The Daily Dish

November 10, 2022

Inflation Day

Welcome to Thursday, Inflation Day! At 8:30 this morning the Bureau of Labor Statistics will release its report on the Consumer Price Index (CPI) for October. With the midterm election now in the rearview mirror (sorta), the discussion can turn from the electoral implications of CPI inflation to measuring the progress of the Federal Reserve in its efforts to return inflation to the 2 percent target.

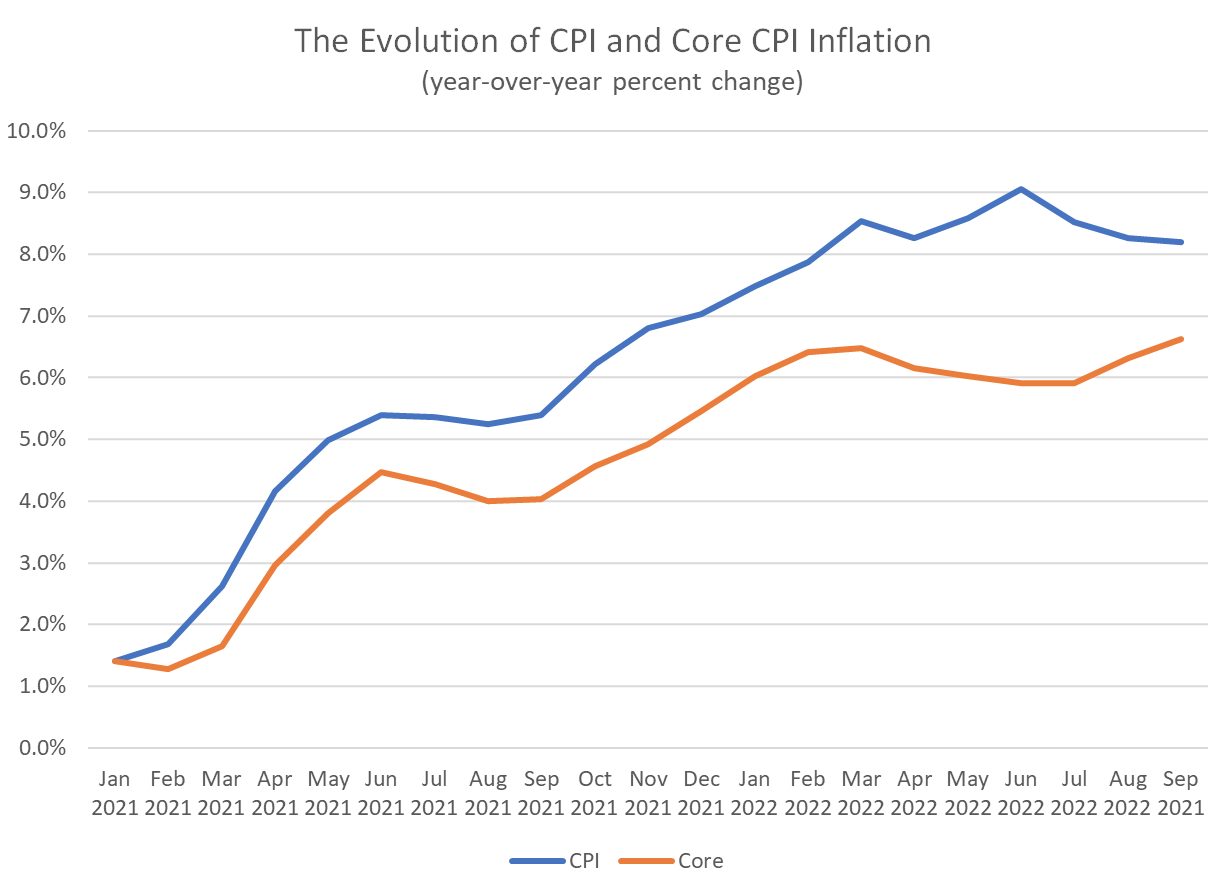

The track record since January 2021 is shown below. The bad news is the overall evolution from sub-2.0 percent to over 8.0 percent inflation. The good news is the recent moderation in top-line CPI inflation. But the cautionary information is the recent uptick in core CPI inflation.

