The Daily Dish

July 5, 2023

Is the Labor Market Cooling?

Friday the Bureau of Labor Statistics (BLS) will release the employment report for June. It will be closely scrutinized for evidence that the labor market is cooling in response to the Fed’s anti-inflation tightening of financial conditions. This raises the question: What has been the impact thus far?

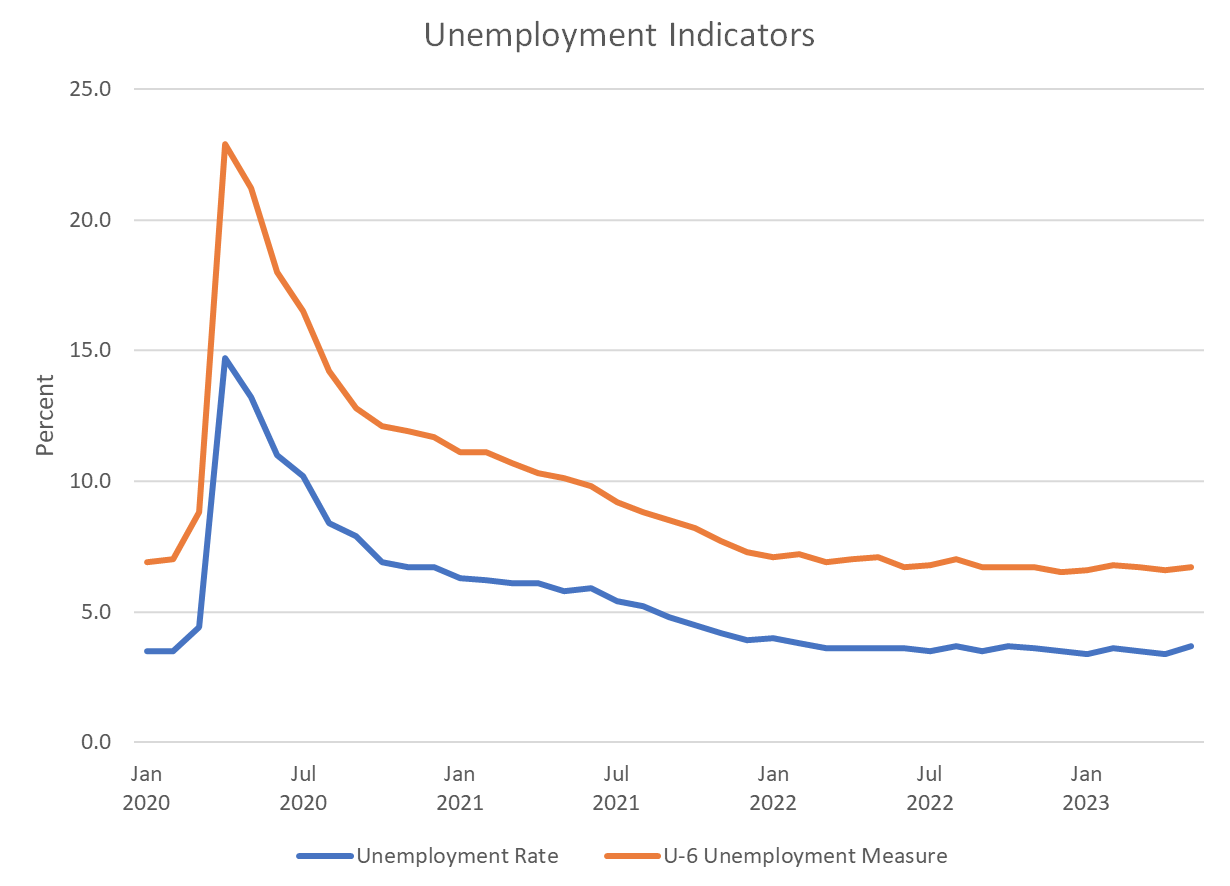

The most basic indicator of labor market slack is the unemployment rate. The graph below shows the conventional measure of unemployment (blue line) along with the broader U-6 measure of underemployment of the labor force. As is well known, both have dropped sharply from their pandemic peaks and plateaued at historic lows. But there is no real indication of any significant movement upward.

