The Daily Dish

September 24, 2025

Can the Fed “Look Through” Tariff Inflation?

The Federal Reserve Board’s Vice Chair for Supervision Michelle W. Bowman gave a speech yesterday that included the argument:

The U.S. economy is experiencing aspects of a negative supply shock from higher tariffs that is also affecting aggregate demand. Since these conditions are unlikely to lead to persistent effects on inflation, and because changes in monetary policy take time to work their way through the economy, optimal policy calls for looking through temporarily elevated inflation readings. Therefore, we should proactively remove some policy restraint on aggregate demand to avoid damage to the labor market and a further weakening in the economy, provided that long-run inflation expectations remain well anchored. (Emphasis added.)

This argument is at the heart of how the Fed should react to the Trump tariffs.

Imagine the economy is humming along with a steady 2-percent inflation when it is hit with a tariff that necessitates a 50-percent rise in prices to cover the cost. In that moment inflation would be 52 percent. But with the tariff now embedded in prices, inflation would go back to the steady 2-percent rate. Bowman is arguing that the Fed should look through the 52-percent inflation to recognize that inflation will return to the 2-percent target in the future.

Bowman’s argument is that there is no need to tighten to offset the rise in inflation; that pressure goes away automatically once prices are adjusted to cover the new cost. Indeed, she is arguing that it makes sense for the Fed to ease and offset any reduction in purchasing power that comes from the tariff.

But there is a big caveat. Readers know this is a one-time event (well, ’cuz you were told). The Fed will know it is a one-time event. But in the real world, tariffs are arriving at different times and at different rates on different products. While each is, in isolation, a one-time event, the appearance may be of prices rising everywhere and all the time. To consumers, it might look like the bad old days of 2021 and 2022 with a return to high inflation and they may start putting inflation into their economic planning.

This is why the caveat “provided that long-run inflation expectations remain well anchored” is so important. If consumers expect inflation, it can be self-fulfilling. The graph below shows the median one-year expected inflation from the New York Fed’s survey. With the arrival of inflation in 2021, expectations shot up to over 8 percent. A big part of the success of the tightening cycle that began in 2022 was the declining inflation expectations until mid-2024. From that point, there has been a bit of a U-turn.

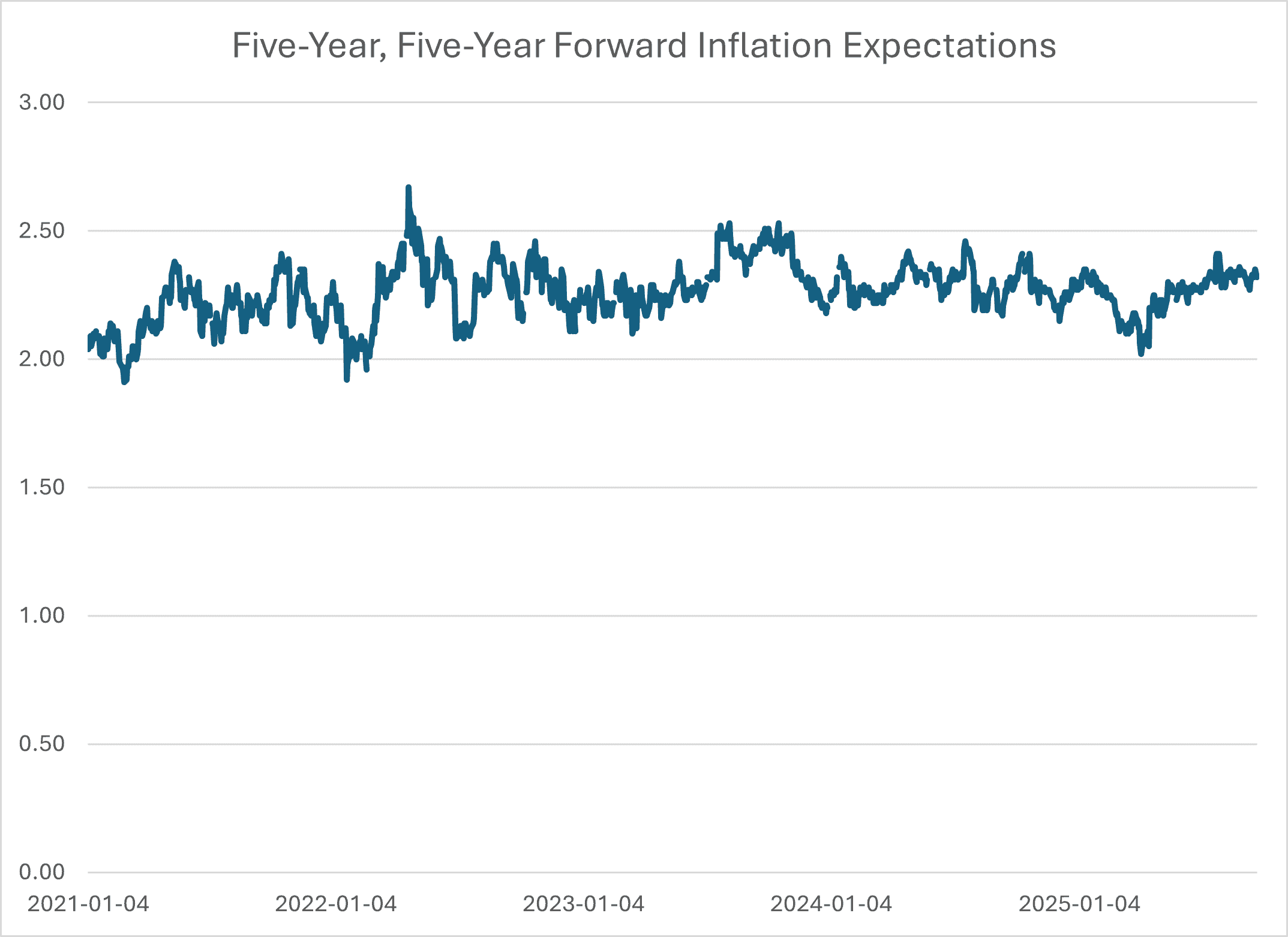

These one-year expectations reflect current events. Notably, the long-run inflation expectations are much better anchored. This chart (below) shows the average inflation expected over a five-year period, beginning five years in the future. It suggests an uptick of 25 basis points or so in the aftermath of the April tariff announcements. If it remains contained, it will be easier for the Fed to be confident that any rate cuts will not translate into durable inflation.

The next data on inflation will arrive on Friday. It will be interesting to see the latest read on inflation, but even more interesting to see how people react to it.

Fact of the Day

Members of the 119th Congress have introduced CRA resolutions of disapproval addressing 61 rulemakings across the Biden and Trump Administrations that collectively involve $138 billion in compliance costs.