Week in Regulation

July 23, 2018

A Very Up and Down Week

In terms of rulemakings with noticeable cost and savings estimates, last week was a doozy. Across 19 such rulemakings, there were notable regulatory and deregulatory actions. Highlights included a Department of Transportation (DOT) rule on public transit safety plans, the rescission of the “Persuader Rule,” and proposed reforms to the “Volcker Rule.” Between both proposed and final rules, agencies published roughly $51.2 million in net cost savings, but 598,000 hours of new paperwork. The per capita regulatory burden for 2018 is negative $15.05.

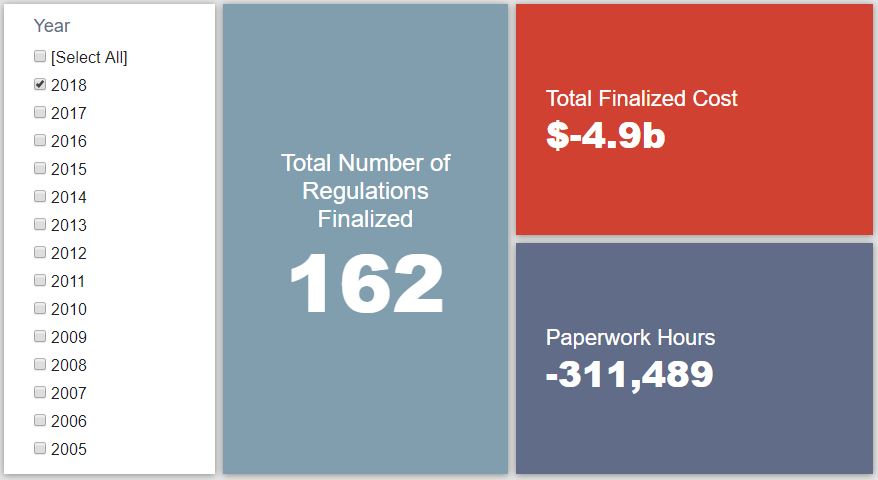

Regulatory Toplines

- New Proposed Rules: 47

- New Final Rules: 62

- 2018 Total Pages of Regulation: 34,516

- 2018 Final Rules: -$4.9 Billion

- 2018 Proposed Rules: $9.6 Billion

The most significant regulatory action was DOT’s “Public Transportation Agency Safety Plan” rule. The rule implements certain requirements from the 2012 “Moving Ahead for Progress in the 21st Century Act” (MAP-21). It requires state and local transit agencies receiving federal funding to produce and implement a comprehensive safety plan. With total costs of more than $600 million, it is the costliest final rule thus far in 2018. Despite its $30.6 million in new annualized costs, DOT is still on track to exceed its Fiscal Year (FY) 2018 regulatory savings goal under Executive Order (EO) 13,771 by more than $120 million.

Tracking Regulatory Modernization

The deregulatory action contributing the most savings towards the EO 13,771 budget was a Department of Labor (DOL) rule that rescinds the 2016 “Interpretation of the ‘Advice’ Exemption in Section 203(c) of the Labor-Management Reporting and Disclosure Act” rule (commonly known as the “Persuader Rule”). The original rule imposed more stringent reporting requirements upon employers and consultants when they provide information to employees on potential collective bargaining issues. DOL now finds that: “The [2016] Rule relied on an inappropriate reading of Section 203(c) that required reporting based on recommendations that constitute ‘advice’ under any reasonable understanding of the term.” The rescission of these reporting requirements yields annual savings of roughly $93 million for affected entities. This brings DOL’s total annualized savings in FY 2018 to $417 million – $280 million beyond its EO 13,771 goal.

According to AAF analysis, since the start of FY 2018 (beginning Oct. 1, 2017), executive agencies have promulgated 46 deregulatory actions with quantified estimates against 10 regulatory measures, under the rubric created by EO 13,771 and the administration’s subsequent guidance document on the matter. These rules combine for net annual savings of roughly $1.3 billion. This means that agencies have thus far surpassed the administration’s cumulative goal for FY 2018 of $687 million in net annual savings. In fact, according to the administration’s latest Unified Agenda, agencies are on track to roughly double that goal.

Click here to view AAF’s examination of the administration’s progress under the “one-in, two-out” executive order through the end of Fiscal Year 2017.

State of Major Obama-Era Initiatives

Based on total lifetime costs of the regulations, the Affordable Care Act has imposed costs of $52.9 billion in final state and private-sector burdens and 176.9 million annual paperwork hours.

There was one proposed rule affecting a very significant part of Dodd-Frank last week. A joint rulemaking between five different financial agencies seeks to streamline the so-called Volcker Rule. One of the most high-profile regulations under Dodd-Frank, the original 2013 rule “generally prohibits any banking entity from engaging in proprietary trading or from acquiring or retaining an ownership interest in, sponsoring, or having certain relationships with a hedge fund or private equity fund.” This current proposal seeks to provide relief for small and medium-sized operations as well as find ways to reduce compliance costs for all affected entities. Among the agencies involved, only the Department of Treasury and the Securities and Exchange Commission provided quantified cost savings estimates totaling roughly $32 million.

Since passage, the Dodd-Frank financial reform legislation has produced more than 82.9 million final paperwork burden hours and imposed $38.9 billion in direct compliance costs.

Total Burdens

Since January 1, the federal government has published $4.7 billion in net costs (despite $4.9 billion in net savings from final rules) and paperwork burdens amounting to 1.5 million hours (including 311,489 hours of paperwork reduced under final rules). Click here for the latest Reg Rodeo findings.