The Daily Dish

September 5, 2023

Assessing the Economic Outlook

Friday we received the August employment report, which showed the economy added 187,000 jobs, a rise in the labor force of 736,000 workers (an increase of 0.2 percentage points in the labor force participation rate), a rise in the unemployment rate from 3.8 percent to 3.5 percent, and an increase in average hourly earnings at an annual rate of 2.4 percent. As noted by Gordon Gray, the report fell nicely into a growing narrative of continuing growth and easing inflation – the proverbial soft landing.

One might think that this would yield confidence in the future, evidence of a strong growth outlook, and approval for the administration’s policy. Not quite.

Consumer confidence is down. In the most recent survey:

“The Conference Board Consumer Confidence Index® declined in August to 106.1 (1985=100), from a downwardly revised 114.0 in July. The Present Situation Index—based on consumers’ assessment of current business and labor market conditions—fell to 144.8 (1985=100) from 153.0. The Expectations Index—based on consumers’ short-term outlook for income, business, and labor market conditions—declined to 80.2 (1985=100) in August, reversing July’s sharp uptick to 88.0. Expectations were a hair above 80—the level that historically signals a recession within the next year.”

And the public is not buying Bidenomics. As reported by The Wall Street Journal: “58% of voters say the economy has gotten worse over the past two years, whereas only 28% say it has gotten better, and nearly three in four say inflation is headed in the wrong direction.”

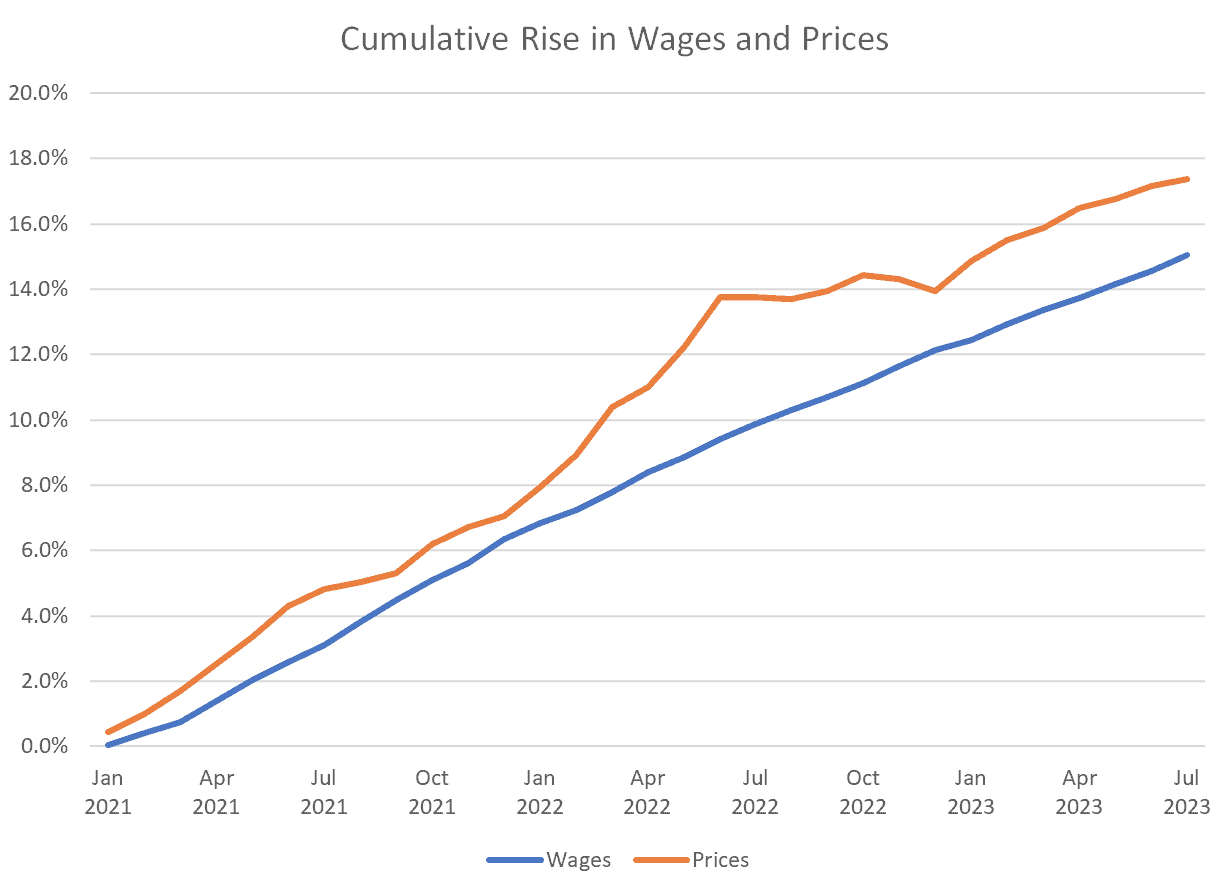

One reason is shown by the chart below, which compares the cumulative percentage rise in prices (as measured by the consumer price index, CPI) and wages (as measured by average hourly earnings by production and non-supervisory workers). While the White House is crowing over a few months of rising real wages, the reality is that over its entire tenure the cumulative rise in prices outstrips the rise in wages.

Finally, the outlook is hardly without risks. Consumers spent robustly in July but were able to do so only by dipping into savings – the personal saving rate has declined for two straight months from 4.7 percent to 3.5 percent. And the inflation outlook is far from quiescent. The Cleveland Federal Reserve’s “Nowcast” of inflation indicates a sharp jump in CPI inflation in July – to 9.9 percent (annual rate) for the top-line and 4.7 percent for the core CPI. (The August CPI will be released on September 13.) Bad news on inflation may force the Fed’s hand to raise interest rates further.

The news has been good, so far. But the outlook remains fraught with risks.

Fact of the Day

The August U-6 (the broadest measure of unemployment) jumped to 7.1 percent, the highest rate since May of 2022.