Weekly Checkup

January 25, 2019

Realigning Incentives in Medicare Part D

Medicare’s costs for outpatient prescription drugs are rising quickly, and there is a growing sense that part of the problem lies in the incentives structure that Medicare Part D creates. Last week, the Trump Administration announced plans for a new, voluntary Part D payment model intended to lower Medicare expenditures on prescription drugs. The model’s basic idea is to increase plans’ liability for the part of the program where costs are rising the most, changing their incentives. These changes are a move in the right direction, but any benefits will likely be limited. More sweeping changes to the program’s structure, such as what AAF’s Team Health has proposed in the past, are needed to contain costs.

Currently there are four phases to a beneficiary’s Part D drug coverage. First there is a deductible, for which the beneficiary is fully responsible. Next is the initial coverage phase where the Part D plan pays 75 percent of drug costs, and the beneficiary pays 25 percent. Then in the third phase—the infamous “coverage gap,” now a misnomer—the beneficiary continues to pay 25 percent of the cost, while the plans cover 5 percent, and drug manufacturers cover 70 percent. Finally, there is the catastrophic phase, where the federal government picks up 80 percent of the beneficiary’s costs, the plan pays 15 percent, and the beneficiary pays 5 percent. Simultaneously, the federal government is covering the bulk of the beneficiary’s premium (74.5 percent of the national average bid for the basic benefit) with the beneficiary paying the remaining portion.

Federal spending on Part D is increasing rapidly, particularly in the catastrophic phase of the program. The Wall Street Journal recently wrote about the incentives that encourage plans to, in effect, increase Medicare’s spending, in part in the catastrophic phase, and AAF’s Tara O’Neill Hayes wrote in more detail about the issue here.

The administration is proposing a two-step solution as part of this new model. There aren’t a lot of details yet, but first they will give participating plans more tools to encourage patients and providers to choose drugs with lower list prices. Exactly what those tools will be isn’t spelled out, and there are some concerns that giving plans more flexibility could mean more limited choice for beneficiaries. In the second part of the model, the Centers for Medicare & Medicaid Services will project what federal spending would have been in the catastrophic phase under current law over five years. Then participating plans will either be on the hook for costs above that estimate, or will be allowed to share with the federal government the savings below that estimate. Ideally this structure will incentivize plans to better control drug spending in the catastrophic phase, saving the government money.

Ultimately the model is voluntary and appears to be fairly limited in what it tries to change, and so its impact will probably not be significant. A larger reform would be better, though, and O’Neill Hayes has a proposal to restructure the standard Part D benefit in a way that realigns incentives—placing greater financial risk for high-cost beneficiaries on both insurers and drug manufacturers—while also protecting beneficiaries from catastrophic financial risk through the imposition of an out-of-pocket cap. These changes are likely to lead stakeholders to alter their behavior in ways that reduce overall Part D expenditures and ensure the program’s continued success. Read more about that proposal here.

