The Daily Dish

January 15, 2026

Inflation Revisited

The inflation data for December were released Tuesday by the Bureau of Labor Statistics (BLS). Top-line consumer price index (CPI) inflation came in at 2.7 percent (year-over-year), while core CPI inflation was 2.6 percent. Both were unchanged from the previous month, and both are at roughly the same level as the end of 2024. In the end, little progress was made in lowering inflation in 2025.

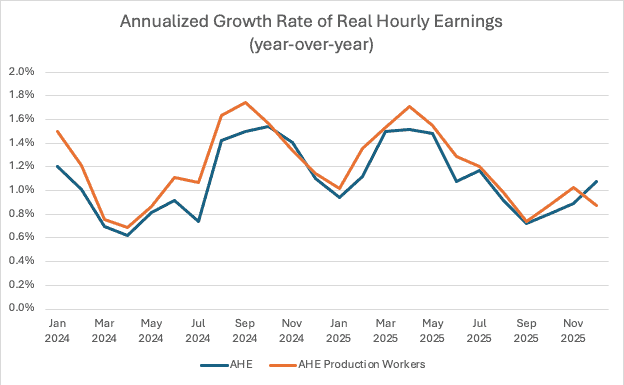

But why would one care? Inflation, per se, is not important. Inflation lowering the purchasing power of one’s wages? That is a big deal. The graph below revisits the recent growth of real (inflation-adjusted) average hourly earnings (AHE) overall (blue line) and for production and non-supervisory workers (orange line). These data are shown as year-over-year growth and are taken from the monthly BLS employment report.

There is good news – these data are uniformly above zero. But there is bad news as well. In particular, there has been a sharp falloff in the growth of real AHE since early 2025. This roughly mirrors the rise in concern about “affordability” in public polling. The lesson is that affordability is not about health insurance premiums, or housing prices, or credit card interest. It is not about any specific price, but rather about the fact that prices overall are rising too fast when compared to wages.

Thus, it would make sense to drop the plethora of small-bore populist initiatives targeting specific prices. Instead, the administration should focus on getting the labor market back to life. Of course, the decline started with the announcement of the tariffs in April. The obvious solution is a U-turn on tariffs, which is not going to happen. But the administration needs to develop an alternative, and quickly.

Fact of the Day

Given the projected growth in the data center industry, energy demand in Virginia is estimated to increase by 183 percent between 2023–2040.