Weekly Checkup

April 12, 2017

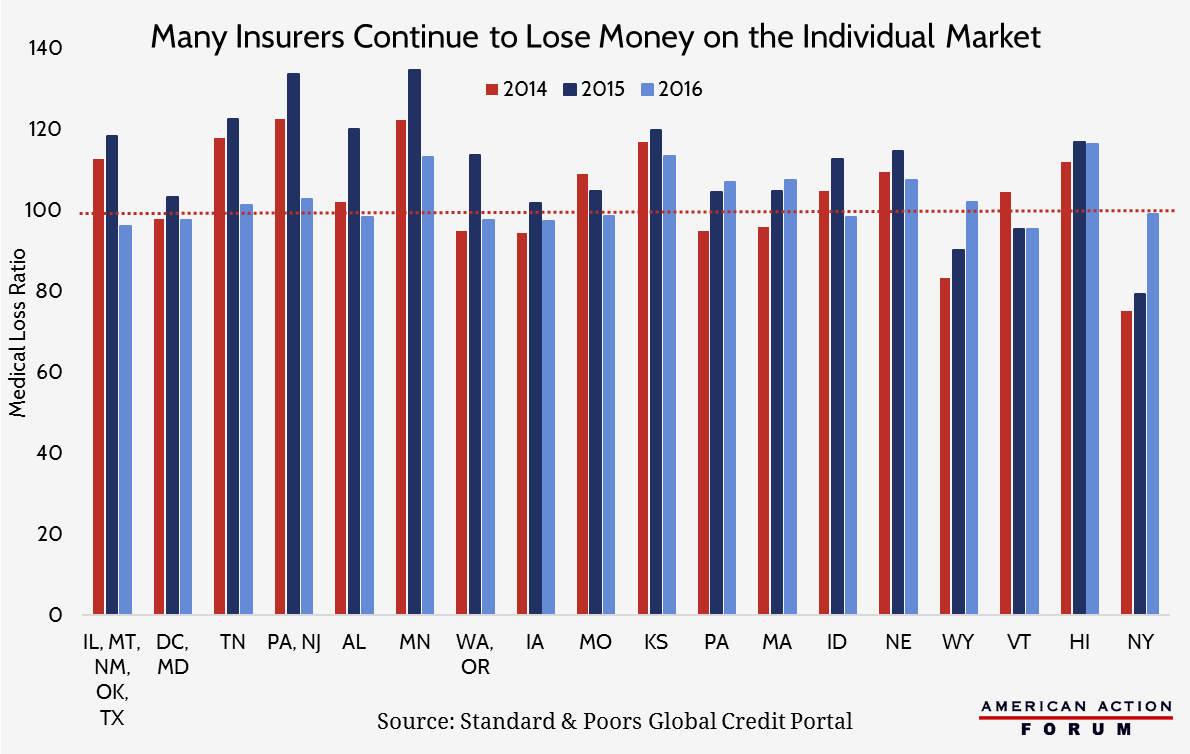

Many Insurers Continue to Lose Money on the Individual Market

Last week, the two largest insurers in the individual market in Iowa—Aetna and Wellmark—announced they would exit the market next year, leavings tens of thousands of individuals potentially without any option for insurance coverage in 2018. With five other states and a third of the nation’s counties currently being served by only one insurer and continued instability in markets across the country, it is worth analyzing which other states might also be faced with this possibility. A recent report from Standard and Poor’s finds the individual market is still fragile and highlights the challenges resulting from legislative and regulatory uncertainty. The graph below shows the medical loss ratio (MLR) of a sample of insurers across the country and the states they serve. The Affordable Care Act mandates insurers maintain a MLR of at least 80 percent for the individual and small group market. The MLR is calculated as the percentage of medical claims paid relative to premium payments received; an MLR of more than 100 percent means the insurer’s medical claims were greater than their premium payments and they lost money. As you can see, the ACA’s mandate has proved unnecessary for many insurers. Among the states shown here, a handful have only one insurer currently offering coverage in most of their counties: Tennessee, Alabama, Missouri, Wyoming. Many of the other states have only two.