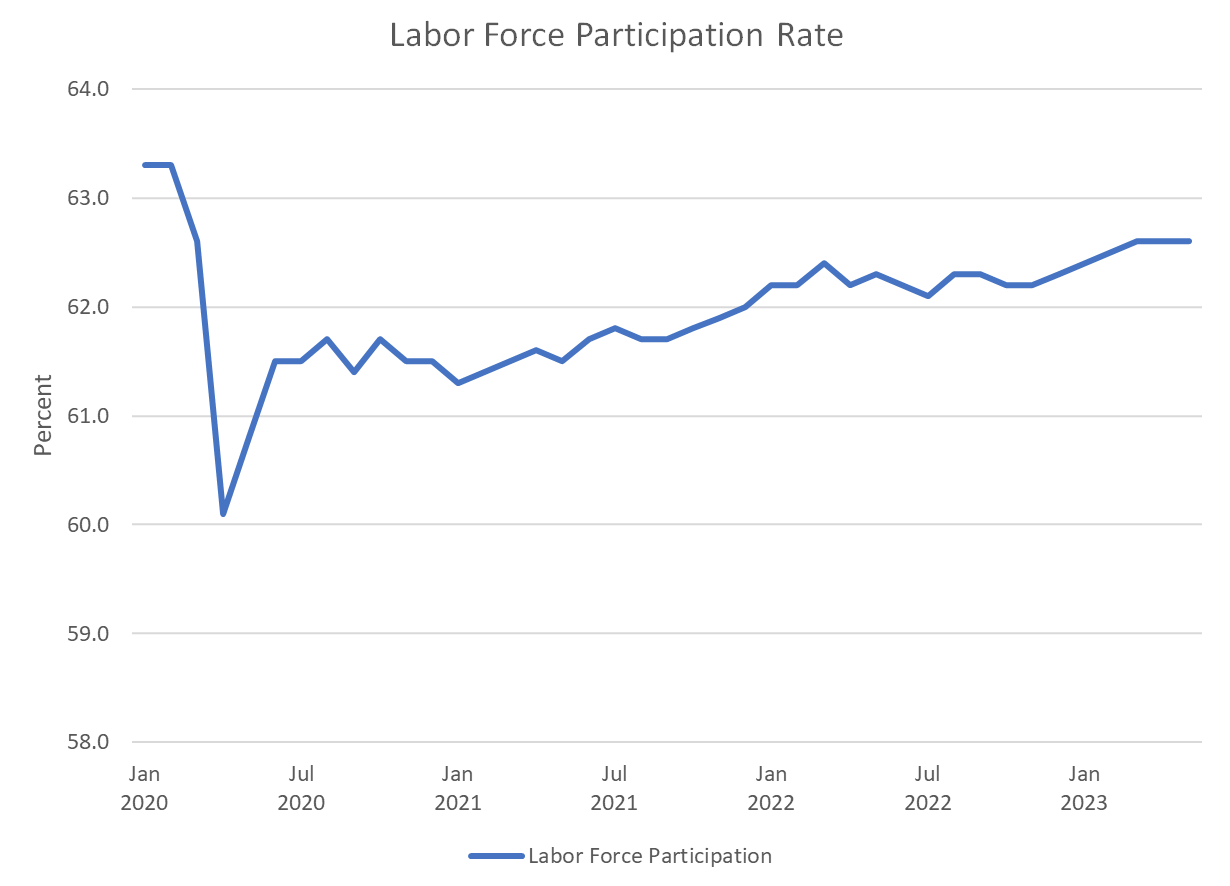

Slack could also be produced by an influx of potential workers into the labor force. Again, it is well recognized that labor force participation dropped sharply during the pandemic. As shown below, labor force participation has recovered significantly, but remains below its pre-pandemic rate.

