The Daily Dish

July 13, 2021

Inflation Update

Eakinomics: Inflation Update

Today at 8:30 the Bureau of Labor Statistics will release the Consumer Price Index (CPI) report for June. All eyes will be on the report, especially given the rising political impact of inflation, the report by The Wall Street Journal that professional forecasters are anticipating inflation above the 2 percent target through the midterm elections and into 2023, and the fact that Fed Chair Jerome Powell will be testifying before Congress twice this week.

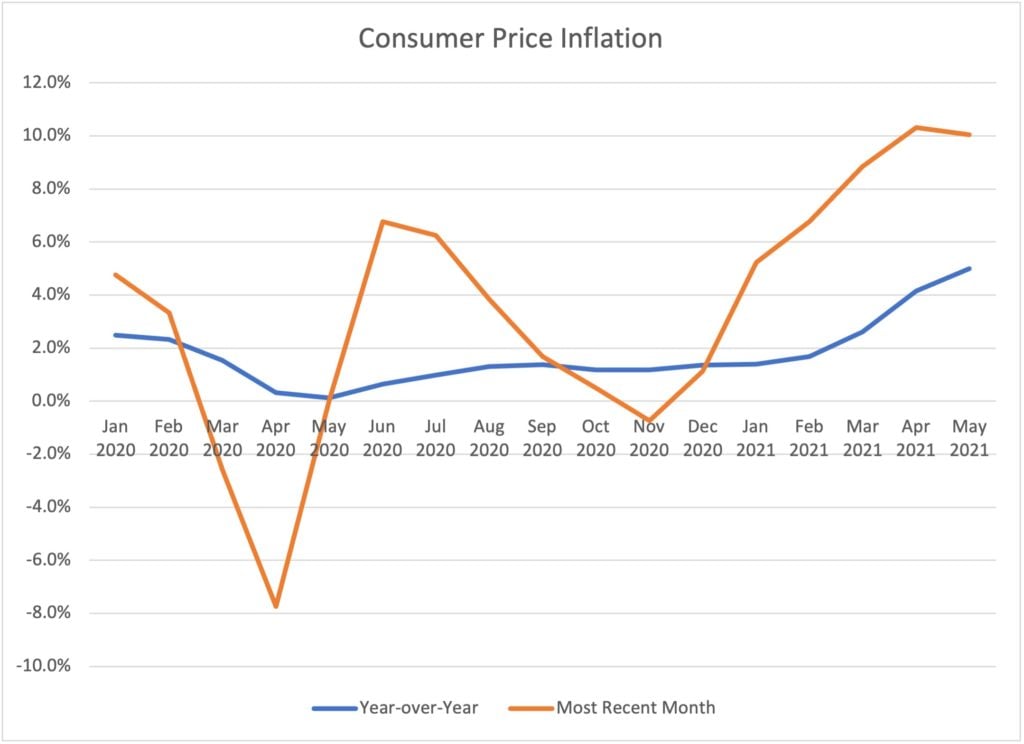

Let’s review the state of play. Shown below is CPI inflation since January 2020, measured in two ways. The first is year over year (blue line), which has the advantage of smoothing out monthly volatility but the disadvantage of comparing, for example, April 2021 with the unnatural conditions of April 2020. The second (orange line) is the most recent month at an annualized rate. The basic story is simple: Inflation is back as CPI inflation has been above the 2 percent target every month of 2021, and substantially so. As a result, the year-over-year measure has steadily drifted north to exceed 4 percent.

