Weekly Checkup

June 8, 2018

BREAKING: Social Security & Medicare Are Still Going Broke

This week the Social Security and Medicare Trustees released their annual reports on the financial health of their respective programs. The reports are a combined 530 pages, but fear not faithful reader, AAF’s own Jonathan Keisling and Tara Hayes have broken out the key findings for you in a much more manageable six-page document, available here. Now I’ll summarize it for you in nine words: both programs are headed for a meltdown, and fast.

Social Security will be unable to meet its obligations by 2034, and Medicare Part A will be similarly situated by 2026. Don’t get too hung up on the specific year—these numbers move around a bit from report to report based on various factors. The important point is that American entitlement programs face a reckoning within the next fifteen years or so. We’ve overcommitted these programs and the time to address this problem is now, not in the future.

Now, as Sam Baker wrote for Axios yesterday morning, “Cutting Medicare benefits is unpopular; so is raising taxes to pay for Medicare.” So, it’s not like there are easy answers. But if we don’t change the benefit structure, we will have to make some draconian decisions on revenue. Let’s take a quick look at what it would have required to balance Medicare’s budget in 2017.

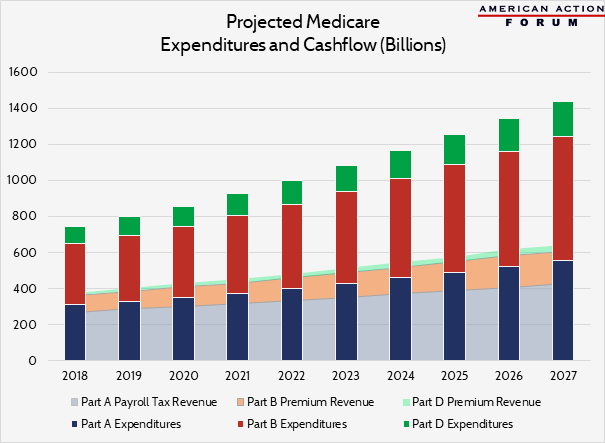

Medicare Part A ran a cash flow deficit last year of $35 billion. To make the Part A trust fund balance, we’d have needed to increase the payroll tax that funds it by 13 percent. Medicare Parts B and D are funded by a mix of premiums and direct payments from the federal Treasury. By law, premiums can only account for 25 percent of total Medicare spending. But for purposes of demonstrating the scale of the problem, let’s imagine we were going to make Parts B and D whole through premium increases. Medicare Part B ran a cash flow deficit of $232 billion in 2017. To balance the Part B budget, we would have needed to increase Part B premiums by 285 percent. The average Medicare beneficiary would have seen a $4,583 increase in their annual premiums. And what about Part D? The 2017 cash flow deficit for the drug program was $85 billion. To balance that disparity, beneficiary premiums would have needed to increase by $2,354, or 545 percent. The chart below shows how these deficits play out over the next decade, absent program reforms or the kind of taxes and premiums outlined here. It’s not pretty.

In the midst of this crisis—and it is a crisis—many on the political left are proposing expanding Medicare’s liabilities through extravagant “Medicare for all” proposals. Perhaps we should first focus on ensuring there is still a Medicare program at all for anyone in future years.

Chart Review

Jonathan Keisling, Health Care Policy Analyst

The graph below illustrates how low Medicare’s projected premium and payroll tax rates are relative to expenditures and, implicitly, the resulting burden on the trust fund and treasury. To ensure hospital payments can continue to be made beyond 2026, cash flows must, at the very least, reflect expenditures. Part A payroll tax revenues would need to increase by an average of 21 percent over the next 10 years.

From Team Health

The Future of America’s Entitlements: What You Need to Know about the Medicare and Social Security Trustees Reports – Tara O’Neill Hayes, Jonathan Keisling, and Douglas Holtz-Eakin

Worth a Look

Axios: The coming health care wars

New York Times: Blood Test Might Predict Pregnancy Due Date and Preterm Birth

Washington Post: Trump administration won’t defend ACA in case brought by GOP states