The Daily Dish

September 9, 2025

Recession Talk

Today the Bureau of Labor Statistics (BLS) will release its preliminary benchmark revisions to the payroll data from April 2024 to March 2025. AAF’s Fred Ashton estimates that the payroll jobs could be downwardly revised by between 470,000 to 740,000 fewer jobs. (Fred is a piker; others estimate the downward revision at a million jobs.) This is a business-as-usual release, and while it covers only two months of the Trump Administration, it could generate some White House commentary.

Certainly, it will add to the concerns about the economic outlook generated by the August jobs report of only 22,000 jobs and a revision that indicated the United States lost 13,000 jobs in June. Also, the manufacturing sector has cut 38,000 jobs so far this year and 78,000 over the past 12 months. At the same time, the number of discouraged workers is on the rise. The number of individuals not in the labor force but who want a job increased by 179,000 in August and 1.36 million since the low in March 2023. If these people were included in the unemployment rate, it would be 7.8 percent. There are lots of good reasons for concern.

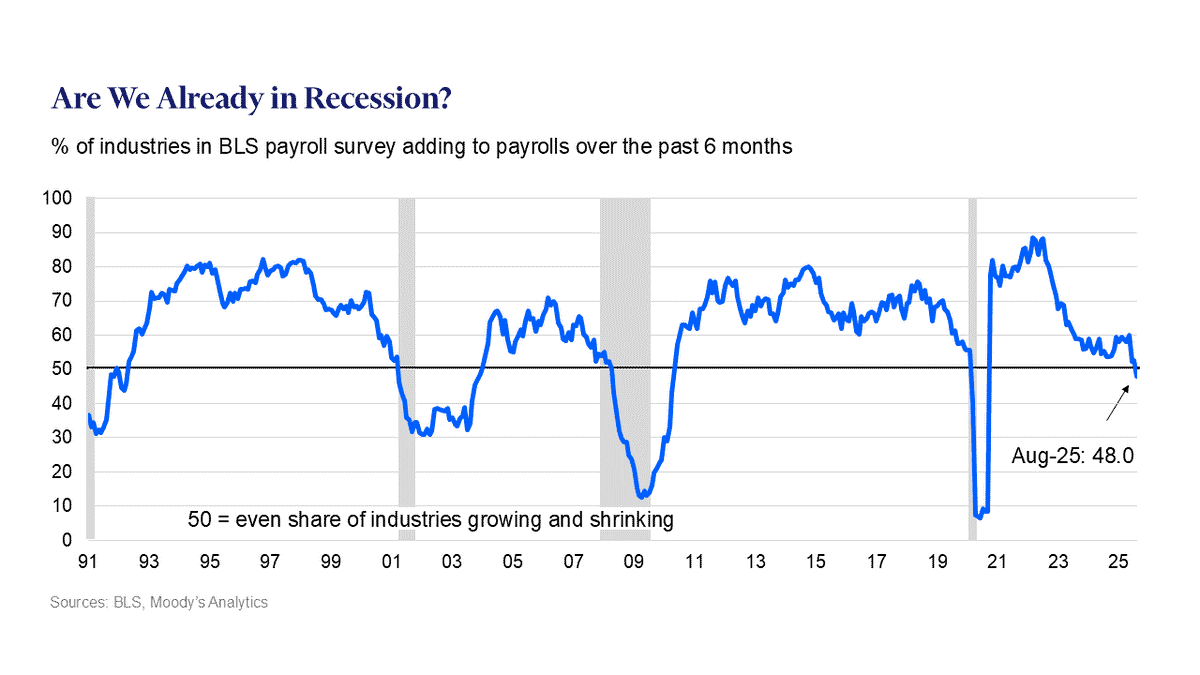

Indeed, the chart (below) published on X by Mark Zandi suggests that the United States is already in a recession. In the chart, the shaded periods are official U.S. recessions. The declining share of industries that are expanding employment tracks these downturns quite closely. If so, the recent decline below 50 percent should be a concern.

But how would one know? Isn’t it a recession when gross domestic product (GDP) declines for two consecutive quarters? Since growth was 3.3 percent in the 2nd quarter, there would be no way for this to be a recession.

Ah, but not so fast. As it turns out (and as loyal readers of Eakinomics – who are sufficiently caffeinated and who have actual memories – know), the official arbiter of business cycles in the United States is the National Bureau of Economic Research’s (NBER’s) Business Cycle Dating Committee. So, ultimately it matters what the committee thinks, and not the growth in output or employment. Indeed:

The NBER’s definition emphasizes that a recession involves a significant decline in economic activity that is spread across the economy and lasts more than a few months. In our interpretation of this definition, we treat the three criteria — depth, diffusion, and duration — as somewhat interchangeable. That is, while each criterion needs to be met individually to some degree, extreme conditions revealed by one criterion may partially offset weaker indications from another.

Unfortunately, using such a data-intensive definition requires that a lot of data be collected and analyzed – and that takes time. The committee does its work carefully and deliberately, so the official dates are not usually determined until well after the fact.

This is inconvenient from the perspective of the news cycle, so there is a natural migration to other indicators, such as GDP or employment. Those data will be available more quickly but also may give a misleading timing to the recession.

Fact of the Day

Across all rulemakings, agencies published roughly $14.2 million in total costs but cut 500 paperwork burden hours.