The Daily Dish

March 3, 2017

The Medical Device Tax and Employment

On Thursday Federal Communications Commission (FCC) Chairman Ajit Pai said that the FCC will be looking to crack down on robocalls. The proposed rulemaking released by Pai will allow service providers to block fake or “spoofed” phone numbers. The move comes as Pai released a post on Medium stating that consumers and industry leaders have long called for reform to combat fraudulent robocalls.

Yesterday the House passed the Regulatory Integrity Act which requires federal agencies to offer transparency to their rule writing processes. The bill seeks to ban federal agencies from attempting to gather public support for proposed rules. It also requires federal agencies to create an online tracking data base for regulations which will track the status, timeframe and description of each rule. It further requires that the databases be accessible to the public.

Eakinomics: The Medical Device Tax and Employment

Given its other flaws, it is often overlooked that the Affordable Care Act (ACA) is full of bad tax policy — an excessively complex surtax on investment income, a horrifically designed Health Insurers Fee, the Cadillac tax (the health policy world’s Edsel) and the Medical Device Tax (MDT). AAF’s Robert Book provided a timely reminder of this reality with recent research into the employment impacts of the MDT.

Recall that the MDT is a 2.3 percent excise tax on all medical devices sold in the United States — both domestically produced and imported devices — with explicit exemptions only for eyeglasses, contact lenses, and hearing aids. It took effect January 1, 2013, but was suspended by Congress for 2016 and 2017. However, in the absence of legislative action it will automatically come back into effect at the beginning of 2018.

Obviously, the main intent of the MDT was to raise revenue. It was intended to raise $8.1 billion between 2013 and 2015, however, it fell well short of the mark and raised only $5.9 billion. The revenue shortfall suggests that the tax destroyed more-than-anticipated amounts of economic activity and, accordingly, one would suspect that the employment impacts would be substantial.

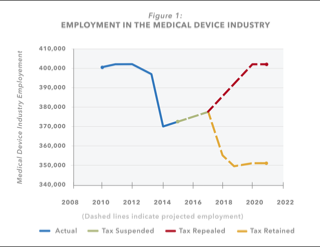

Employing the Eakinomics version of an old adage (“a picture is worth 75 words”), below find the bottom line of the research. The industry has lost 28,000 jobs in the three years under the tax. If it is reinstated, one could expect another cumulative loss of 25,000 jobs by 2021, but if it is repealed the additional 25,000 in job losses will be avoided and the 28,800 in actual losses to date will ultimately be recovered.

Why repeal the device tax? Over 53,000 jobs, that’s why.

Fact of the Day

The Affordable Care Act has helped to add more than 300 million hours of paperwork, pushing HHS’s total to record levels.