The Daily Dish

March 28, 2023

Have Recession Risks Risen?

There is a confused and confusing discussion occurring over whether the recent bank-sector turbulence is a harbinger of recession. It needn’t be so daunting.

Going into the SSS (Silvergate, Silicon Valley Bank, Signature Bank) episode, observers expected some probability of a downturn over the next 9 to 12 months. With the onset of bank volatility, it is frequently observed that for any given level of interest rates, banks will be more cautious in their lending decisions, effectively restricting credit. It is this observation that leads some to conclude that recession risks have risen in the aftermath of SSS.

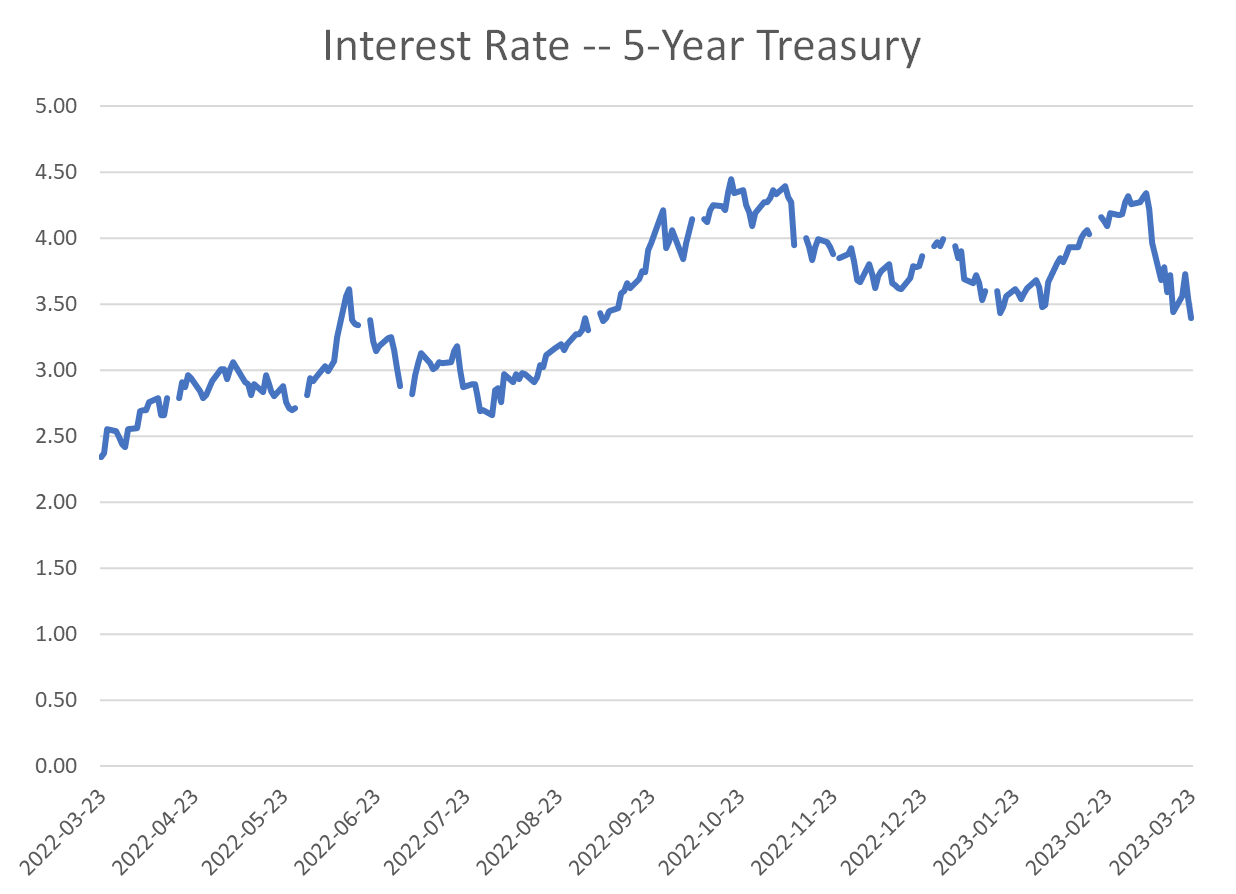

Notice, however, that simultaneously market interest rates have declined for any given level of the federal funds rate (the Fed’s policy rate). This can be seen in the graph below (drawn for 5-year Treasuries; the same picture holds for other maturities). Interest rates are back to levels not seen since January (briefly) or September 2022.

