The Daily Dish

March 15, 2023

Inflation, the Fed, and the Banks

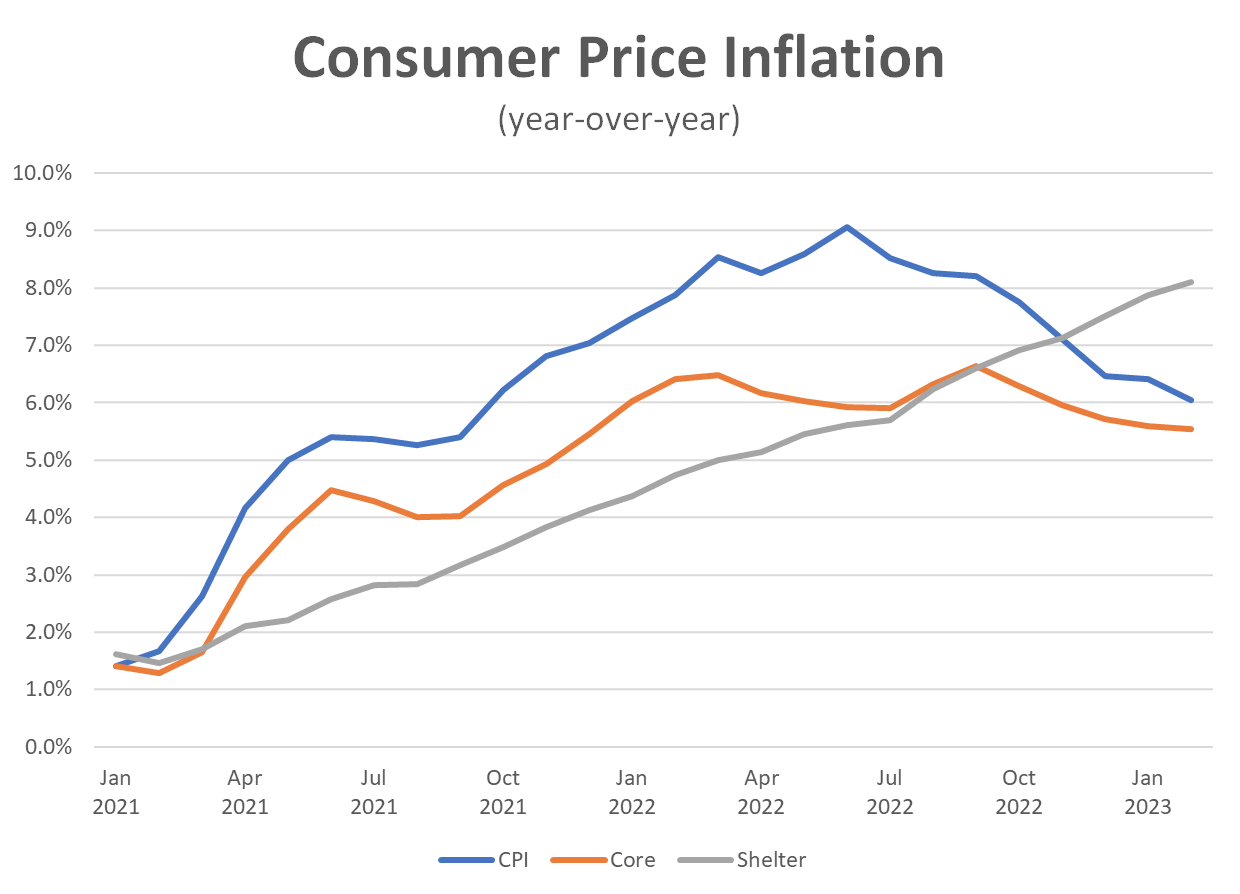

The Bureau of Labor Statistics delivered the February report on the Consumer Price Index (CPI) yesterday. As the old saying goes, a picture (below) is worth 38 pages of inflation data. As shown in the graph, CPI inflation – measured from the same month one year earlier – edged down from 6.4 percent to 6.0 percent. This was strongly influenced by a decline in the energy component at an annualized rate of 6.8 percent. For this reason, the core CPI measure barely moved – 5.5 percent in February compared to 5.6 percent the month before.

But the big story remains shelter inflation (gray line). Once again, it defied interest-rate gravity, rising to an 8.1 percent rate compared to 7.9 percent in January and now up every month for two straight years. Shelter is one-third of the CPI, so it is not possible to hit a 2 percent inflation target with 8.1 percent shelter inflation unless all other prices are falling at a year-over-year rate of 1.1 percent.

Markets reacted by rallying, a puzzling movie we have seen before. For reasons that evade Eakinomics, some believe this report is a precursor to the Fed halting interest rate hikes or even cutting rates. NGH (Not Gonna Happen). Recall that Fed Chair Jerome Powell emphasized that the mistake the Volcker Fed made in fighting the inflation of the late 1970s and early 1980s was easing prematurely. This CPI report matches others (especially the personal consumption expenditure price index) that show only modest progress on inflation over the past year. There is nothing that says either “stop” or “reverse.”

Some point to the problems at Silicon Valley Bank and Signature Bank as a factor that may swing the Fed from rate increases to a pause. Eakinomics disagrees. The deposit guarantee and loan facility are new tools that the Fed will use to manage any residual banking sector problems. Interest rates will continue to rise until the disinflation is achieved.

Fact of the Day

The PRO Act could put up to $2.3 trillion of gross domestic product at risk.