The Daily Dish

July 3, 2023

Friday’s Inflation Report

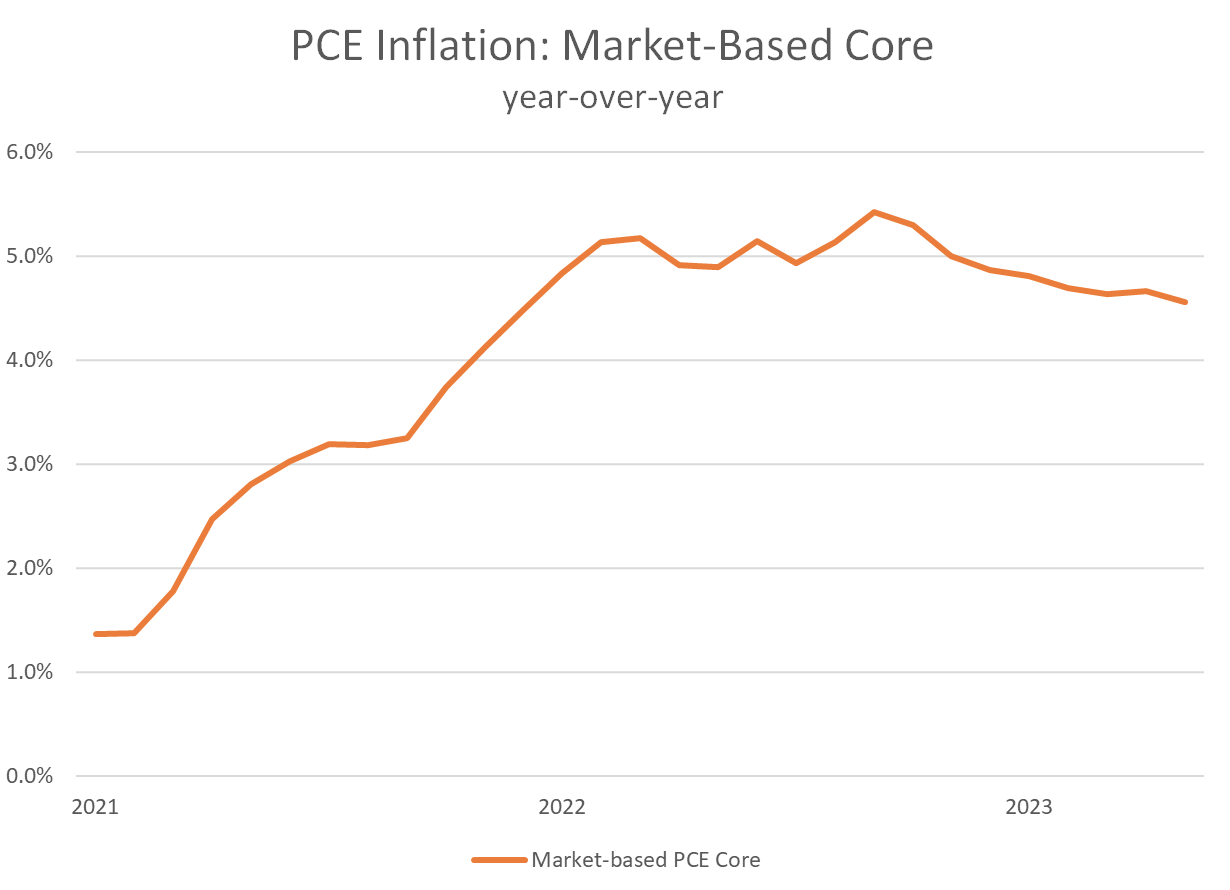

This past Friday the Bureau of Economic Analysis (BEA) released the May data for Personal Income and Outlays. The data are a monthly check-in on the growth of income and spending in the economy, but are of particular interest at present because they contain the Federal Reserve’s preferred measure of inflation: the market-based index for personal consumption expenditures excluding food and energy. That’s a mouthful; most people refer to it as the “market-based core PCE.”

By focusing solely on actual transactions in the economy (“market-based”) and excluding the volatile food and energy components (“core”), the index displays the underlying trend rate of inflation in the economy. It is shown below.