This moves recession risks in the other direction because borrowers are facing lower credit costs and may be willing to debt-finance more purchases. This is precisely opposite to the Fed’s intention to slow the growth of demand in the economy.

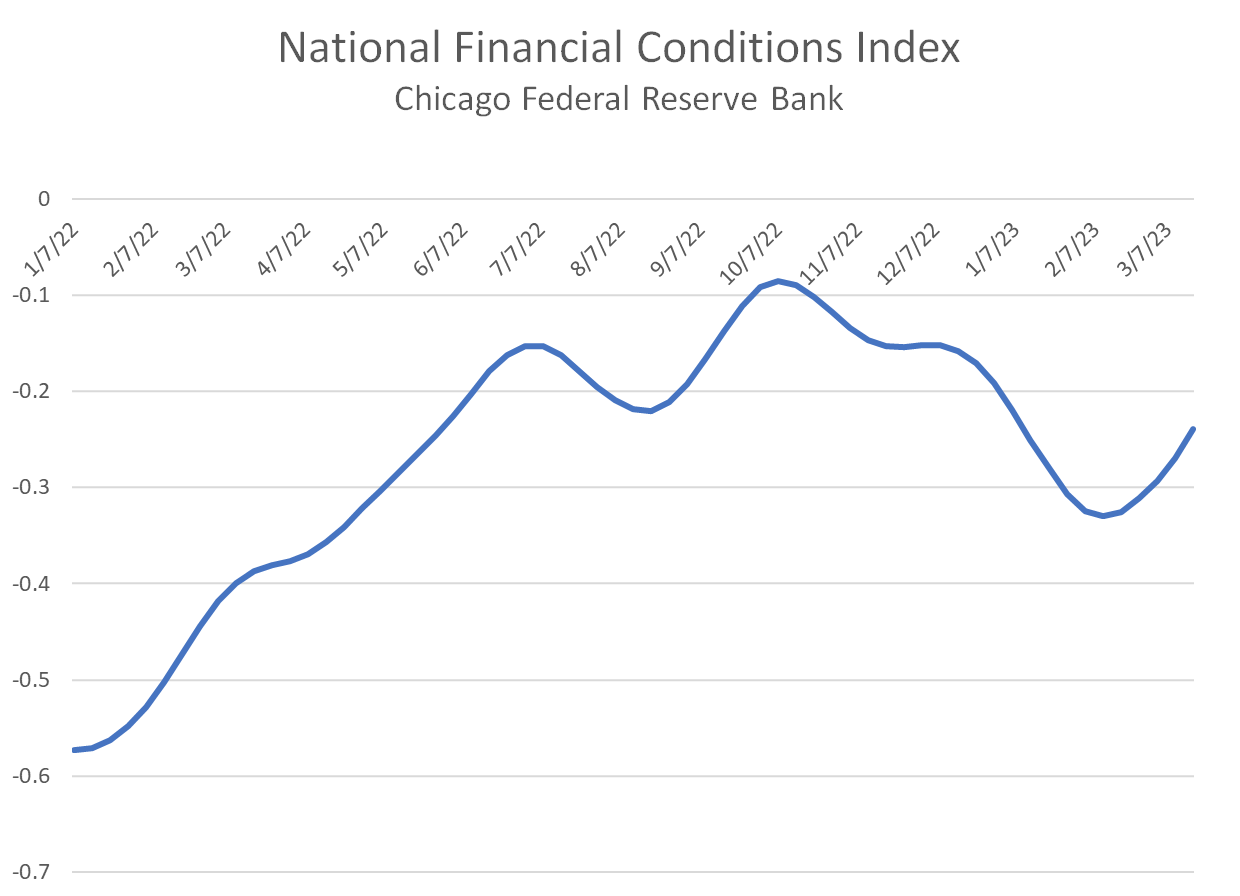

What’s the bottom line? One way to decide is to use a “financial conditions index” – a composite created using a wide variety of financial data. The National Financial Conditions Index (NFCI) shown below is created by the Chicago Fed. It has two key features at the moment.

First, all the values since the start of 2022 are below zero. That means financial conditions are relatively loose historically. These loose financial conditions are precisely the breeding ground for the SSS episode. Second, in recent weeks the NFCI has moved north, indicating that on balance financial conditions have tightened somewhat. But the tightening is considerably smaller than that engineered by the Fed over its 2022 tightening cycle.

Observers will reach different conclusions based on these data. But to my eye, recession risks look very much the same as they did before the SSS meltdown.

Fact of the Day

Across all rulemakings this past week, agencies published $142.2 million in total costs and added 647,365 annual paperwork burden hours.