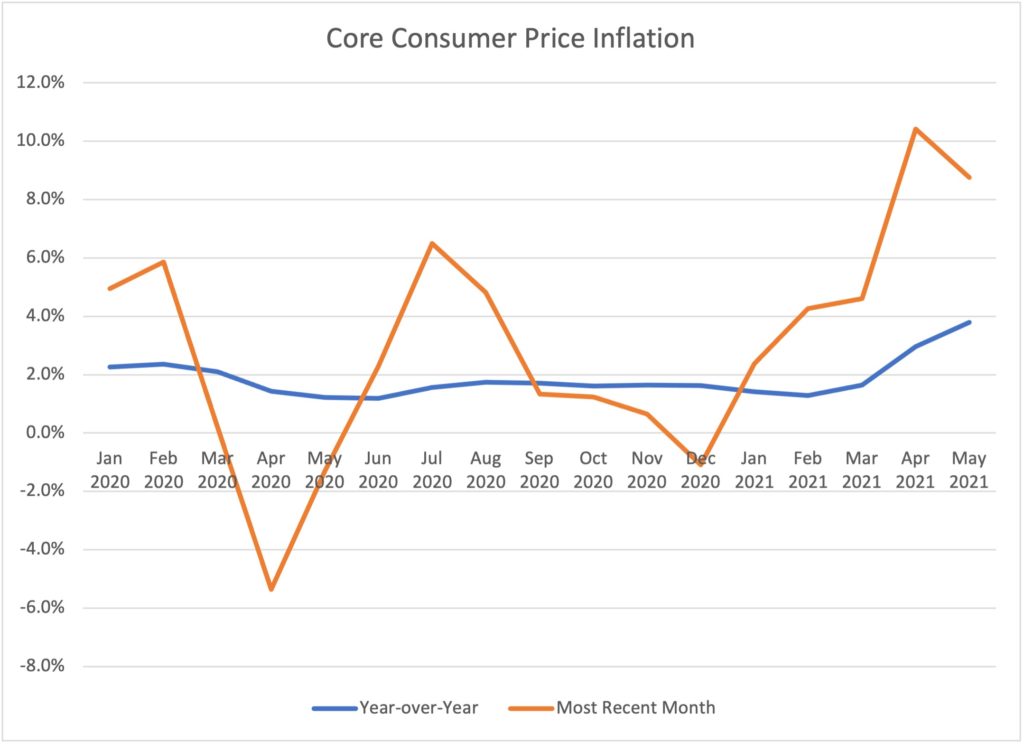

The CPI includes the notoriously volatile food and energy components; it is common to look at the “core” CPI (non-energy, non-food) to get a feel for inflation trends. At this point in time (see below), it does not change the basic story at all. Monthly core inflation has jumped above 2 percent every month in 2021 and pulled the year-over-year measure up to the vicinity of 4 percent.