A good report today would yield a move down in the top-line to below 8.0 percent, measured from October 2021, especially if this were accompanied by a reversal in the recent course of core inflation. In any event, it will be many months before the Fed can be expected to announce any significant victory in this campaign.

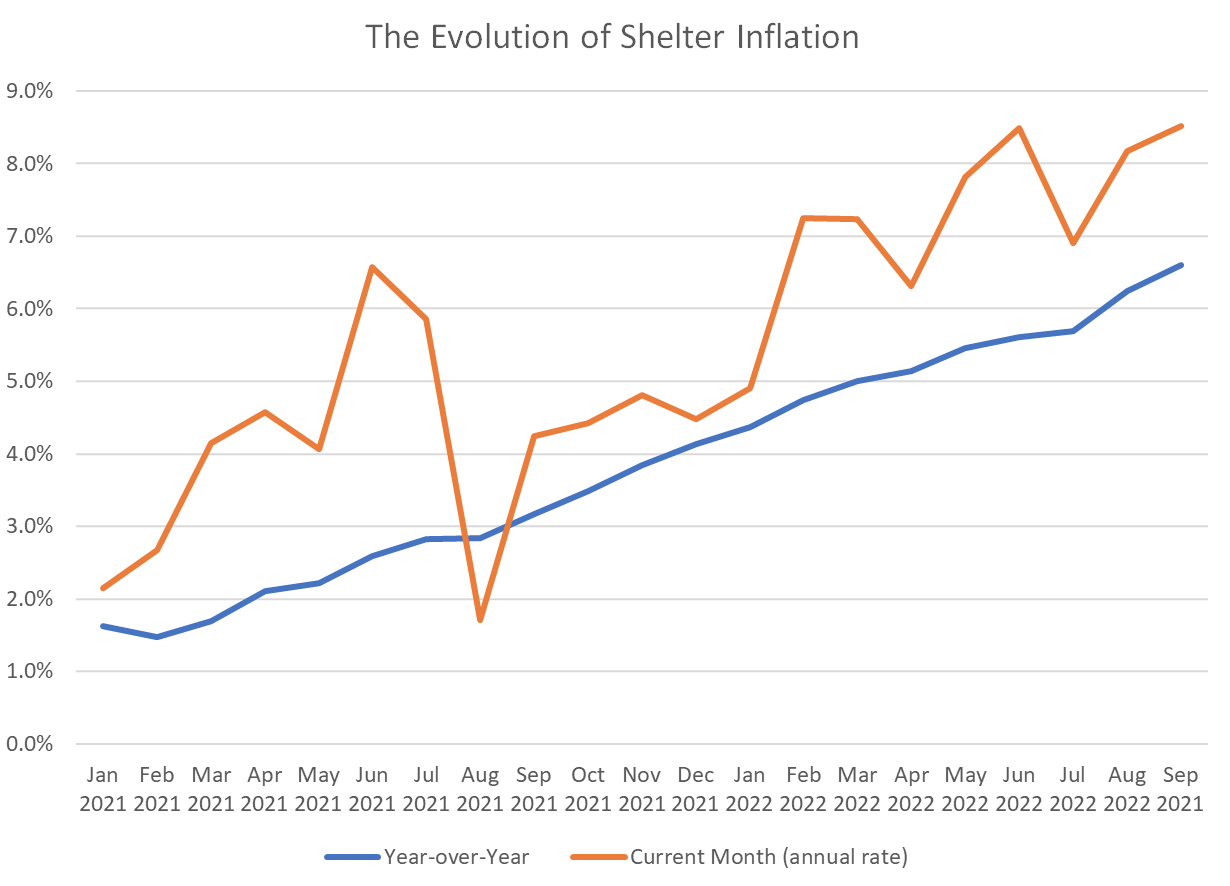

An important subplot in the inflation data is the outlook for shelter inflation. As Eakinomics has stressed, shelter constitutes one-third of the CPI (i.e., is about a third of the average family’s budget), is not beset by supply chain issues (and is thus a good barometer of progress in restraining demand growth), and has yet to show any sign of peaking. Year-over-year inflation now stands at 6.6 percent (see below).

The most important near-term benchmark will be for shelter inflation to peak and start heading south. Will this be the month?

Fact of the Day

Since January 1, the federal government has published rules that imposed $233.8 billion in total net costs and 140.7 million hours of net annual paperwork burden increases.