Weekly Checkup

December 7, 2018

“Torture Numbers and They’ll Confess to Anything.”

In October, the Centers for Medicare and Medicaid Services (CMS) announced that premiums in 2019 for benchmark Silver plans in the 39 states using the federally facilitated health insurance marketplaces would be down—on average—1.5 percent compared to 2018. Now, new research from AAF Health Policy Analyst Jonathan Keisling shows that for all 50 states and the District of Columbia, 2019 premiums for benchmark Silver plans increased by just 1 percent, compared to a 36 percent increase the year prior. The obvious takeaway from both reports is that the individual market, as reconstructed by the Affordable Care Act (ACA), is finally starting to stabilize after years of skyrocketing premiums. But averages mask variation, and there is often more going on behind the topline figures than is immediately apparent.

As discussed in the last edition of the Weekly Checkup, overall enrollment is on track to drop from last year’s levels, which might seem odd when considering the relatively stable premiums. Stable premiums typically indicate a corresponding stability in the risk pool. Further, entry of new plan issuers in many markets corroborates this conclusion. But as the Greg Easterbrook quote in the title indicates, numbers are slippery things. A number of factors could be impacting enrollment decisions, and as Keisling’s research indicates, premiums are still one of them.

2019 premiums at the rating-area level are far from static. Rather than incremental premium growth across the board, some states are seeing dramatic decreases. For example, in Minnesota most of the state’s rating areas are seeing benchmark Silver plan premiums drop by between 20 and 30 percent. In Georgia, where premiums are up in some rating areas and down in others, one rating area saw the benchmark Silver plan decrease 51 percent. Much of Texas will see benchmark Silver plan increases of between 20 and 30 percent, while almost all of North Dakota will experience increases of at least 30 percent. In one rating area in Kentucky—another state with wide variation—the benchmark Silver plan will be 35 percent more expensive in 2019 than it was in 2018. These variations have real implications for enrollees and plan issuers, and they can drive behavior—such as lower than anticipated enrollment—that might seem at odds with what the national averages would imply.

There are a number of reasons to believe the individual market, after years of volatility, is stabilizing, but some of that volatility will remain under the surface. Policymakers should always remember that averages don’t tell the whole story.

Chart Review

Jonathan Keisling, Health Care Policy Analyst

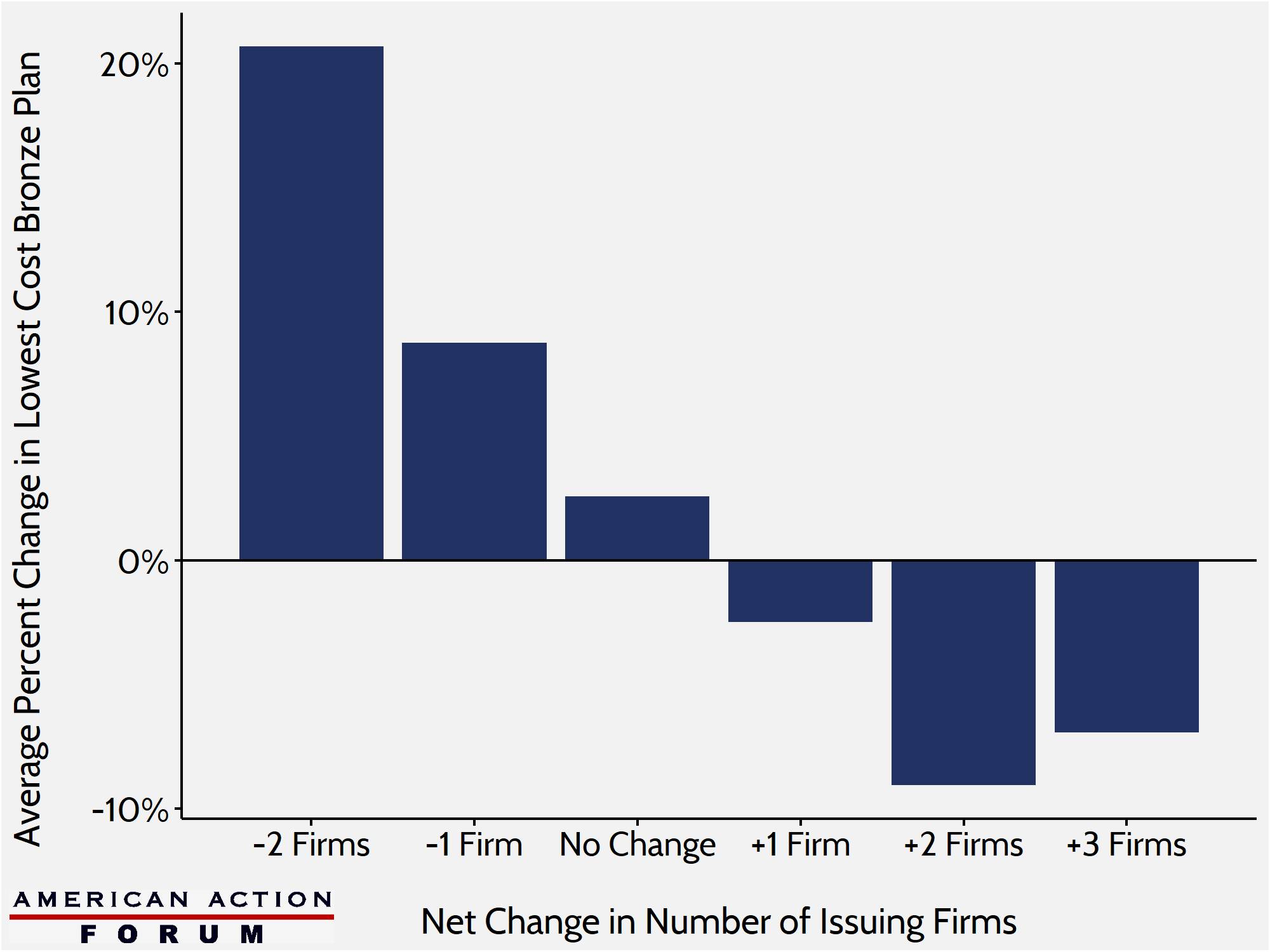

The most encouraging feature in the ACA’s 2019 marketplaces is the clear relationship between competition and premium increases. For 2019, increased competition has led to a decrease in premiums. In rating areas where competition increased, the average lowest-cost Bronze premium decreased by roughly 4 percent. In areas where competition stayed the same or decreased, that premium increased by 4 percent.

Worth a Look

Wall Street Journal: Employers Change Tactics to Curb Health-Insurance Costs

Health Affairs: Unpacking Lower Federal Funding For Minnesota’s Reinsurance Program