The Daily Dish

May 23, 2022

Consumer Gloom

It is not news that the American public is bent out of shape over the pace of inflation, and largely blames the administration for the economic woes. The magnitude of the discontent is, however, quite striking.

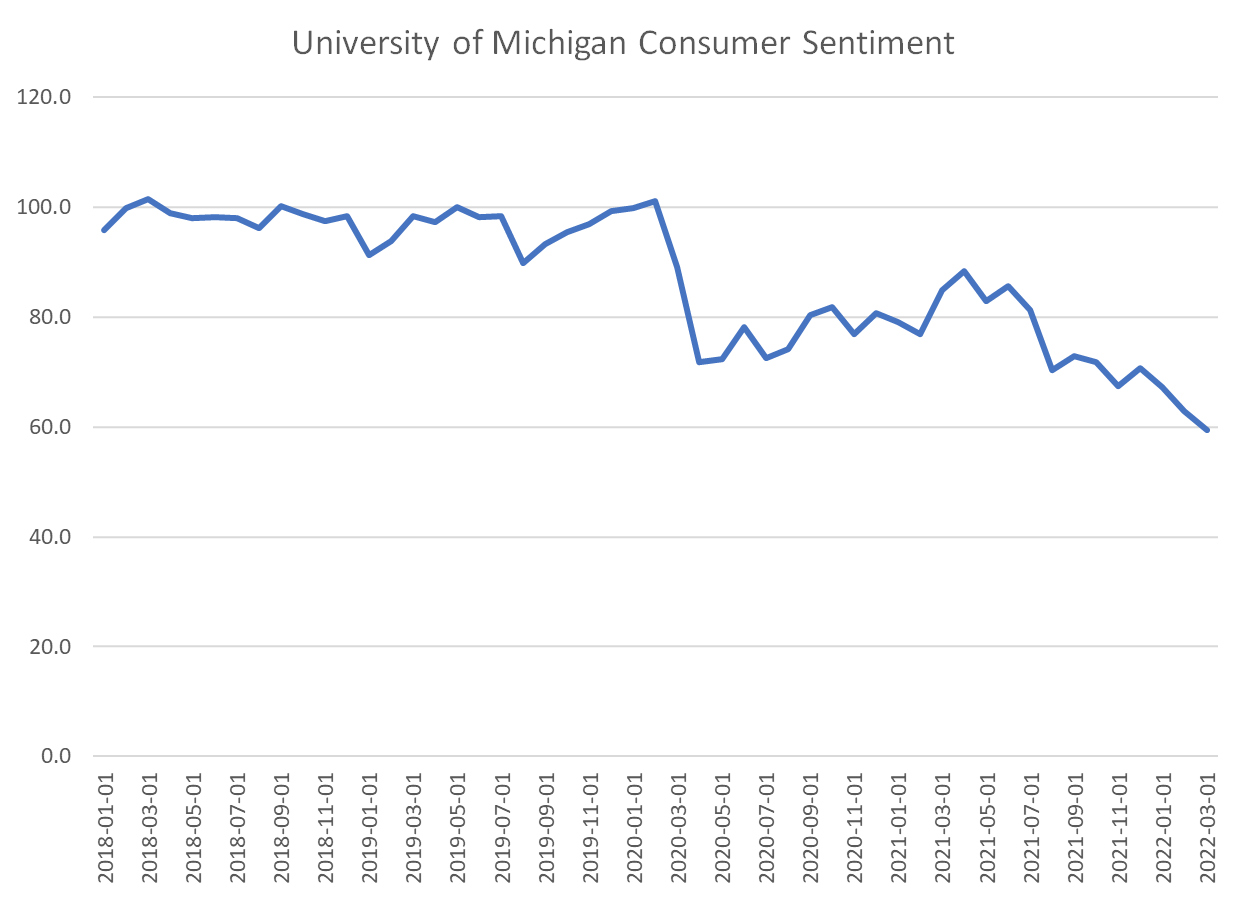

The chart (below) shows the University of Michigan index of consumer sentiment (courtesy of the St. Louis Federal Reserve Bank). In March, the sentiment index fell to 59.4. It has since fallen further to 59.1 in the preliminary May data. That is lower than in April 2020 when the economy shed 20 million jobs (10ten times more than in any previous single month) and the unemployment rate jumped by 10 percentage points (again, 10 times larger than any single month’s rise). Historically, it has been lower, but only rarely and both times coinciding with bad economic times – May 1980 and November 2008.

The gloom stands in sharp contrast to the continued strong household balance sheets, growth in household income, and overall household spending. What will win out over the next year or two: the facts or how people feel about them?

The essence of the moment is that the Fed is attempting to address the key element of the discontent – inflation – by slowing the growth of the economy. In the process it will diminish the luster of the monthly economic data and the health of the household sector – at least as measured by the numbers.

The litmus test of a soft landing engineered by the Fed is a populace that is more content overall with somewhat softer economic data but inflation that is in the rearview mirror.

Fact of the Day

The health insurance coverage provisions under current law for the non-elderly are estimated to increase federal outlays by $7.06 trillion from 2022–2032.