The chart shows some progress in getting inflation back to the 2.0 percent target. It has fallen from a high of 5.4 percent in September 2022 to 4.5 percent in May. That is progress, but inflation remains more than double the target rate and at the current pace of progress it will take until early 2025 to reach the Fed’s target. For those eager to declare victory against inflation, it is a daunting picture.

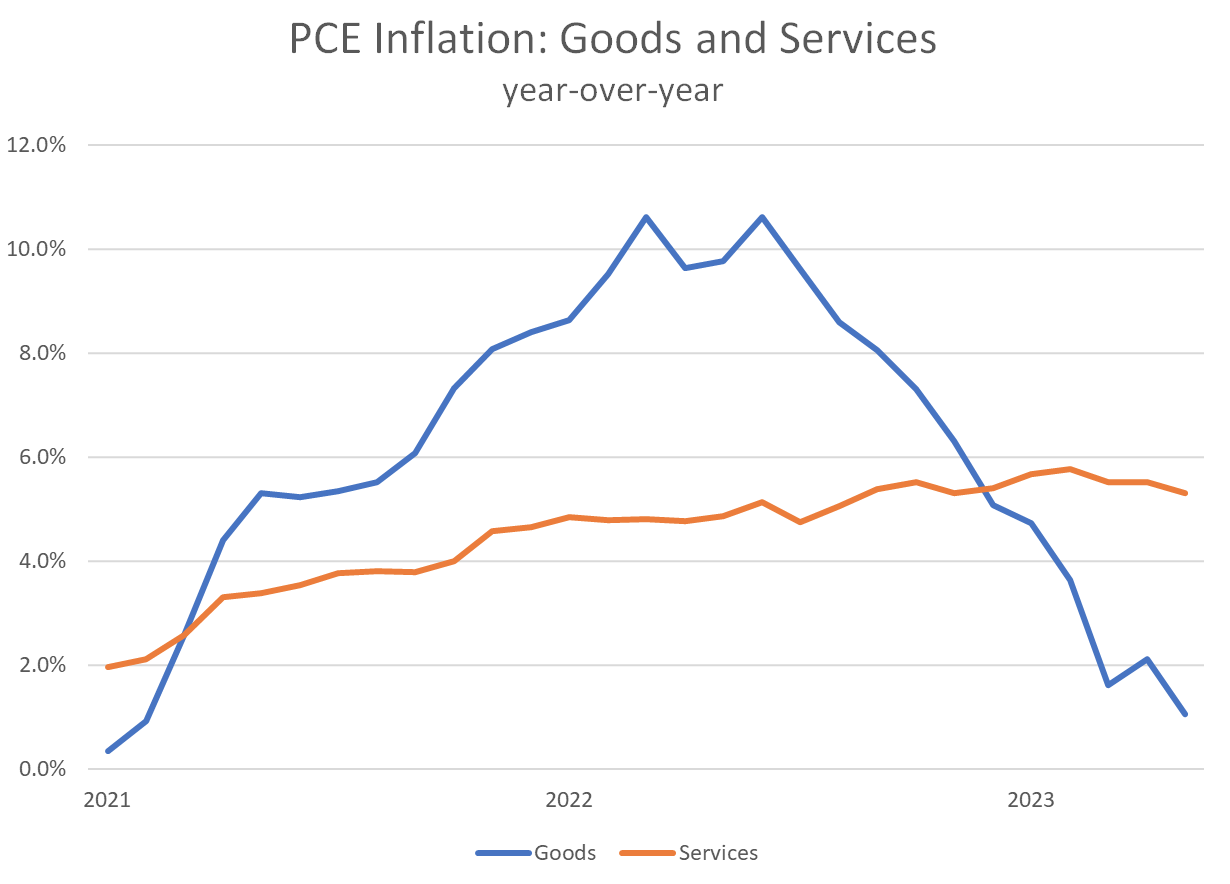

Nevertheless, the top-line distracts from two areas of real success. First, the Fed has successfully tamed inflation in the prices of goods. As shown in the next chart, goods-price inflation peaked at 10.6 percent but has fallen below the 2.0 percent target. The remaining inflation is in the price of services. Services inflation remains elevated and is much more dependent upon domestic (as opposed to international) considerations, especially tightness in the labor market and inflation expectations.

