The Daily Dish

June 15, 2023

Inflation – Looking Forward

The June meeting of the Federal Open Market Committee (FOMC) is now history and, as expected, the FOMC chose not to raise the federal funds target rate. Is this a “skip” with rate increases resuming at the July meeting? Is it a “pause” with an extended period of unchanging rates before additional firming or easing is put in place? Opinions differ widely, even among Fed officials.

In light of this, it is useful to highlight a recent analysis by Ben Bernanke and Olivier Blanchard of the sources of inflation. Bernanke, of course, is the former chairman of the Fed who is now at the Brookings Institution, while Blanchard is the former chief economist at the International Monetary Fund who currently resides at the Peterson Institute for International Economics. Their analysis is grounded in data analysis that attributes the rise in inflation to a variety of contributing factors. It is worth a read.

But what is most interesting from the perspective of what’s next is this conclusion: “[A]lthough tight labor markets have thus far not been the primary driver of inflation, the effects of overheated labor markets on nominal wage growth and inflation are more persistent than the effects of product-market shocks. Controlling inflation will thus ultimately require achieving a better balance between labor demand and labor supply.”

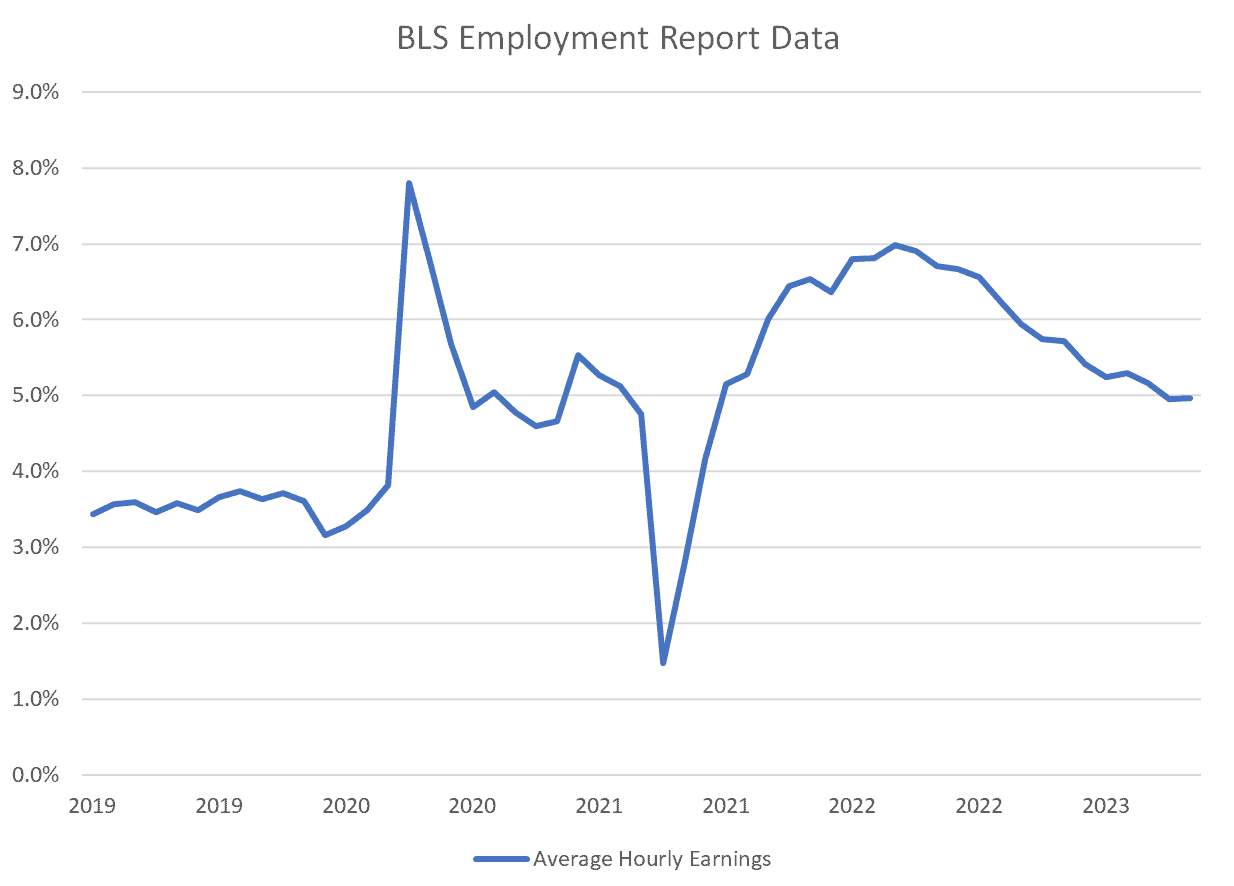

Labor markets do remain overheated. A bit of evidence on this front can be gleaned from the various surveys conducted by the Bureau of Labor Statistics (BLS). Each month, the employment report measures average hourly earnings by production and non-supervisory workers. As shown in the graph below, this trended along in the mid-3 percent range prior to the pandemic, grew to as much as 7 percent (year over year) during the recovery, and remains in the region of 5 percent. Especially in light of the recent poor productivity performance, this shows an excess of demand over supply.

It is comforting that the same story emerges from another source – the quarterly survey of employee costs. This survey delivers a measure of total compensation, as well as one focused on wage and salary pay. These are graphed below. Again, prior to the pandemic, these grew at a year-over-year rate of roughly 3 percent but are currently in the vicinity of 5 percent.

Over the first half of 2023, Eakinomics has repeatedly awaited a BLS employment report signaling a sharp cooling of the labor market. Instead, each report shows continued strength, albeit with some modest evidence of cooling. Similarly, each month the data on the Consumer Price Index (or Personal Consumption Expenditures Price Index) shows only the most modest progress on core inflation.

The Bernanke-Blanchard analysis suggests that these are the same phenomenon and that only when the labor market finally cools will the stubborn inflation return to the Fed’s 2 percent target.

Fact of the Day

The EPA estimates its rule regarding the federal "Good Neighbor Plan" updating the 2015 Ozone National Ambient Air Quality Standards will impose $9.4 billion in present value costs.