The Daily Dish

March 13, 2024

February CPI Inflation

Yesterday the Bureau of Labor Statistics released the February report on the Consumer Price Index (CPI). Roughly in line with expectations, year-over-year CPI inflation was 3.2 percent in February, up a tick from 3.1 percent in January. Similarly, core (non-food, non-energy) inflation was 3.8 percent, down from 3.9 percent in January. The stubborn persistence of inflation reflects the ongoing services inflation, with shelter inflation, in particular, remaining high. Shelter inflation was 5.7 percent, the first reading under 6.0 percent since July 2022.

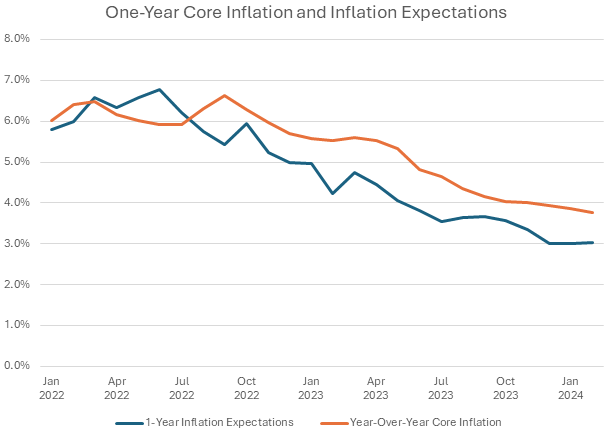

Where does this leave the Federal Reserve and the future stance of policy? First, it is important to recognize the enormous progress. Core CPI inflation peaked at 6.6 percent; it is thus down considerably. (See chart, below.)

Just as important, the public expects this success to continue. Also shown in the chart are inflation expectations over the next year from the New York Fed. Inflation expectations have fallen dramatically from a high near 7.0 percent, although they appear to have stalled somewhat around 3 percent. The importance of inflation expectations was highlighted by Chairman Jerome Powell in his August 2022 speech at the Jackson Hole conference. Recalling the last great inflation 40 years ago, he noted:

“The second lesson is that the public’s expectations about future inflation can play an important role in setting the path of inflation over time.” “If the public expects that inflation will remain low and stable over time, then, absent major shocks, it likely will. Unfortunately, the same is true of expectations of high and volatile inflation. During the 1970s, as inflation climbed, the anticipation of high inflation became entrenched in the economic decisionmaking of households and businesses. The more inflation rose, the more people came to expect it to remain high, and they built that belief into wage and pricing decisions. As former Chairman Paul Volcker put it at the height of the Great Inflation in 1979, ‘Inflation feeds in part on itself, so part of the job of returning to a more stable and more productive economy must be to break the grip of inflationary expectations.’”

Viewed from this perspective, the success in controlling inflation expectations is an integral part of the to-date success of the Fed in returning to its 2 percent target.

Having acknowledged that, the job is far from done. The most recent report reinforces the lesson that inflation remains stubbornly above 2 percent and that it may remain so even if the Fed continues its restrictive stance. As long as the data indicate persistent inflation, expect policy to remain unchanged. As Powell said in the same speech:

“That brings me to the third lesson, which is that we must keep at it until the job is done. History shows that the employment costs of bringing down inflation are likely to increase with delay, as high inflation becomes more entrenched in wage and price setting. The successful Volcker disinflation in the early 1980s followed multiple failed attempts to lower inflation over the previous 15 years. A lengthy period of very restrictive monetary policy was ultimately needed to stem the high inflation and start the process of getting inflation down to the low and stable levels that were the norm until the spring of last year. Our aim is to avoid that outcome by acting with resolve now.”

Repeatedly, over the past 18 months, market participants have misjudged the willingness of the Fed to tighten further or keep policy in its restrictive state. The Fed started out intending to act “with resolve” and will continue to do so until the data provide confidence that inflation will reach and remain at the 2 percent target.

Fact of the Day

Over 10 years, the President’s Budget for FY2025 proposes an average level of taxation of 19.7 percent, higher than any 10-year period in the history of the modern U.S. tax system.