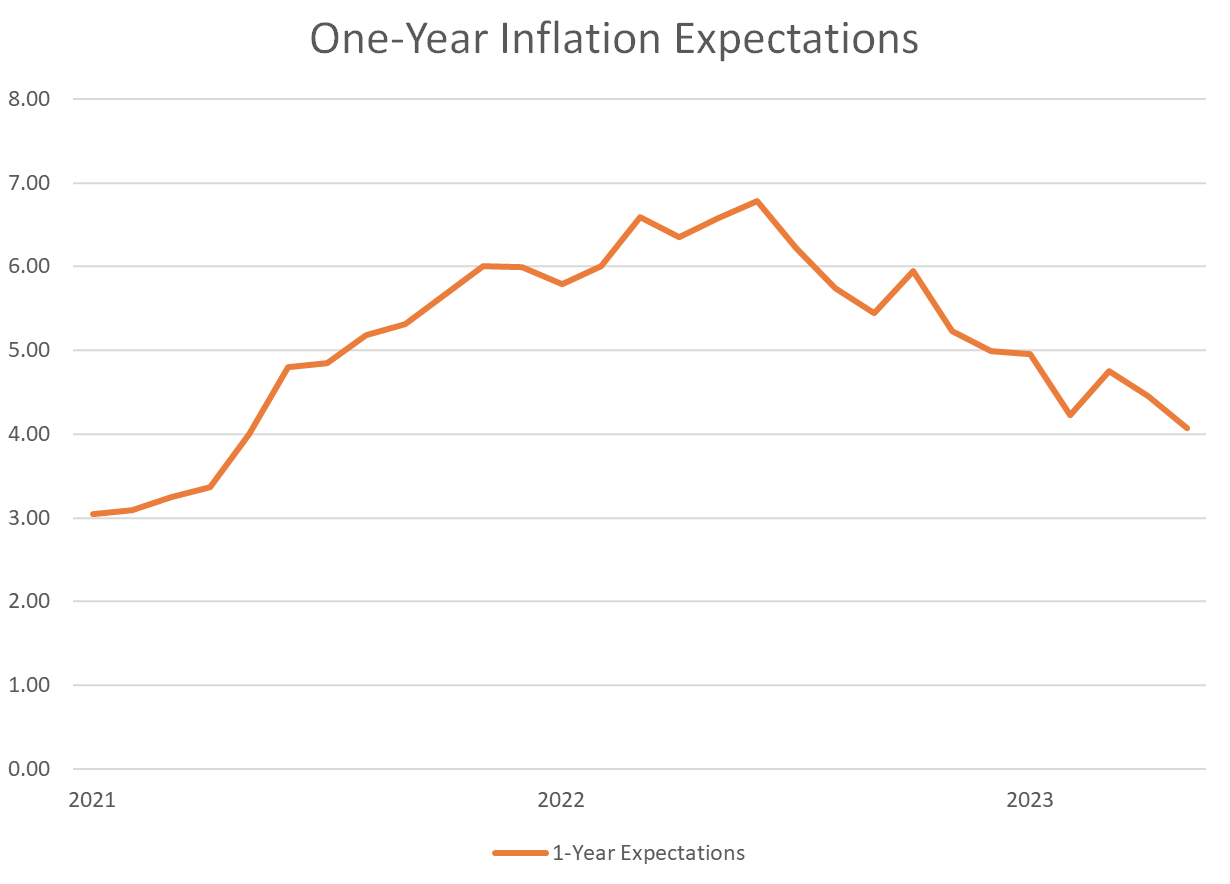

The next reading on the labor market will arrive Friday with the Bureau of Labor Statistics’ employment report for June. A useful guide on inflation expectations comes from the New York Federal Reserve Bank. The one-year inflation expectations are graphed below.

The median expected inflation at the start of 2021 was 3 percent. By June 2022 it had reached 6.8 percent. Since then, the Fed’s efforts have pushed expected inflation back to the 4.0 percent level. That is still twice as high as the target, but continued progress makes the Fed’s job progressively easier.

Friday’s release continues a trend of reports on the economy that show steady, if slow, progress against inflation. Most important, any progress is not dramatic enough to dissuade the Fed from its intention to hike rates again in July.

Fact of the Day

According to the Congressional Budget Office, debt held by the public will reach 181 percent of gross domestic product in 2053.