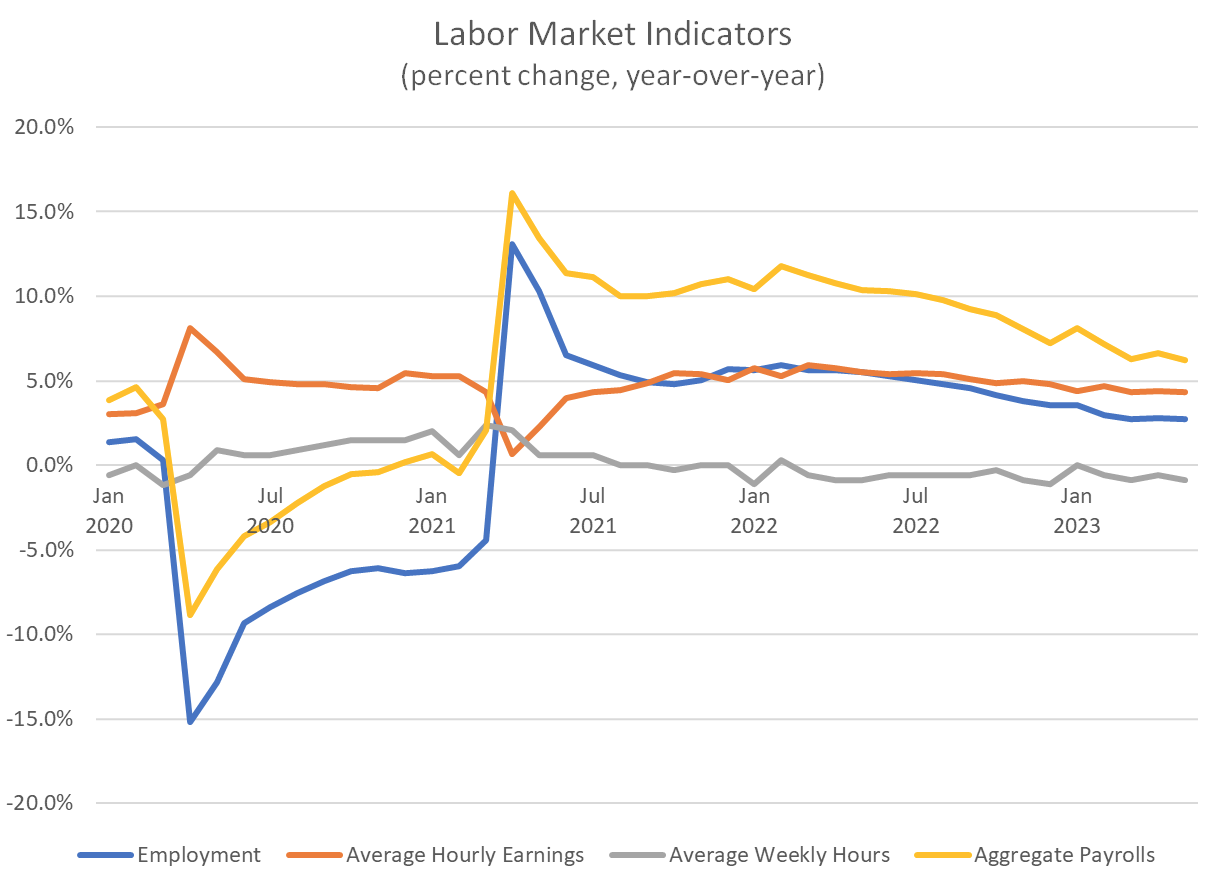

These data suggest that any significant slack in the labor market will have to be produced by reduction in the demand for labor. Eakinomics’ preferred monthly measure of labor demand is the growth payrolls, which combines the impact of the growth in firms’ willingness to employ, willingness to expand hours of work, and willingness to pay per hour.

The (very busy) chart below shows the recent year-over-year growth in payrolls and each component. The yellow line traces the evolution of payroll growth. It climbed sharply as the economy exited the pandemic, exceeding 15 percent in April 2021. In early 2023 it was essentially one-half this level; in May it was down to 6.2 percent. This represents a significant reduction in labor demand, dominated by growth in employment (blue line). By contrast, there has been relatively little significant movement in average weekly hours or average hourly earnings, although both series have declined somewhat over the past year.

In sum, the Fed has noticeably reduced the pace of growth in labor demand but will have to do so even further. The Friday report will be an important indicator of Fed interest rate policy in July and thereafter.

Fact of the Day

Across all rulemakings this past week, agencies published $4.9 billion in total costs and added 3.3 million annual paperwork burden hours.