The Daily Dish

June 14, 2022

Is the World Ending?

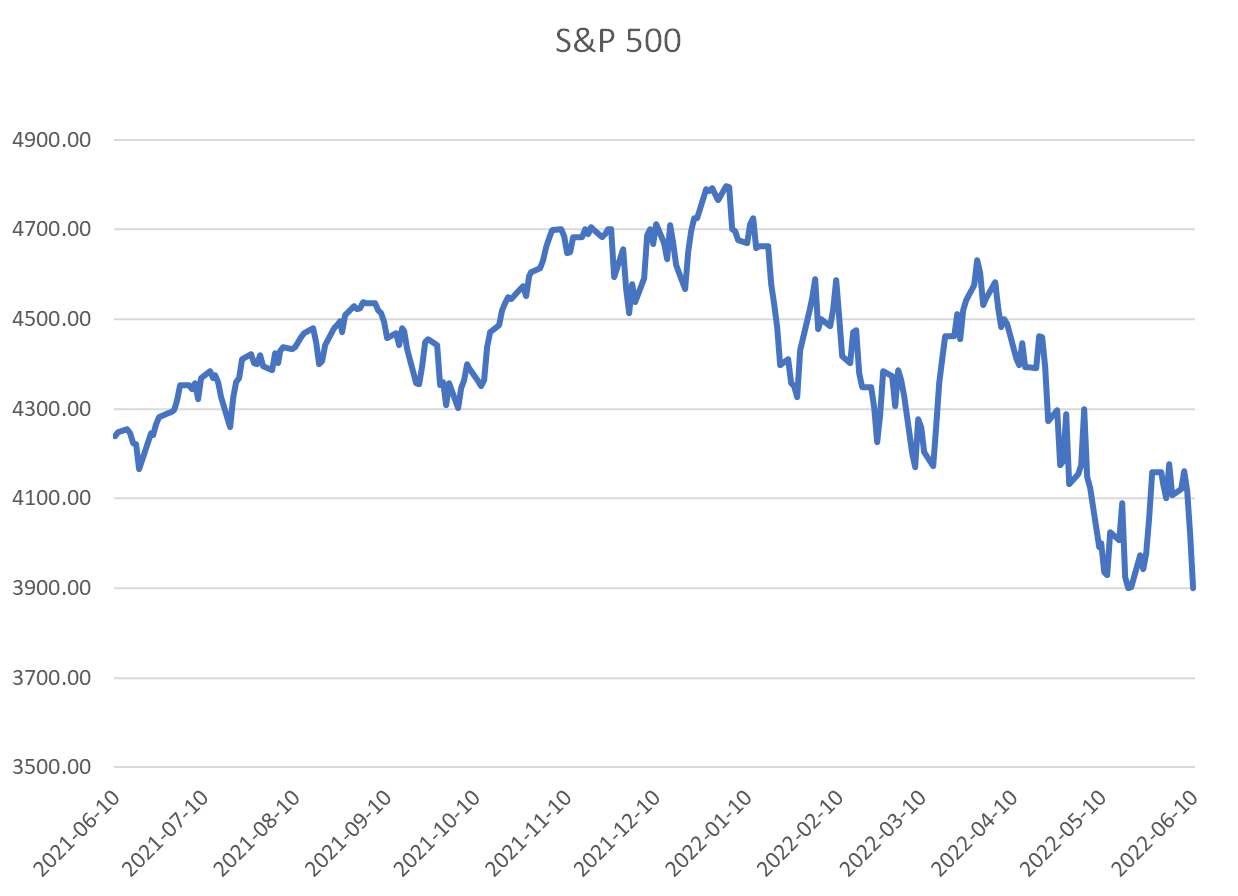

The travails of equity markets have garnered the bulk of the business/economics media coverage over the past week, which is hardly shocking given the sharp declines in 2022. (For reference, the daily close of the S&P 500 index is shown below.) Is the world ending? Put differently, how worried should one be about the economy?

The first, and most obvious, point is that the stock market is not the economy, and the economy is not the stock market. Yes, they are related but they can become disconnected over certain periods.

The excessive fiscal and monetary stimulus in 2021 is one such period. Trillions of dollars sloshing around household balance sheets and financial markets produced asset price appreciation not based on the fundamentals (“froth”). Markets have been thoroughly de-frothed this year.

The second point is that investors have learned substantial new information about the economy’s fundamentals. To begin, there has been a continuous revelation of the scale of the inflation problem and the size of the Fed policy response needed to control it. Put differently, the past two months have been an education on the amount of tightening of financial conditions (rate hikes and portfolio shrinkage) the Fed will have to undertake.

In addition, it has become increasingly obvious that the administration has no plan for vigorous, private-sector-led growth. It understands federal spending (usually euphemistically called “investments”), transfer programs, trillions in tax increases and a relentless rise in the burden of the regulatory state, but not how the private sector grows. If the Fed is able to miraculously execute a soft landing, it will be the equivalent of landing on an aircraft carrier in rough seas, only to find out there is no propulsion.

The world does not have to be ending. Inflation and poor growth policies are self-inflicted wounds. But there is no sign yet of the needed course correction.

Fact of the Day

Across all rulemakings this past week, agencies published $30.9 million in total net costs and added 155,415 annual paperwork burden hours.