Chart Review

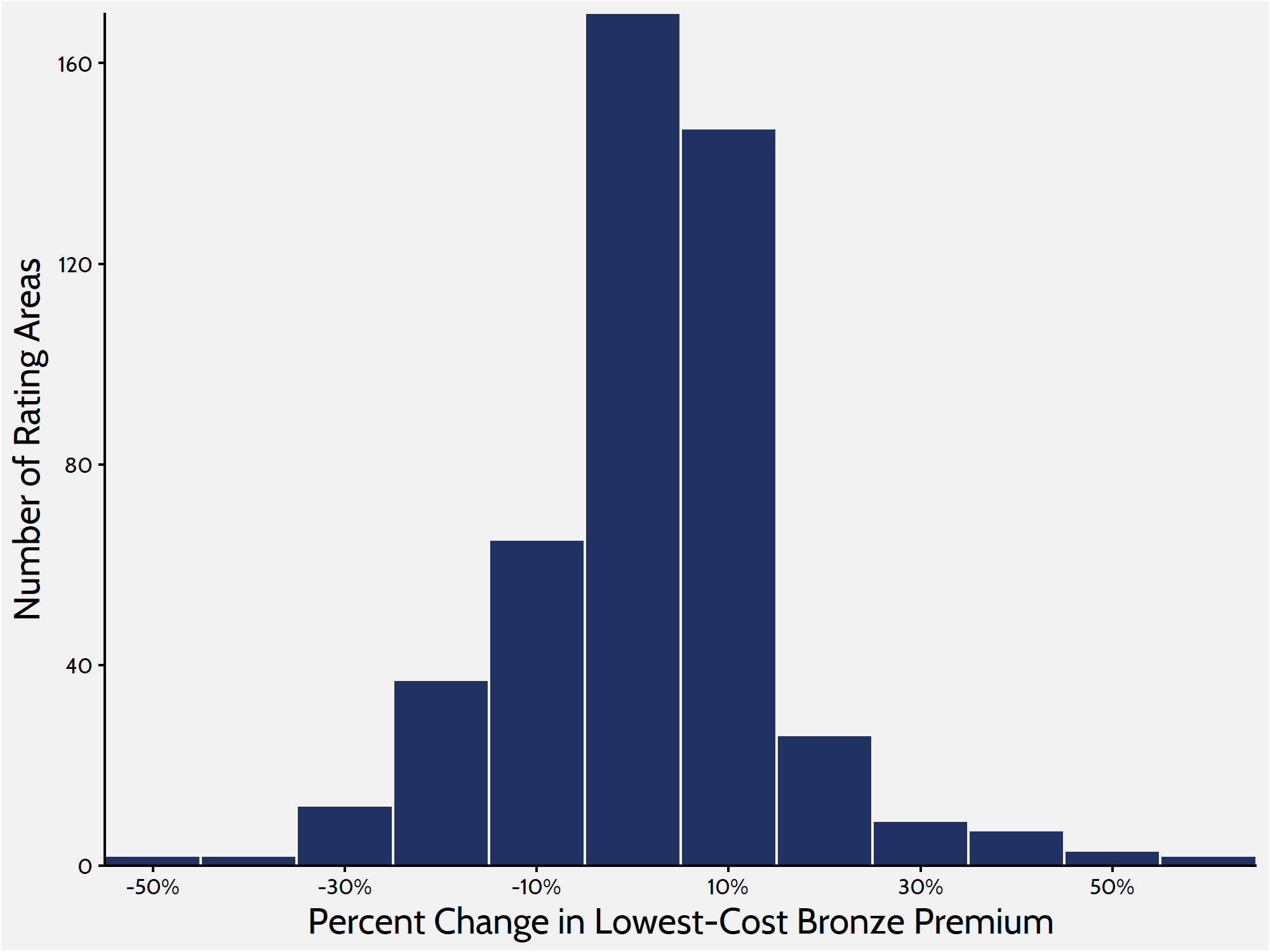

AAF recently analyzed premium changes in the Affordable Care Act’s individual-market exchanges. To get a more complete picture of what is happening in the individual marketplace, it is helpful to look at premiums for Bronze and Gold plans. When weighted by population, premiums for the lowest-cost Bronze plan have increased by 1 percent between 2018 and 2019.The histogram below shows the distribution of Bronze premium changes among rating areas, with the bulk of rating areas seeing premium changes between -5 and 5 percent.

Lowest-Cost Bronze Premium Changes

From Team Health

More Evidence of The Need for Structural Reform in Medicare Part D

Deputy Director of Health Care Policy Tara O’Neill Hayes examines Medicare Part D’s incentive structure in light of a recent news report about insurers’ profits in the program. Realigning the program’s incentives could potentially save money for all parties—insurers, beneficiaries, and taxpayers—she writes.

Worth a Look

Axios: Massachusetts’ governor backs direct price-setting for drugs

STAT: After ‘CRISPR babies,’ international medical leaders aim to tighten genome editing guidelines