The Daily Dish

March 27, 2024

Meet the New Crisis, Same As…

This passage in the Financial Times caught my eye:

Phillip Swagel, director of the Congressional Budget Office [CBO], said the mounting US fiscal burden was on an “unprecedented” trajectory, risking a crisis of the kind that sparked a run on the pound and the collapse of Truss’s government in the UK in 2022. “The danger, of course, is what the UK faced with former prime minister Truss, where policymakers tried to take an action, and then there’s a market reaction to that action.”

Yikes! That sounds scary.

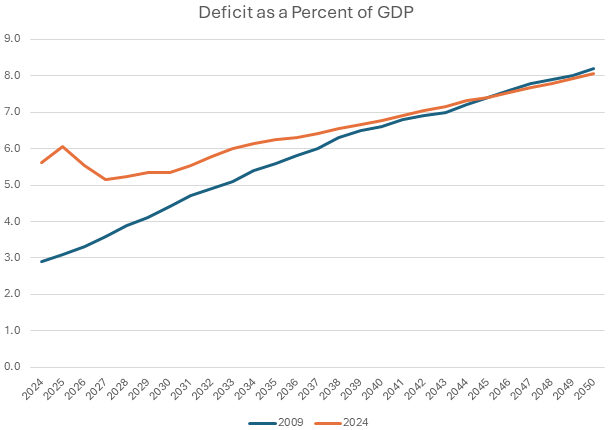

Please allow Eakinomics to both disagree and agree with Mr. Swagel. First, the trajectory is hardly “unprecedented” as the CBO has issued the same basic long-term budget outlook report since at least 2003. Using the data available on the CBO website, which dates only back to 2009, a comparison of the 2009 and 2024 projections for the deficit shows the same ultimate structural deficit of 8 percent of gross domestic product (GDP). The jumping-off point in 2024 is simply much worse and far more irresponsible than could have been imagined 15 years ago.

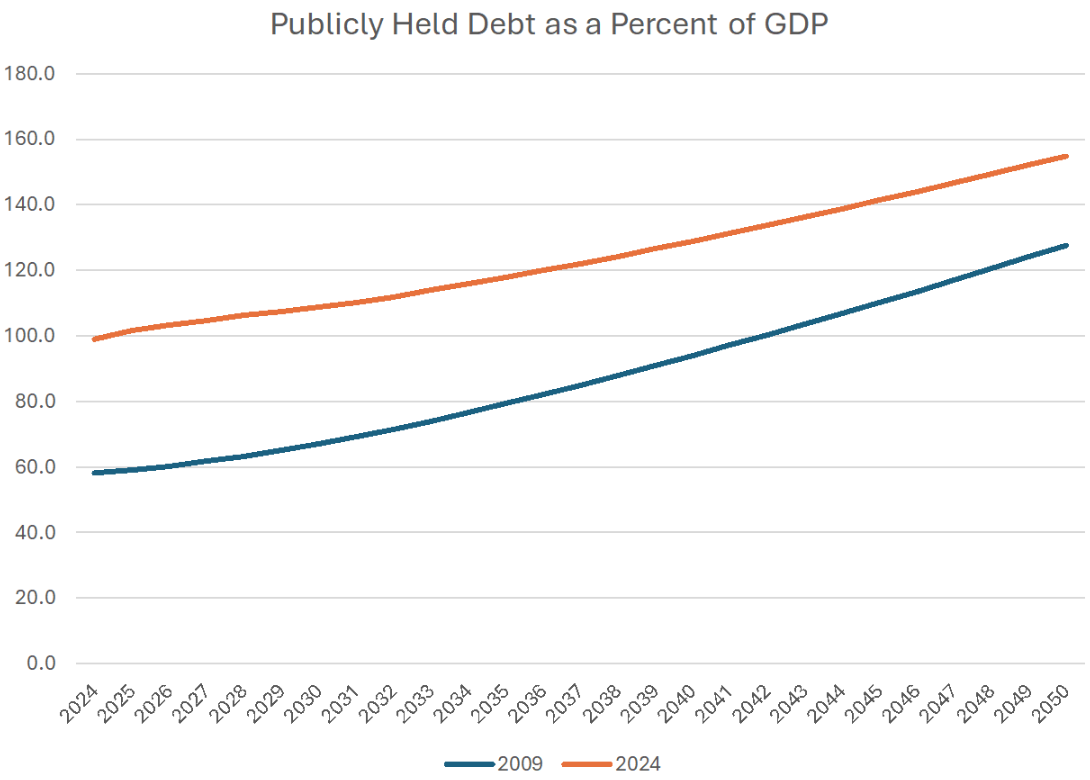

Similarly, the trajectory for federal debt is essentially the same. Once again, the paths converge to the same ultimate growth, with the only difference being a jumping–off point in 2024 that is much worse and far more irresponsible than could have been projected in 2009.

So, to repeat, there is nothing new or unprecedented about the fiscal trajectory. Neither is there anything new or unprecedented about the Biden Administration’s irresponsible budgetary stupor; we’ve seen previous administrations asleep at the switch as well.

What is new and unprecedented is that it is 2024, not 2009 or 2003. The United States has let the first two decades of the 21st century pass without transforming Social Security into a modern retirement program, without building value-driven Medicare and Medicaid programs, and without ending the pretense that somehow a handful of rich folks can foot the bill for a generous social safety net for the middle class.

And, for the record, we are already in a crisis. As I said in testimony before the Senate Finance Committee:

From 1960 through 2000, the average pace of growth in real GDP per capita was 2.4 percent. At this pace, GDP per capita – a rough measure of the standard of living – would double every 29 years. Thus, in roughly one working career, growth would double the standard of living, giving American families the opportunity to pursue their economic dreams.

Since then, from 2001 to 2022 the average pace of growth has been a full percentage point slower: 1.4 percent. At this pace the standard of living will double only every 56 years. There is the palpable sense that access to the American Dream is disappearing over the horizon.

The implications are enormous. Had the pace of growth been maintained in the 21st century, real GDP (in 2017 dollars) would have been $6.3 trillion higher in 2022, translating into additional real income of nearly $19,000 per capita. There is no government transfer program that can compete with the power of compound economic growth.

There is little doubt that the fiscal trajectory lies at the heart of this economic failure. The federal budget is essentially a large subsidy to current consumption at the expense of saving and investment. Countries that save and invest too little fail.

Fact of the Day

As of March 20, the Fed’s assets stood at $7.5 trillion.