The Daily Dish

October 5, 2022

Fed Speak

This is a big week for Federal Reserve officials to convey the Fed’s message to the American public. It began Monday with a speech by New York Fed President John Williams. Tuesday had Cleveland Fed President Loretta Mester, the first speech of Federal Reserve Governor Philip Jefferson, and San Francisco Fed President Mary Daly. More on Jefferson in a moment, but he is not the end of the blitz.

Today brings Atlanta Fed President Raphael Bostic, Thursday Fed Governor Lisa Cook’s first speech as governor, and Cleveland Fed President Loretta Mester (again). Finally, Friday closes with John Williams (again), Minneapolis Fed President Neel Kashkari, and Fed Governor Christopher Waller.

Jefferson highlighted the crucial role of inflation expectations: “‘While oil and gasoline prices have come down in recent months, I am concerned that fluctuations in prices of the goods to which people pay the most attention, like food and housing, will affect expectations of future inflation,’ said Mr. Jefferson in remarks prepared for delivery at a Fed conference in Atlanta.”

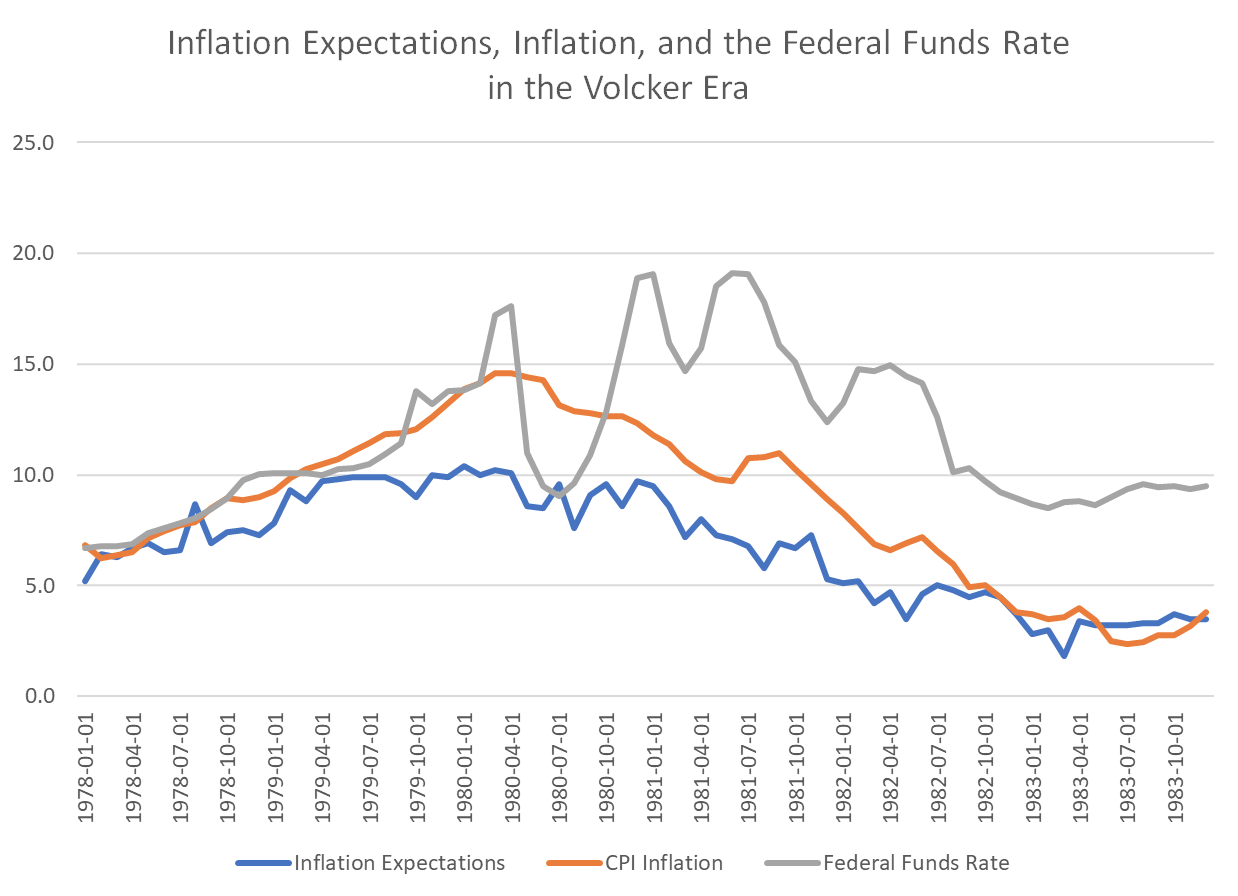

The Fed is leaning on the lessons of history. In particular, during the Great Inflation of the 1970s and 1980s, inflation expectations (see: blue line in the graph below, as measured in the Michigan Survey of Consumer Sentiment) rose steadily from 5.2 percent in January 1978 (when the data begin) to 10.4 percent in January 1980.

Inflation (orange line, measured as year-over-year consumer price index inflation) rose too. This self-fulfilling prophecy is a troubling threat to the Fed. If people expect inflation, they bargain for higher wages, sign supply contracts with higher purchase prices, and guarantee a large rise in the cost of doing business that has to be passed along as higher consumer price inflation.

Only when expectations declined did inflation begin to moderate, with both ultimately coming to rest in the 3–4 percent range.

The second lesson is that it will take a sustained effort to control inflation. As Williams put it: “Tighter monetary policy has begun to cool demand and reduce inflationary pressures, but our job is not yet done.” This is consistent with the notion that the Fed must “keep at it,” as Chairman Powell articulated in recent appearances.

The price of quitting too soon can be seen in the chart as well. On two occasions – mid-1980 and early 1981 – the Fed cut the federal funds rate (gray line) only to see inflation bounce back a few months later. The Fed is sending the message that it is committed to keeping rates at a restrictive level until inflation clearly moderates.

It is not surprising that when there is bad economic news there are calls for the Fed to reverse course on rate hikes. The Fed is sending the message that it has no intention of doing so.

Fact of the Day

While today the total market value of all cryptocurrency is roughly $1 trillion, this figure was over $3 trillion in November 2021.