The Daily Dish

January 3, 2019

Fairly Assessing Year One of the TCJA

Eakinomics: Fairly Assessing Year One of the TCJA

I appreciate a good drive-by distorted analysis as much as the next guy, but Paul Krugman’s latest screed is beyond the pale. It begins:

“The 2017 tax cut has received pretty bad press, and rightly so. Its proponents made big promises about soaring investment and wages, and also assured everyone that it would pay for itself; none of that has happened.”

Let me stipulate at the outset that nobody – not even Paul Krugman – can know what the Tax Cuts and Jobs Act (TCJA) really has accomplished. It is just too soon for a fair and conclusive evaluation, and its impact will be intermixed with good news from regulatory reform and bad news from misguided trade shenanigans and the administration’s ad hominem attacks on the Fed.

But a fair evaluation was never what Mr. Krugman had in mind, it seems. It is impossible to damn the law based on the (very preliminary) data we have, while what evidence we do have is generally positive. Let’s take a look at what the numbers say so far about the TCJA.

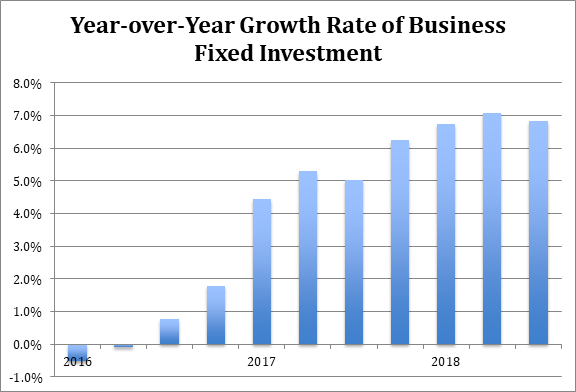

As shown in the chart below, non-residential fixed investment (“business fixed investment”) has grown much more rapidly since the start of 2017, and even faster (nearly 7 percent versus just over 5 percent annually) in the past year. You might want even more rapid investment – I do – but the growth has certainly shifted north.

A similar story prevails for wages. Using Bureau of Labor Statistics (BLS) data for the employment cost index (ECI), the most reliable source of wage data, the picture is:

Wage growth in 2018 has been about 3 percent higher than the same quarter in 2017 and up noticeably since prior to 2016. Again, one could – and should – want even faster growth, but wage growth is moving in the right direction.

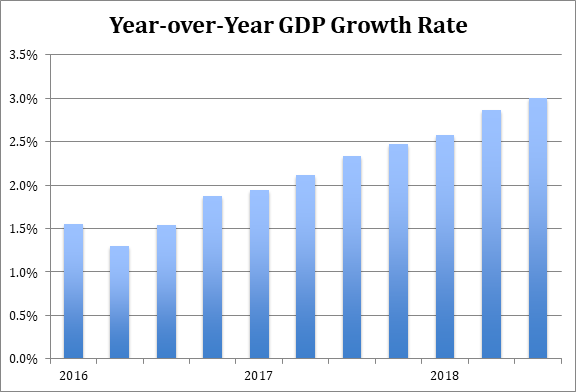

These indicators are specific manifestations of economic growth that has simply accelerated every quarter since the start of 2017, and especially so since the passage of the TCJA.

There are dozens of caveats that would apply to a fair discussion of these data. But as blanket assertions go, they suggest that we are moving toward – rather than away from – stronger investment and wages.

But Krugman doesn’t let facts get in the way of his argument. He writes: “Yet coverage actually hasn’t been negative enough. The story you mostly read runs something like this: The tax cut has caused corporations to bring some money home, but they’ve used it for stock buybacks rather than to raise wages, and the boost to growth has been modest. That doesn’t sound great, but it’s still better than the reality: No money has, in fact, been brought home, and the tax cut has probably reduced national income. Indeed, at least 90 percent of Americans will end up poorer thanks to that cut.”

The fact that the economy is growing more rapidly (and there is so much demand for workers that the unemployment rate is below 4 percent) undercuts the argument of “reduced national income” and “90 percent of Americans will end up poorer.” The arcane argument undergirding these assertions makes sense only in a static economy. The economy is not static, and the assertions make no sense.

Finally, Mr. Krugman adds to the confusion over repatriated funds by getting the argument exactly backward. He asserts that one should ignore the clear evidence (see his chart) that firms altered their behavior in response to the TCJA because “you need to look at the overall balance on financial account.” But the latter reflects the economy as a whole – not just businesses – and policies as a whole – not just the TCJA. You don’t learn anything about the response to the TCJA per se by looking at it. To learn something, you need to focus on the behavior of businesses in repatriating funds and reducing their investments abroad – exactly the strong evidence Krugman dismissed.

The TCJA is not perfect. Its genuine impact on what matters – trend growth of capital, productivity, and wages – is yet to be determined. But while those interested in the actual effect of public policy accumulate and weigh the evidence, one should ignore the occasional unmoored screed.

Fact of the Day

Based on total lifetime costs of the regulations, the Affordable Care Act has imposed costs of $52.9 billion in final state and private-sector burdens and 176.9 million annual paperwork hours.