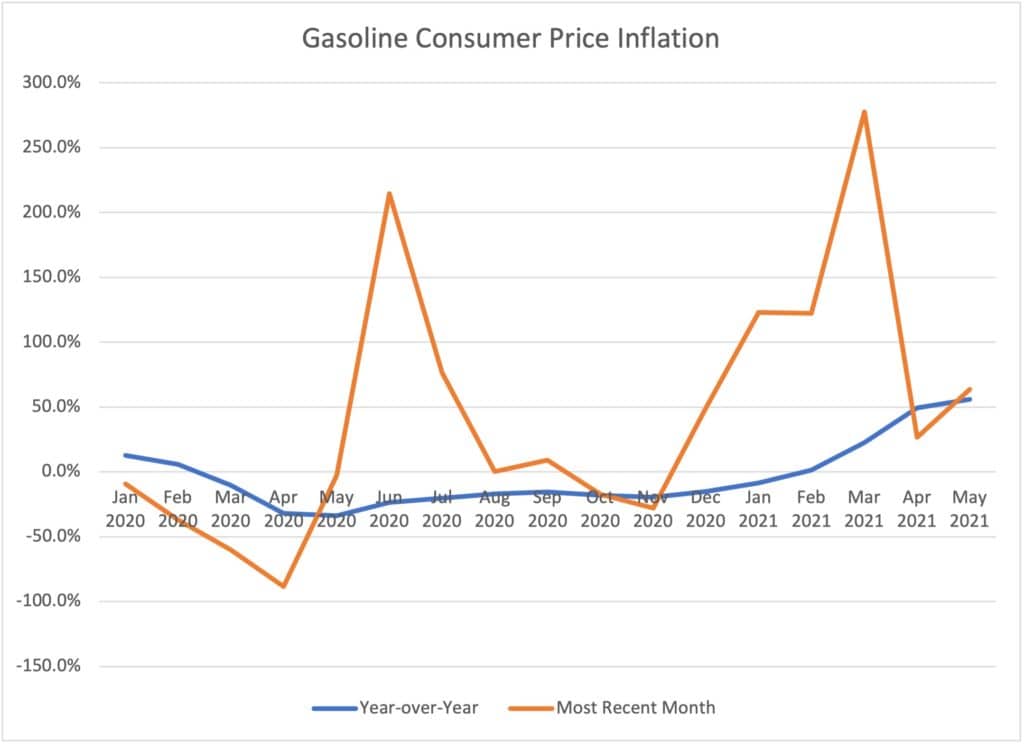

Their weakness as an indicator of inflation trends does not change the fact that gasoline prices are politically very salient. So, if you want some excitement, check out recent gasoline inflation (below). Recall that in April 2020, world oil prices actually went negative briefly, driving gasoline inflation into negative territory. Gasoline prices recovered until COVID-19 cases rose during the fall and winter, depressing global energy markets again. More recently, the monthly changes in gasoline prices have been spectacular and generated a lot of attention.

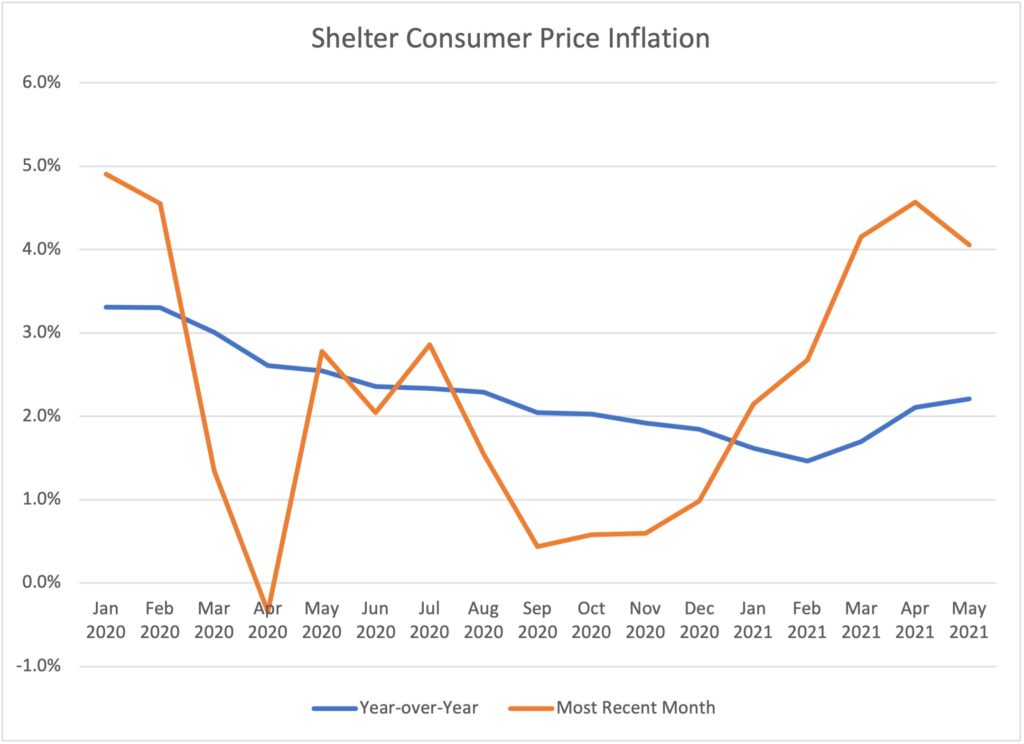

One expects that gasoline prices will stabilize somewhat. But a more troubling pattern is found in the shelter component of the CPI. Shelter is roughly one-third of the average monthly budget, so its price matters a lot. The shelter component is essentially the rent for rental units and the amount that homeowner would pay to rent her home for a month. Shelter inflation is shown below.

Inflation of shelter prices slowed during the pandemic but have reversed course in 2021. Shelter inflation is now over 4 percent and exceeds 2 percent on a year-over-year basis. Unlike food and energy prices, shelter prices do not typically reverse course quickly or rapidly, adding credence to the notion that inflation momentum is sufficient to exceed the 2 percent target for more than a year.

Stay tuned for the news at 8:30. Then get ready for a heavy dose of the difficulty of interpreting the data, especially when the analysis has such large political stakes.

Fact of the Day

Across all rulemakings, agencies published roughly $23.3 million in total net costs and added 8.5 million annual paperwork burden hours.