Weekly Checkup

June 4, 2021

The Expensive, Unnecessary, and Flailing COBRA Subsidies

This week The Washington Post reported on the Biden Administration’s struggles to launch the COBRA subsidy for laid-off workers that was enacted as part of the American Rescue Plan. It’s noteworthy because the proposal didn’t make a lot of sense at the time, and the struggles to get it off the ground have undoubtably limited any benefit the program might have had. The situation illustrates policymakers’ unfortunate tendency to react thoughtlessly to problems with ultimately ineffective, if expensive, solutions.

First, some background: COBRA is a transitional insurance program dating back to 1985 that allows employees to continue their enrollment in their employer-sponsored insurance (ESI) plan for between 18 and 36 months in most cases, starting when employment ends. COBRA enrollees pay both the employee and employer shares of the premium, however, so while COBRA provides continuity, it also can be prohibitively expensive. Most commonly COBRA is used as a stopgap when people are transitioning between employers and ESI plans.

In April 2020—when upwards of 22 million Americans had lost their jobs—I wrote that a federal subsidy for COBRA premiums might be a sensible policy. Job loss is a qualifying event that allows people to enroll in federally subsidized individual-market insurance coverage under the Affordable Care Act (ACA), but shifting tens of millions of Americans out of their existing ESI plans and into ACA or Medicaid coverage seemed like an unhelpful disruption amid a global pandemic.

Ultimately, no action was taken on a COBRA subsidy in 2020, but President Biden and congressional Democrats pressed forward with a 100 percent subsidy of COBRA premiums in March of this year that was supposed to take affect April 1 and run through September 30. The logic behind the COBRA subsidy at that point in time was confusing. As I explained, it came well after the most significant pandemic-related job loss had already occurred, and the economy was finally starting to show signs of rebounding. It was also after the ACA’s 2021 open enrollment period, a sensible point for anyone who was still paying COBRA premiums to transition to subsidized exchange coverage. Additionally, the COBRA subsidy was enacted at the same time as temporary enhancements to ACA coverage and as the Biden Administration was reopening enrollment.

The subsidies were supposed to kick in starting in April, but guidance from the Internal Revenue Service on exactly who qualifies wasn’t issued until mid-May. According to the Post, most eligible COBRA enrollees are still paying their full premium due to various logistical challenges as we enter the third month of subsidized coverage. According to the Department of Labor, enrollees will receive their subsidies, either in the form of a refund for the premiums they’ve paid or by extending the payments past September to ensure a full six months of subsidies.

Ultimately, however, there doesn’t seem to be much point. In theory, the objective was to aid workers who lost their ESI because of the pandemic until such time as they were able to obtain new coverage. But there have been several opportunities in the last six months for unemployed workers to transition from COBRA to more affordable options. In fact, because benefits are only being paid out well over a year after COVID-19 disrupted the labor force and ESI market, many who ultimately benefit from the subsidy—which the Congressional Budget Office projected will cost $7.8 billion—will not have experienced job loss directly related to the pandemic.

The whole thing is reminiscent of the 2009 American Recovery and Reinvestment Act and “shovel ready” projects that weren’t so shovel ready after all. Policymakers are often quick to throw money at perceived problems and then move on, leaving policies that linger ineffectively after the original need is gone.

Video: The Current State of Public Health Relations

Christopher Holt discusses the recent decline in confidence in public health officials amid the COVID-19 pandemic.

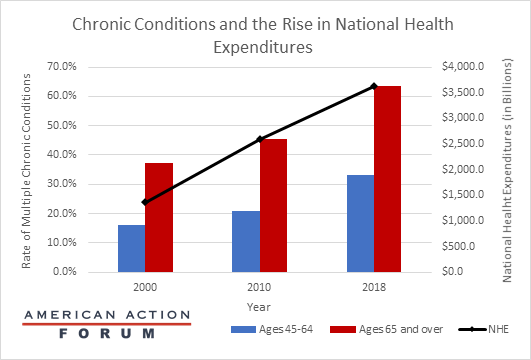

Chart Review: Chronic Conditions and the Rise in National Health Expenditures

Jackson Hammond, Health Care Policy Analyst

While many have noted the connection between chronic disease and increased mortality from COVID-19, the prevalence of chronic disease in the United States has been negatively impacting the health care system and Americans’ health since long before the current crisis. The chart below, based on data from the Centers for Disease Control and Prevention and the Centers for Medicare and Medicaid Services Information Survey, demonstrates a correlation between the rise in the number of adults with multiple chronic conditions and the rise in National Health Expenditures from 2000 to 2018. While increased innovation and consolidation have also contributed to increases in the cost of care, Americans are becoming less healthy each decade. Fifty percent of all U.S. health care costs are already incurred by the unhealthiest five percent of patients, and further decreases in population health will only increase overall health care costs. Further, as the U.S. under-65 population becomes less healthy, we can expect mid-life health issues to compound late-life health issues, further driving up costs as time goes on.

Tracking COVID-19 Cases and Vaccinations

Jackson Hammond, Health Care Policy Analyst

To track the progress in vaccinations, the Weekly Checkup will compile the most relevant statistics for the week, with the seven-day period ending on the Wednesday of each week.

| Week Ending: | New COVID-19 Cases: 7-day average |

Newly Fully Vaccinated: 7-Day Average |

Daily Deaths: 7-Day Average |

|

June 2, 2021 |

14,349 |

344,489 |

324 |

|

May 26, 2021 |

22,138 |

712,144 |

414 |

|

May 19, 2021 |

27,934 |

986,465 |

498 |

|

May 12, 2021 |

34,823 |

1,185,382 |

557 |

|

May 5, 2021 |

45,368 |

1,385,226 |

592 |

|

April 28, 2021 |

52,068 |

1,426,642 |

622 |

|

April 21, 2021 |

61,025 |

1,468,573 |

633 |

|

April 14, 2021 |

68,256 |

1,717,594 |

651 |

|

April 7, 2021 |

63,934 |

1,554,660 |

622 |

|

March 31, 2021 |

63,972 |

1,357,418 |

739 |

|

March 24, 2021 |

57,527 |

955,923 |

747 |

|

March 17, 2021 |

52,781 |

1,016,618 |

884 |

|

March 10, 2021 |

54,100 |

946,298 |

1,160 |

|

March 3, 2021 |

60,922 |

905,151 |

1,426 |

|

February 24, 2021 |

64,294 |

837,616 |

1,783 |

|

February 17, 2021 |

74,070 |

737,247 |

1,928 |

|

February 10, 2021 |

99,290 |

693,251 |

2,382 |

|

February 3, 2021 |

128,629 |

478,558 |

2,726 |

|

January 27, 2021 |

157,703 |

332,653 |

3,160 |

Sources: Centers for Disease Control and Prevention Trends in COVID-19 Cases and Deaths in the US, and Trends in COVID-19 Vaccinations in the US

Note: The U.S. population is 332,384,972.

Worth a Look

Axios: U.S. COVID booster shots study tests mixing vaccine brands

Kaiser Health News: Little-Known Illnesses Turning Up in Covid Long-Haulers