeo findings.